Team established in 1988

Our history reflects our long-term approach; we look for quality companies that we can buy and hold over time.

Absolute return mind-set

Our investment approach focuses on generating absolute returns for our clients. With every investment we make, we look at the potential downside and not just upside.

Integrated sustainability analysis

Sustainability analysis is embedded into the investment process and is undertaken by our investment analysts, rather than outsourced to a separate team.

Our investment philosophy

"We believe that preserving capital is the most important aspect of growing it."

Putting theory into practice

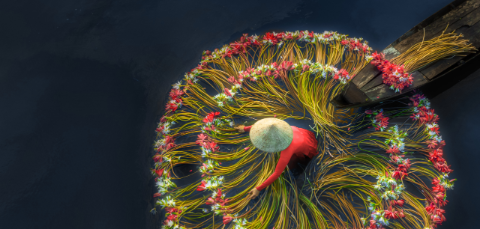

Global Emerging Markets

Guided by conviction.

Not constraints.

We craft portfolios that prioritise resilience over short-term trends.

Our latest Sustainability Report

We are pleased to present the FSSA Sustainability Report 2024, using case studies to highlight our ongoing engagement with companies.

Our latest investment insights

View all our insights

Defence vs. Offence

Beyond the AI rally