This is a financial promotion for The First Sentier Asia Pacific ex-Japan Strategy. This information is for professional clients only in the EEA and elsewhere where lawful. Investing involves certain risks including:

- The value of investments and any income from them may go down as well as up and are not guaranteed. Investors may get back significantly less than the original amount invested.

- Currency risk: the Fund invests in assets which are denominated in other currencies; changes in exchange rates will affect the value of the Fund and could create losses. Currency control decisions made by governments could affect the value of the Fund's investments and could cause the Fund to defer or suspend redemptions of its shares.

- Single country / specific region risk: investing in a single country or specific region may be riskier than investing in a number of different countries or regions. Investing in a larger number of countries or regions helps spread risk.

- Charges to capital risk: The fees and expenses may be charged against the capital property. Deducting expenses from capital reduces the potential for capital growth.

- Emerging market risk: Emerging markets tend to be more sensitive to economic and political conditions than developed markets. Other factors include greater liquidity risk, restrictions on investment or transfer of assets, failed/delayed settlement and difficulties valuing securities. .

- Smaller companies risk: Investments in smaller companies may be riskier and more difficult to buy and sell than investments in larger companies.

For details of the firms issuing this information and any funds referred to, please see Terms and Conditions and Important Information.

For a full description of the terms of investment and the risks please see the Prospectus and Key Investor Information Document for each Fund.

If you are in any doubt as to the suitability of our funds for your investment needs, please seek investment advice.

Asia Pacific Equities: Fund Manager Q&A

In response to recent questions from our clients, we had a conversation with Martin Lau, managing partner and lead portfolio manager for a number of FSSA strategies, covering Asia and Greater China.

Asia Pacific Equities

Can quality growth stocks outperform when consumer sentiment is weak?

We continue to believe that high-quality companies often turn out to be the best long-term investments. This view became more popular (up until two or three years ago), when interest rates were held at zero. Many investors overpaid for such companies, especially consumer businesses across the Asia region.

As quality growth companies became expensive, and interest rates started rising along with commodity prices and oil prices, commodity stocks outperformed and quality companies lagged. This divergence in performance, or reversion to the mean, is typical for stock market cycles — and has been happening for the past few years.

However, when it comes to investing, the longer the time horizon, the more important are the people, the business franchise and the financials. Less important are cycles, interest rates, Gross Domestic Product (GDP) growth, etc. As long-term investors, we still seek out quality growth companies for our portfolios, even though they may perform less well over shorter time periods because of market forces or negative sentiment.

What are your views on China’s slowing growth?

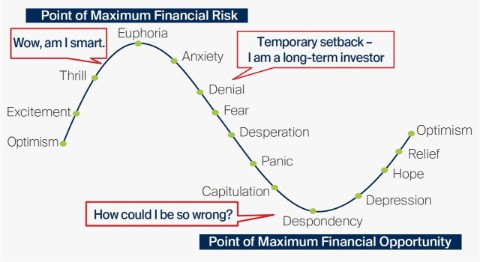

Over the many years that I have looked at China and other markets, every market, country or economy has a cycle. China is undergoing a difficult cycle because the property bubble has burst and also because of negative sentiment around geopolitics and regulations. There are usually signs of exuberance which mark the peaks of cycles, and signs of giving up which signal the troughs.

Where are in the cycle?

Importance of Maximum Financial Risk

Rather than trying to time the cycle, we focus on investing in quality companies. For example, almost every company in our portfolio has a net cash balance sheet, a proven business model, cash-flow generation, and high returns on capital employed, which allow these companies to withstand a relatively tough economic cycle. And when the valuations become very cheap or attractive enough, we would add to these positions, as we have done in the past year.

The other thing we want to see is how companies would respond to an especially difficult economic period, for example, looking to return more cash to shareholders. In my view, observing the attitude and actions of companies’ management is more important than trying to time the trough of the cycle, which only becomes clear after the fact.

How do you see China vs India?

I think India is quite special. First of all, there are many companies which have a long history of being listed, like HDFC Bank or Godrej Consumer. We have been shareholders in them for a long time and have been very impressed by the management quality.

Generally speaking, the companies in India have many of the qualities we like. Chinese companies seem to be more focused on growth, whereas Indian companies are more focused on returns. But one concern is that valuations in India are getting more expensive, so the stocks could be prone to a correction.

Another difference compared to China — for example, Godrej Consumer’s annual revenue is around USD1.5 billion. Compare that to a consumer company in China, for example China Mengniu, its revenue is about USD15 billion a year, or ten times the size1.

For China, the concern is that it has become very big and therefore growth is going to be slower. Considering the lower valuations, it’s debatable whether this low growth has been priced in. For India, the investment case is that the base is pretty low, which suggests more potential for growth, but the PE (price-to-earnings) ratio is high.

What are your views on HDFC’s recent volatility?

We talked about how we like quality companies with strong management, and HDFC Bank belongs to this category. We have been shareholders in HDFC Bank for many years. Under the previous CEO, Mr Puri, it became the leading privately-owned bank in India. For the last 10-15 years, the track record has been phenomenal.

Stocks tend to follow earnings in the long run

HDFC Bank share price vs. forward earnings per share (EPS), INR

Source: Factset, FSSA Investment Managers, March 2024. Investment involves risk. Past performance is not indicative of future performance.

We believe the growth will continue, but it’s no longer a small bank, so the future growth is going to be less strong compared to before. We believe it can still generate 10-15% EPS growth in the future. But for the last 20 years it was more than 20%. So the growth will likely slow down.

Another thing, which is more short term — because of the recent integration with the parent HDFC Corp, there's a need to deleverage the balance sheet, because HDFC Corp had a wholesale-funded mortgage book. But currently, liquidity is tight in India. So to deleverage the balance sheet, HDFC Bank would need to compete for deposits, and I think the market is concerned about how this could affect growth.

That said, we believe the best time to buy a high-quality company is when it is cheaper and going through a difficult period, which is the case with HDFC Bank. For investors with a 3-5 year horizon or longer, we believe it is an attractive investment.

How are you investing in artificial intelligence (AI)?

Rather than trying to make predictions on leading-edge technology, we usually approach it in a simpler way. We have been invested in Taiwan Semiconductor (TSMC) for many years, because it produces an integral part of the AI supply chain — in other words, the most advanced chips developed by Nvidia, AMD, MediaTek and others. So we see it as a good company with a strong franchise and competitive edge in the leading technologies.

In terms of AI’s potential, it is a big debate. Recently I read a report which said it's going to help banks to save expenses, help drug development because it's much smarter, help fund management because it can do a lot of the analysis for you, etc.

I believe it would need to expand into more day-to-day applications. We like companies like MediaTek or Samsung because for AI to be sustainable, there needs to be more applications which can increase profits for companies, such as smartphones or automobiles which use AI. I think AI will help us become more connected, becoming ingrained in consumer interfaces and used in more applications.

One area it could impact is general productivity. We are invested in automation companies like Keyence and Advantech. Before AI happened, it made communication much easier with 5G. And with that, it became easier to control a robot compared to 3G and 4G. So I think AI would be another catalyst for automation as the world is running short of labour.

How do you view Japan stocks in the context of the regional portfolio?

We have been investing in Japan for more than 10-15 years. Japan is interesting because the economy has been bad for so long. For any companies to have survived three decades of recession or deflation, that speaks to the management ability and balance sheet strength.

Another interesting aspect of Japan is that there are many niche companies which focus on very specific products. For example, SMC is a leader in pneumatic components and has this singular focus. Likewise, one of our first investments into Japan was a company called Pigeon, which focuses on infant milk bottles and related products.

So the detail-oriented mentality and culture is something that intrigues us. One of the major areas that we're invested in is automation. Keyence has been one of the largest positions in the FSSA's Asia Strategy for a number of years, because it’s strong in optical sensors in the automation space. It has a very strong track record and financial performance.

We also like the creativity among companies in Japan. For example I grew up with Mario Brothers from Nintendo. There are many of these likable characters which are intellectual properties (IPs) in Japan, which I think is quite unique. Hello Kitty is another example, and Street Fighter from Capcom.

In my view, Japan is complementary in a regional portfolio because if you believe in China’s automation, you may find the leading automation companies are actually Japanese, and better-positioned to benefit from this trend. Similarly, if you look for leaders in hardware, you might consider TSMC in Taiwan. If you want to find a leader in content or IP, you can consider Nintendo in Japan. In our case, we own Sony Group, which has Sony Music, Sony PlayStation games, and is a leader in CMOS image sensors.

What makes FSSA unique among asset managers?

Our team has a very strong culture and a strong belief in our investment philosophy. Many fund managers may say they invest in good companies and are long-term investors, but we really practice this. For example, our portfolios typically have very low annual turnover, like 15-20%. In addition, I spend most of my time researching companies. So this passion for finding good companies and holding them for the long run is very unique in my view.

Finally, we will actively engage with the companies we invest in, because we believe being long-term shareholders comes with certain responsibilities. Just before this meeting, I was writing a letter to a portfolio company because of certain engagement issues, so we don't just delegate it to other people.

Why should clients stay invested in FSSA’s Asia and China strategies?

Last year, the performance in relative terms has been disappointing. A number of the high-quality companies, which are long-term holdings in our portfolio, were derated from relatively high levels. Whereas some of the commodity shares, such as CNOOC and Petrochina (which are actually on the US sanctions list), performed very well.

This is not good excuse, but it needs to be put into context. We believe our longer-term performance is still solid. Perhaps more importantly, we haven't changed our investment philosophy or portfolio. We are still holding on to the same investment process, the same companies, the same management teams which we want to back. We hope our clients will share the same philosophy as us, and believe in these companies for the long run.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same.

1. Source: Company filings, Factset based on 2022 data.

This document has been prepared for informational purposes only and is only intended to provide a summary of the subject matter covered. It does not purport to be comprehensive or to give advice. The views expressed are the views of the writer at the time of issue and may change over time. This is not an offer document and does not constitute an offer, invitation or investment recommendation to distribute or purchase securities, shares, units or other interests or to enter into an investment agreement. No person should rely on the content and/or act on the basis of any material contained in this document.

This document is confidential and must not be copied, reproduced, circulated or transmitted, in whole or in part, and in any form or by any means without our prior written consent. The information contained within this document has been obtained from sources that we believe to be reliable and accurate at the time of issue but no representation or warranty, express or implied, is made as to the fairness, accuracy, or completeness of the information. We do not accept any liability whatsoever for any loss arising directly or indirectly from any use of this document.

References to “we” or “us” are references to First Sentier Investors a member of MUFG, a global financial group. First Sentier Investors includes a number of entities in different jurisdictions. MUFG and its subsidiaries do not guarantee the performance of any investment or entity referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk including loss of income and capital invested.

If this document relates to an investment strategy which is available for investment via a UK UCITS but not an EU UCITS fund then that strategy will only be available to EU/EEA investors via a segregated mandate account.

In the United Kingdom, issued by First Sentier Investors (UK) Funds Limited which is authorised and regulated in the UK by the Financial Conduct Authority (registration number 143359). Registered office Finsbury Circus House, 15 Finsbury Circus, London, EC2M 7EB number 2294743. In the EEA, issued by First Sentier Investors (Ireland) Limited which is authorised and regulated in Ireland by the Central Bank of Ireland (registered number C182306) in connection with the activity of receiving and transmitting orders. Registered office: 70 Sir John Rogerson’s Quay, Dublin 2, Ireland number 629188. Outside the UK and the EEA, issued by First Sentier Investors International IM Limited which is authorised and regulated in the UK by the Financial Conduct Authority (registered number 122512). Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB number SCO79063.

Copyright © (2024) First Sentier Investors

All rights reserved.

Read our latest insights

- Article

- 6 mins

- Article

- 8 mins

- Article

- 3 mins