This is a financial promotion for The First Sentier China Strategy. This information is for professional clients only in the UK and EEA and elsewhere where lawful. Investing involves certain risks including:

- The value of investments and any income from them may go down as well as up and are not guaranteed. Investors may get back significantly less than the original amount invested.

- Currency risk: the Fund invests in assets which are denominated in other currencies; changes in exchange rates will affect the value of the Fund and could create losses. Currency control decisions made by governments could affect the value of the Fund's investments and could cause the Fund to defer or suspend redemptions of its shares.

- Single country / specific region risk: investing in a single country or specific region may be riskier than investing in a number of different countries or regions. Investing in a larger number of countries or regions helps spread risk.

- China market Risk: although China has seen rapid economic and structural development, investing there may still involve increased risks of political and governmental intervention, potentially limitations on the allocation of the Fund's capital, and legal, regulatory, economic and other risks including greater liquidity risk, restrictions on investment or transfer of assets, failed/delayed settlement and difficulties valuing securities..

- Concentration risk: the Fund invests in a relatively small number of companies which may be riskier than a fund that invests in a large number of companies.

- Smaller companies risk: Investments in smaller companies may be riskier and more difficult to buy and sell than investments in larger companies.

For details of the firms issuing this information and any funds referred to, please see Terms and Conditions and Important Information.

For a full description of the terms of investment and the risks please see the Prospectus and Key Investor Information Document for each Fund.

If you are in any doubt as to the suitability of our funds for your investment needs, please seek investment advice.

Tapping into a broader range of investment opportunities as China market opens up

Introduction

The China equity market includes a myriad of share classes, each with distinct characteristics. ‘Offshore’ Chinese equities are listed on overseas stock exchanges such as New York and Hong Kong and denominated in foreign currencies, while ‘onshore’ Chinese equities are listed on the Shanghai and Shenzhen Stock Exchanges and denominated in RMB.

China’s onshore stock market, particularly the A-shares segment, is much larger than the offshore component, with more than 3,900 companies listed on the Mainland exchanges, compared to around 1,600 listed offshore.

Source: Hong Kong Exchanges and Clearing (HKEX), NASDAQ, as at 31 October 2020

Evolving China market access

A closed economy and a history of capital controls meant that foreign investors have previously had few opportunities to participate in China’s onshore market. As a result, China A-shares are largely underrepresented in global portfolios, though this is starting to change.

The launch of the Qualified Foreign Institutional Investor (QFII) programme in 2002 permitted a small number of overseas investors to purchase China A-shares. However, trading was subject to strict preapprovals, licenses and quotas.

Restrictions have eased over time; and by the time of the launch of the Renminbi-QFII (RQFII) programme in 2011, the number of qualifying investors and eligible securities had expanded significantly.

In 2014, the launch of the Stock Connect platform marked a step-change for overseas investors. With Stock Connect, access to the China A-share market became much more straightforward.

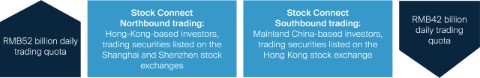

Initially, Stock Connect provided a link between the Shanghai and Hong Kong stock exchanges, allowing foreign investors to trade selected A-share stocks on a daily basis without needing to apply for individual quotas, or be subject to minimum lock-up periods and capital repatriation limits. It also allowed Mainland investors to diversify their equity holdings and foreign exchange exposure by purchasing Hong Kong-listed stocks.

Toward the end of 2016, the Shenzhen and Hong Kong stock exchanges were similarly linked via Stock Connect. At the same time, aggregate trading quotas were removed. Daily trading limits have remained; though in early 2018, daily quotas quadrupled from RMB 13 billion to RMB 52 billion for Northbound trading and from RMB 10.5 billion to RMB 42 billion for Southbound trading.

Stock Connect now covers around 85% of the market capitalisation of the Shanghai and Shenzhen exchanges – or around 1,300 companies. Foreign ownership of China A-shares has risen steadily (total shareholding value of Mainland companies via Stock Connect has grown to RMB1,952 billion1) and trading volumes have reached record highs.

1 Source: Hong Kong Exchanges and Clearing (HKEX) as at 31 July 2020

Stock Connect Average Daily Trading Volume (HKD bn)

SB record of HKD60.2bn on 6 Jul 2020

NB record of RMB 191.2bn on 7 Jul 2020

Source: Hong Kong Exchanges and Clearing (HKEX), as at 31 July 2020.

China A-share inclusion in equity indices

As China continues to open up its economy and its capital markets, foreign investors have started to allocate China A-shares to client portfolios, and benchmark index providers have been taking note. After a multi-year consultation period and a year-long planning interval, MSCI added approximately 230 China A-shares to the MSCI Emerging Markets Index over a two-phase process in May and August 2018.

While the initial allocation was small – just 0.8% of the MSCI Emerging Markets Index and 2.3% of the MSCI China Index based on a 5% partial inclusion factor – it represented an important milestone. MSCI has since increased the China A-shares index inclusion factor to 20% and expanded coverage to include large-cap, mid-cap and ChiNext securities.

According to MSCI data, Chinese equities could eventually comprise more than 50% of the MSCI Emerging Markets Index, with more than 20% weighted in China A-shares. For the MSCI China Index, the domestic equity component could increase to almost 40%.

FTSE Russell, another major index provider, started to add China A-shares to its indices in three tranches starting from June 2019, based on 25% of the investable market capitalisation of eligible securities as designated by the FTSE China A Stock Connect All Cap Index. China A-shares now comprise approximately 6% of the FTSE Emerging Index and 0.7% of the FTSE Global All Cap Index.

As two of the main benchmark index providers for the industry, these developments mark an inflection point for Chinese equities. Although full A-share inclusion is unlikely to happen quickly, the next five years should see a steady progression towards full representation.

As index weightings change to better reflect the relative size of the China equity market in terms of market capitalisation and trading volumes, Chinese equities could eventually qualify as a standalone asset class.

What might happen in the next five years?

Source: MSCI, as at 31 October 2020. Forecasted weights for 100% inclusion have been simulated on a best efforts basis by MSCI.

The broadening opportunity set

The All China equity market, including both onshore and offshore equities, contains plenty of high quality franchises and growth opportunities for bottom-up stock selectors to choose from. Chinese companies have delivered attractive earnings growth over the long term in comparison to major global markets in the US, Europe, Japan and across the Asia Pacific.

In the offshore market, earnings growth estimates for the MSCI China2 in calendar year (CY)2020/2021 is -0.3%/19.9%, while the 12-month forward price-to-earnings (P/E) for the index is 15.3x. The Hang Seng Index is trading at around 9.6x forward P/ E with a 2.8% dividend yield for CY2020. In the onshore market, the Shanghai and Shenzhen Composite indices are trading at 12.7x and 20.9x P/E respectively.

2 Source: J.P. Morgan China and Hong Kong Market Wraps, October 2020.

China has delivered strong historical earnings growth

EPS CAGR 2000-2020

Source: Bloomberg, FSSA Investment Managers. Trailing weighted EPS growth from 30 September 2000-2020. *Shenzhen Composite figure from 30 September 2001.

A-share aggregate earnings (RMB bn)

Source: FactSet, Calendar Year (CY) figures.

Onshore vs. offshore

As investor portfolios might already include offshore Chinese equities, how would the inclusion of A-shares affect the asset allocation? Although there is some overlap – some companies are dual-listed with both an A-share and an H-share class – the broad-based A-share market covers a wider range of industry sectors and is considered to be more representative of the underlying Chinese economy.

For example, home furnishing retailers, housewares and general merchandise stores are exclusive to the A-share market, while others, such as food distributors and diversified real estate investment trusts (REITs) are part of the offshore H-share market, but are not in A-shares.

Within A-shares, there are also differences between the two main domestic exchanges. Due to historical reasons (proximity to the seat of government in Beijing, as well as being the hub for merchant trading since the late 1800s), state-owned enterprises (SOEs), large-caps and ‘old economy’ industries such as consumer companies, financials and manufacturers form the majority of the Shanghai Stock Exchange.

The Shanghai Stock Exchange Science and Technology Innovation Board (also known as the STAR Market) launched in 2019 to house China’s new economy, biotechnology and other ‘new generation’ start-up companies.

Meanwhile, the Shenzhen Stock Exchange, which includes the Main Board, the SME3 Board and the ChiNext Board, contains smaller to mediumsized companies; and includes a greater number of ‘new economy’ and technology stocks.

The ChiNext Board, in particular, is similar to the NASDAQ in the United States (or the AIM market in the United Kingdom) and allows fledgling growth companies to raise equity capital with more flexible listing requirements than the Main Board.

In the offshore market, H-shares are dominated by financials, mainly due to the major Chinese banks and financial institutions which chose to list in Hong Kong to raise capital outside of China. Red chips are skewed towards the energy and telecoms sectors, while P Chips and N-shares are predominantly focused on technology and consumer companies.

Note: Green colour indicates New China sectors

Source: Wind, FactSet, Goldman Sachs Global Investment Research

3 Small and Medium Enterprises

China Indices – sector differences

Source: Bloomberg, FactSet, FSSA Investment Managers, as at 31 October 2020.

MSCI China - Top 10 weights over time

A few considerations

The China A-share market is still relatively young and, like the overall Chinese economy, remains heavily influenced and directed by the government. This has led to some market idiosyncrasies that investors should be aware of.

Firstly, market participants are mostly retail investors, often trading on margin accounts which provide financing to leverage an investor’s stock market exposure. Around 80% of the market (by trading volume) is comprised of small retail investors and day traders who tend to be more speculative and have a shorterterm mind-set. This is one of the key reasons for the A-share market’s heightened volatility.

To combat this, general stock prices are subject to daily up/ down trading limits of +/- 10%, which restrict an investor’s ability to buy or sell securities during volatile periods. If a company’s share price hits the price limit (either up or down), trading is automatically halted until the following day.

Companies can also voluntarily suspend trading of their shares, in an attempt to ride out market volatility and avoid investor selling. During the stock market rout in mid-2015, more than half of all listed A-share companies suspended trading in an attempt to stem outflows.

During these periods of market volatility, state-owned banks and brokers are often conscripted into ‘national service’, with statemandated trading designed to support stock prices. National service can also be called upon to lift market sentiment ahead of important dates in the political diary.

These interventions distort the price discovery mechanism and lead to an inefficient market over the shorter term. However, this presents an attractive opportunity for active investors to generate alpha – by investing over a longer-term time horizon, using a fundamentally-driven investment approach and employing robust valuation models to identify mispriced stocks.

FSSA Investment Managers China Funds Range

FSSA China Funds Range

Source: First Sentier Investors, as at 31 October 2020.

About the team

FSSA Investment Managers manage US$28.7 billion^ on behalf of clients globally. Operating as an autonomous investment team within First Sentier Investors, we are a team of dedicated investment professionals based in Hong Kong, Singapore, Tokyo and Edinburgh.

We are bottom-up investors, using fundamental research and analysis to construct high-conviction portfolios. We conduct more than a thousand direct company meetings a year, seeking to identify high quality companies that we can invest in for the long term.

As responsible, long-term shareholders, we have integrated ESG analysis into our investment process and engage extensively on environmental, labour and governance issues.

Investment approach

In summary, our investment approach is based on:

- Bottom-up stock selection

- Quality companies

- Strong valuation disciplines

- Long-term investing

- Absolute return mindset

- Benchmark indifference

Related insights

Important Information

This document has been prepared for informational purposes only and is only intended to provide a summary of the subject matter covered and does not purport to be comprehensive. The views expressed are the views of the writer at the time of issue and may change over time. It does not constitute investment advice and/or a recommendation and should not be used as the basis of any investment decision. This document is not an offer document and does not constitute an offer or invitation or investment recommendation to distribute or purchase securities, shares, units or other interests or to enter into an investment agreement. No person should rely on the content and/or act on the basis of any material contained in this document.

This document is confidential and must not be copied, reproduced, circulated or transmitted, in whole or in part, and in any form or by any means without our prior written consent. The information contained within this document has been obtained from sources that we believe to be reliable and accurate at the time of issue but no representation or warranty, express or implied, is made as to the fairness, accuracy, or completeness of the information. We do not accept any liability whatsoever for any loss arising directly or indirectly from any use of this information.

References to “we” or “us” are references to First Sentier Investors.

In the UK, issued by First Sentier Investors (UK) Funds Limited which is authorised and regulated by the Financial Conduct Authority (registration number 143359). Registered office Finsbury Circus House, 15 Finsbury Circus, London, EC2M 7EB number 2294743. In the EEA, issued by First Sentier Investors (Ireland) Limited which is authorised and regulated in Ireland by the Central Bank of Ireland (registered number C182306) in connection with the activity of receiving and transmitting orders. Registered office: 70 Sir John Rogerson’s Quay, Dublin 2, Ireland number 629188. Outside the UK and the EEA, issued by First Sentier Investors International IM Limited which is authorised and regulated in the UK by the Financial Conduct Authority (registered number 122512). Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB number SC079063.

Certain funds referred to in this document are identified as sub-funds of First Sentier Investors Global Umbrella Fund plc, an umbrella investment company registered in Ireland (“VCC”). Further information is contained in the Prospectus and Key Investor Information Documents of the VCC which are available free of charge by writing to: Client Services, First Sentier Investors , 1 Grand Canal Square, Grand Canal Harbour, Dublin 2, Ireland or by telephoning +353 1 635 6798 between 9am and 5pm (Dublin time) Monday to Friday or by visiting www.firstsentierinvestors.com. Telephone calls may be recorded. The distribution or purchase of shares in the funds, or entering into an investment agreement with First Sentier Investors may be restricted in certain jurisdictions.

Representative and Paying Agent in Switzerland: The representative and paying agent in Switzerland is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich, Switzerland. Place where the relevant documentation may be obtained: The prospectus, key investor information documents (KIIDs), the instrument of incorporation as well as the annual and semi-annual reports may be obtained free of charge from the representative in Switzerland.

First Sentier Investors entities referred to in this document are part of First Sentier Investors a member of MUFG, a global financial group. First Sentier Investors includes a number of entities in different jurisdictions. MUFG and its subsidiaries do not guarantee the performance of any investment or entity referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk including loss of income and capital invested.

Copyright © (2021) First Sentier Investors

All rights reserved.