This is a financial promotion for The First Sentier India Strategy. This information is for professional clients only in the UK and EEA and elsewhere where lawful. Investing involves certain risks including:

- The value of investments and any income from them may go down as well as up and are not guaranteed. Investors may get back significantly less than the original amount invested.

- Currency risk: the strategy invests in assets which are denominated in other currencies; changes in exchange rates will affect the value of the strategy and could create losses. Currency control decisions made by governments could affect the value of the strategy's investments and could cause the strategy to defer or suspend redemptions of its shares.

- Indian subcontinent risk: although India has seen rapid economic and structural development, investing there may still involve increased risks of political and governmental intervention, potentially limitations on the allocation of the strategy's capital, and legal, regulatory, economic and other risks including greater liquidity risk, restrictions on investment or transfer of assets, failed/delayed settlement and difficulties valuing securities.

- Single country / specific region risk: investing in a single country or specific region may be riskier than investing in a number of different countries or regions. Investing in a larger number of countries or regions helps spread risk.

- Smaller companies risk: Investments in smaller companies may be riskier and more difficult to buy and sell than investments in larger companies.

For details of the firms issuing this information and any strategies referred to, please see Terms and Conditions and Important Information.

For a full description of the terms of investment and the risks please see the Prospectus and Key Investor Information Document for each strategy.

If you are in any doubt as to the suitability of our funds for your investment needs, please seek investment advice.

India Equities: Fund Manager Q&A

Asia Pacific Equities

What excites you about India?

Shivika: We have always been excited about India. We started investing in India 30 years ago so it’s our 30th anniversary this year. We have always found great opportunities in the market, regardless of whether it's been in favour or popular.

Vinay: A lot has changed in India in the last 20 years, in terms of the market size, the number of companies that are available, and the amount of institutional and foreign ownership. I remember making a presentation early in my career, which had a slide that talked about companies with more than 1% foreign shareholding in India. The number was around 70 then, but that number is at least 10 times more today.

Shivika: The number of companies we look at has been growing over time, as more companies list and become bigger. Sometimes companies which were very small, perhaps family run, were not managed in the best way. Then the next generation would come in, perhaps after being educated in the West, and understand how to run a listed business and create shareholder value. All of this means that the pool of investable companies is growing every year for us.

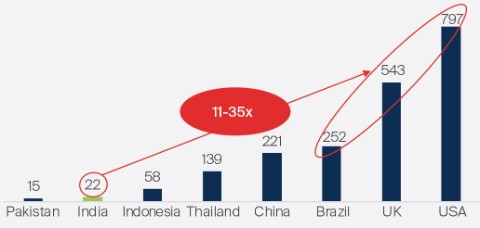

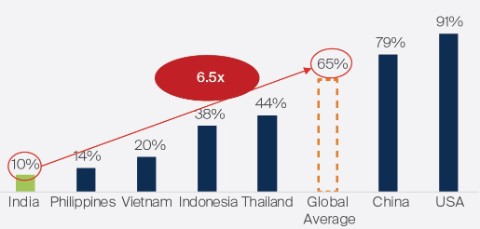

There is plenty of growth potential for pretty much any category. For example, there are 7 million air conditioners sold a year for a population of 1.4 billion people, versus 70 million air conditioners in China for a similar-sized population.1 Almost any category we look at has been capital starved. So at certain stages of India’s evolution, each of these categories will start taking off and can grow multi-fold.

Sree: The governance standards in India and the quality of companies have improved consistently. This is partly because the regulatory standards for issues like minority shareholder protection are significantly superior to what we find in other markets. Similarly, factors around the quality of boards are strongly regulated in India, for example, the minimum number of independent directors, the diversity of the board, the tenure of various board members, and the tenure of the auditor.

Growth runway is still long

Vehicles per 1,000 people

Air-conditioner Penetration (% of Households)

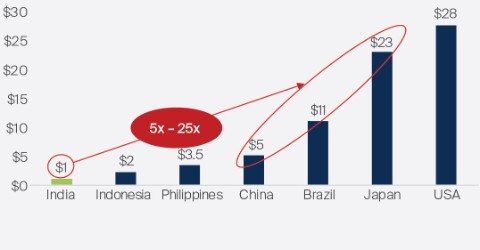

Per-capita spend on Oral Care Products per Annum (US$/capita)

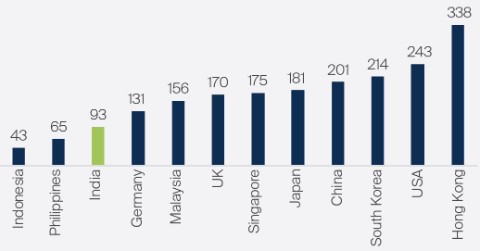

Private Credit to Gross Domestic Product (GDP) (%)

Source: Euromonitor, Goldman Sachs, FSSA Investment Managers, March 2023.

How have the investment themes evolved over the years?

Vinay: 20 years ago in India, it was very easy to make a case for under-penetration in any consumer category. Whether it was soaps, detergents, or shampoo, the per-capita consumption for any consumer category was very low. The companies were market leaders who were generating tons of cash, high return on capital, and built significant moats around themselves. However, that penetration story is largely complete for most categories as incomes have risen. From here on, it will be more about premiumisation.

Sree: For financial products, previously a large part of the savings would go into bank deposits. Now, people are willing to invest in insurance products. There is more wealth management and direct participation in equity markets. In other words, people are moving from basic bank deposits to more discretionary financial products. In almost any aspect of the consumption categories that we operate in, we see that people are consuming differently and will continue to consume differently over the next decade.

Vinay: I think in the next 20 years, manufacturing will also become an important part of the economy and our investment universe. For example, we are invested in an air conditioner company and today they import most of the components, then assemble and sell the products. They don't manufacture much. As they keep growing quickly, they are investing more to develop their manufacturing capabilities. As that manufacturing base increases, because of a large domestic market, that will increase the scale of the manufacturing for these companies. And with that, the benefits of scale will start accruing to them. And then they can start looking at export opportunities.

What has also helped is that global multi-national companies are looking to diversify their supply chain away from China, and India has become one of the alternatives. The Indian government has also taken some steps to incentivise more manufacturing in India and I think there will be more opportunities in that space.

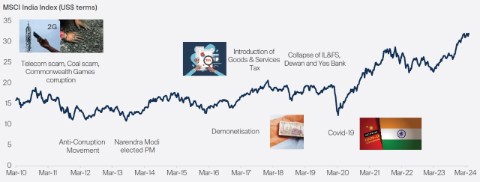

Growth and profitability are improving after a tough decade

These figures refer to the past. Past performance is not a reliable indicator of future results. For investors based in countries with currencies other than USD, the return may increase or decrease as a result of currency fluctuations. Source: FSSA Investment Managers, Financial Times, Outlook India, Bloomberg as at 2 May 2024.

What are your views on India versus China?

Vinay: I think India in itself has been an amazing investment destination, if people were paying attention to it. Over the last 10, 20 or 30 years, companies in India have created a significant amount of wealth for shareholders. It's unfortunate that people have not noticed it and mainly think of it in relative terms versus China.

The Bombay Stock Exchange is the oldest stock market in Asia, and one of the oldest in the world. The culture of equity ownership in India is far more ingrained. The businesses understand what it means to be a listed company, whereas in China, it is a relatively newer concept. Most of the companies in China have so far been state owned and only in the last 10, 15 years, through SOE (state-owned enterprise) reforms, some of them have become privatised. But even so, the founding team in those companies were actually SOE employees when they joined those businesses. So there is a lingering SOE culture, which will take some time to change. There are a number of private companies to choose from in India, which is not the case in China. It is just the nature of evolution of both the markets.

We like family-owned businesses because they think in terms of multiple generations. They think very long term, versus completely professionally-run businesses, which often think in terms of the next 3-5 years. In many cases, these become self-enrichment schemes, with no long-term stewards and no oversight from large owners.

There are a number of families in India who have been running their businesses for many years, businesses which are in the third generation, or even the fourth, fifth and sixth generation. With such long track records, you can see how they have behaved and evolved over time, what decisions they took, especially in tough periods, and did they disadvantage any of the stakeholders when they were growing.

Whereas in China, there are very few companies which have such long track records. That makes it difficult for us to assess their quality, as we focus so much on the history and evolution of companies and how they have behaved in the past.

Also, China has done so well over the last 20-30 years, but in that short history, it has only been a rising curve for these companies, so they haven't really been tested. Whereas India goes through cycles every year. And Indian companies operate in 30 different states with different state governments, with diverse interests pulling them in different directions. I think this makes Indian companies and the management teams very resilient in running businesses through tough periods, which seem to come every six months.

Sree: What has not changed in India is the awareness among the owners of companies to earn high returns on capital. That has always been a focus of Indian owners, because historically India was always capital constrained. So even as interest rates have come down over time in India, and the cost of capital has moderated, that awareness and that DNA of trying to earn high returns on capital has stayed the same.

Vinay: That has largely not been the case in China. There are many companies which care about return on capital. But because the economy has been state directed, if the state decided to build roads, infrastructure or renewable energy, then the capital availability wasn't much of an issue. Hence, the return on capital consciousness has been lower on average if we compare the two markets.

As a team, we find more companies in India which we think are investable – privately-owned, focused on return on capital, with significant growth opportunity ahead, and good governance. And because they are smaller today in India compared to China, there is much more runway for these companies in India. Therefore, I think India has always been a great investment destination, and not just because China is going through a tough period.

What are some risks you keep in mind when investing in India?

Shivika: India's currency often devalues and it will probably continue to do so in the next few years. We believe good companies will have the pricing power to overcome this currency devaluation. While the Indian rupee would have depreciated by 70% to 80% in the last 30 to 40 years, these companies would have still compounded earnings, had attractive returns on capital employed, and cemented their market leadership over time. Hence, pricing power makes a huge difference when we're trying to identify companies to invest in.

With respect to politics, India has had many different governments over time, which have lasted from two weeks to over 10 years. Despite all the political complexities, the country still works. Quality businesses do well despite the politics - not because of it.

Sree: Firstly, for India to grow at the pace it aspires to, it will need to consume a lot of resources. Unfortunately, given how the world is positioned today and how large India is, it cannot afford to consume resources at the same intensity as others have in the past. Therefore, we need to find more efficient ways to grow and be innovative about it as a society. Everyone will have to come together to achieve that. If you look at the list of some of the most polluted cities in the world, Indian cities would feature quite highly. That is something we worry about in terms of becoming a constraint to growth. For example, if these cities become very polluted, the companies that operate there will not be able to attract the best talent.

Finally, one thing that comes to mind is economic concentration. We like the fact that India is such a broad and deep market to invest in. In recent years, however, we have seen some groups which have, over time, garnered a larger share of the economy and the investable universe. When these companies start to suppress competition across a number of industries because of their scale, it could become a less deep, less broad market to invest in. These companies might feel that they are too big to fail. Meanwhile the economy could get too concentrated among a few companies or families.

What are we doing differently compared to peers?

Shivika: On our team, we have a bottom-up approach where we try to find good companies run by good people. Our process involves a lot of debate and discussion where every member on our team tries to understand what can go wrong and question each other on it.

Sree: Our time horizon tends to be much longer. Typically, we take a view of at least five years on a business – often, it's much longer than that. Most of the core India holdings in our portfolios have been part of the portfolio for more than a decade.

Because we take a long-term view, we don't spend time trying to forecast short-term numbers like the next quarter’s or next year's earnings per share (EPS). We spend our time identifying the right people to back – who are the right families or the right management teams, who can build successful businesses over the long term, and whether we as minority shareholders will feel aligned with them.

When we engage with companies, we’re not looking for them to agree with us necessarily. Instead, we try to gauge whether they are open to receiving engagement from a stakeholder, or dismissive of it. That response tells us how they would treat not just us, but other minority stakeholders as well, whether it's their distributors, suppliers, employees or the community in which they operate.

We make six to seven trips to India every single year, so almost every month or couple of months. On these trips, in addition to engaging with management teams, we also conduct 360-degree checks on them. We meet their competitors, their suppliers and their distributors to conduct reputational checks. Asking a supplier whether they get paid by the company on time tells us more about the financial quality of the business than just looking at numbers on a Bloomberg screen. Similarly, asking a competitor who they respect the most in the industry often gives us an idea on which management teams they rate highly and, therefore, which we should be looking at as well. These channel checks help us understand the people behind the businesses better.

Vinay: We think of risk as losing money and not underperforming a random collection of companies, which helps us stick to our philosophy and process. And we know what we will not do, no matter what.

Source: Company data retrieved from company annual reports or other such investor reports. Financial metrics and valuations are from FactSet and Bloomberg. As at 22 May 2024 or otherwise noted.

Footnotes

1 Source: Jefferies and Euromonitor, as of fiscal year 2023

Read our latest insights

- Article

- 3 mins

- Article

- 4 mins

- Article

- 3 mins

This document has been prepared for informational purposes only and is only intended to provide a summary of the subject matter covered. It does not purport to be comprehensive or to give advice. The views expressed are the views of the writer at the time of issue and may change over time. This is not an offer document and does not constitute an offer, invitation or investment recommendation to distribute or purchase securities, shares, units or other interests or to enter into an investment agreement. No person should rely on the content and/or act on the basis of any material contained in this document.

This document is confidential and must not be copied, reproduced, circulated or transmitted, in whole or in part, and in any form or by any means without our prior written consent. The information contained within this document has been obtained from sources that we believe to be reliable and accurate at the time of issue but no representation or warranty, express or implied, is made as to the fairness, accuracy, or completeness of the information. We do not accept any liability whatsoever for any loss arising directly or indirectly from any use of this document.

References to “we” or “us” are references to First Sentier Investors a member of MUFG, a global financial group. First Sentier Investors includes a number of entities in different jurisdictions. MUFG and its subsidiaries do not guarantee the performance of any investment or entity referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk including loss of income and capital invested.

If this document relates to an investment strategy which is available for investment via a UK UCITS but not an EU UCITS fund then that strategy will only be available to EU/EEA investors via a segregated mandate account.

In the United Kingdom, issued by First Sentier Investors (UK) Funds Limited which is authorised and regulated in the UK by the Financial Conduct Authority (registration number 143359). Registered office Finsbury Circus House, 15 Finsbury Circus, London, EC2M 7EB number 2294743. In the EEA, issued by First Sentier Investors (Ireland) Limited which is authorised and regulated in Ireland by the Central Bank of Ireland (registered number C182306) in connection with the activity of receiving and transmitting orders. Registered office: 70 Sir John Rogerson’s Quay, Dublin 2, Ireland number 629188. Outside the UK and the EEA, issued by First Sentier Investors International IM Limited which is authorised and regulated in the UK by the Financial Conduct Authority (registered number 122512). Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB number SCO79063.

Copyright © (2024) First Sentier Investors

All rights reserved.