Management quality: how we identify teams built to last

At FSSA Investment Managers, we invest in businesses we expect to be part of our portfolio for decades to come. That’s why we put such a premium on the quality of management teams, choosing leaders who we believe have the skills to build strong franchises and deliver long-term growth.

The emerging market landscape was very different when the FSSA team first started investing in the late 1980s1.

In the wake of the Asian financial crisis of 1997, the region was seen as risky. It was essential to carry out extensive due diligence into businesses and the people who ran them. As investors, we needed to ensure we could trust them to guide their firms into the future.

Competitive advantages, financial fundamentals, company valuations and the size of the market opportunity naturally had their roles to play in stock selection.

But we found management quality was just as significant a factor when it came to choosing companies to invest in – and we remain firm in this belief. While a company’s financials and franchise strength are of course hugely important, without the right people to guide the business, we would not invest.

Our commitment to carrying out in-depth, in-person research into companies has given us a key advantage and helped to deliver sustained growth for our clients.

Our evaluation process

Our unwavering focus on management quality is far from typical in emerging-market investing.

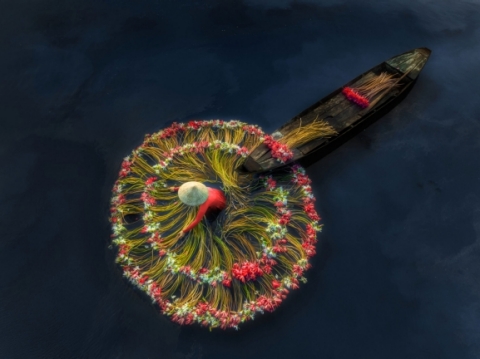

We put in the time and go the distance. Our portfolio managers regularly travel to destinations around the globe to meet management teams face-to-face, directly in the places they do business.

This represents a key step in our process of understanding how companies operate and identifying the leadership teams capable of turning promising business models into long-term success.

What we look for in management teams

We’re looking for a sense of stewardship. Does this leadership team consistently ‘do the right thing’, not just for themselves but for other stakeholders? How do they treat minority shareholders, or employees?

Management’s past performance, especially during downturns and more challenging trading conditions, makes up a significant proportion of our analysis. Our in-person experience helps us fill the gaps in our initial research and understand how the company has adapted to the external environment, as well as whether it has taken any shortcuts to reach its current position.

With a portfolio of, at most, 45 businesses, the FSSA Global Emerging Markets strategy rejects far more companies than we move forward with. If we encounter certain red flags in terms of governance or a history of misdemeanours, for example, we will move on to other opportunities.

No matter how compelling the growth opportunity or the current valuation, we simply will not invest unless we have faith in management and their ability to sustain the business through the cycles.

Fostering ongoing relationships

Our assessment of management quality does not end the moment we make our initial investment. As long-term, patient investors, FSSA Investment Managers seek to establish long-term partnerships with investee businesses.

We believe we have a useful role to play in providing support and promoting growth as emerging markets continue to develop in areas such as corporate governance and sustainability disclosure. We regularly engage with firms on topics such as capital allocation and board diversity, and share best practices across our portfolio companies.

As the emerging market landscape evolves, our ethos remains the same. It has served us and our clients well, and consistently enabled us to partner with companies we believe will be the long-term winners.

1 FSSA Investment Managers has a long history of investing in Asia Pacific and Global Emerging Market equities as part of the former Stewart Ivory & Company Limited, which subsequently became known as First State Stewart. After years of organic growth, the team split in two in 2015 and First State Stewart Asia was formed. We subsequently renamed the team FSSA Investment Managers in 2019.

Related articles

- Article

- 4 mins

- Article

- 4 mins

Important Information

For institutional investors only

This document has been prepared for general informational purposes only and is only intended to provide a summary of the subject matter covered. It does not purport to be comprehensive or to give advice. The views expressed are the views of the writer at the time of issue and may change over time. This is not an offer document and does not constitute an offer or invitation or investment recommendation to distribute or purchase securities, shares, units or other interests or to enter into an investment agreement. No person should rely on the content and/or act on the basis of any material contained in this document.

This document is confidential and must not be copied, reproduced, circulated or transmitted, in whole or in part, and in any form or by any means without our prior written consent. The information contained within this document has been obtained from sources that we believe to be reliable and accurate at the time of issue but no representation or warranty, express or implied, is made as to the fairness, accuracy, or completeness of the information. We do not accept any liability whatsoever for any loss arising directly or indirectly from any use of this document.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE PERFORMANCE.

Certain statements, estimates, target returns, and projections in this document may be forward-looking statements. These forward-looking statements are based upon First Sentier Investors' current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Actual returns can be affected by many factors, including, but not limited to, inaccurate assumptions, known or unknown risks and uncertainties and other factors that may cause actual results, performance, or achievements to be materially different. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will continue, and First Sentier Investors undertakes no obligation to publicly update any forward-looking statement. You are cautioned not to place undue reliance on the performance objective in making your decision to invest with First Sentier Investors.

Reference to the names of each company mentioned in this communication is merely for explaining the investment strategy, and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of FSI.

The comparative benchmarks or indices referred to herein are for illustrative and comparison purposes only, may not be available for direct investment, are unmanaged, assume reinvestment of income, and have limitations when used for comparison or other purposes because they may have volatility, credit, or other material characteristics (such as number and types of securities) that are different from the funds managed by First Sentier Investors.

References to "we" or "us" are references to First Sentier Investors ("FSI"), a member of Mitsubishi UFJ Financial Group, Inc., a global financial group.

In the United States, this document is issued by First Sentier Investors (US) LLC. This material is solely for the attention of institutional, professional, qualified or sophisticated investors and distributors who qualify as qualified purchasers under the Investment Company Act of 1940 and as accredited investors under Rule 501 of SEC Regulation D under the US Securities Act of 1933. It is not to be distributed to the general public, private customers or retail investors in any jurisdiction whatsoever.

For more information please visit www.firstsentierinvestors.com. Telephone calls with FSI may be recorded.