Discerning value amid China’s macro noise

“Whenever you find yourself on the side of the majority, it is time to pause and reflect.”1

-Mark Twain

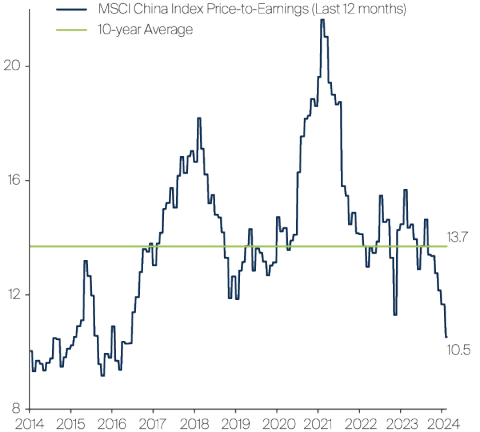

When China reopened at the end of 2022, domestic stocks had a V-shaped rebound, analysts raised their earnings forecasts, and companies prepared for a steep recovery in the economy. But the market’s optimism soon faded and turned into disappointment. Consumers did not return to pre-Covid levels of spending, and companies overinvested in new capacity and inventory. Mismatches between demand and supply led to increased competition in many sectors, along with price cuts and deflation. Adding to the pessimism were media reports of tightening regulations, rising unemployment, falling birth rates, property company defaults and tensions with the West. On the back of these concerns, the China market’s valuations fell back to low levels.

MSCI China Index valuations vs the past decade

Source: Factset, FSSA Investment Managers, as at 14 February 2024.

Source: Factset, FSSA Investment Managers, as at 14 February 2024.

However, from our perspective as fundamental, bottom-up investors, the picture was more mixed. Since the borders reopened at the start of 2023, members of the FSSA team have visited China regularly to meet with companies. China’s overall consumption did not return to the pre-Covid levels, and we were surprised by the level of competition in certain industries, but some segments posted decent recoveries which were often overlooked amid the pessimism. Many companies still benefited from premiumisation, import substitution, and more capital discipline. Many also continued to upgrade their research and development (R&D), ESG and management capabilities.

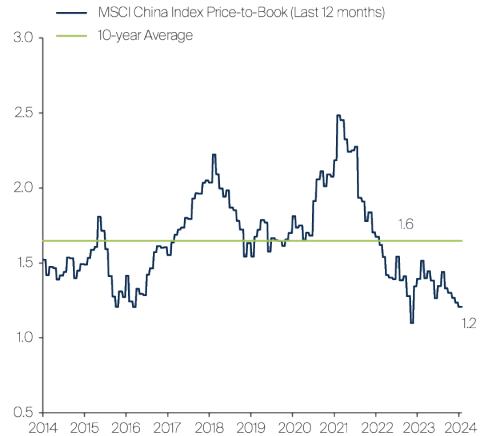

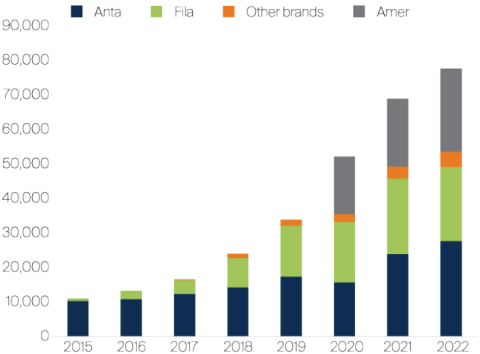

We recently visited Midea Group’s headquarters in Shunde, a southern city near Shenzhen with 2.5 million people. Midea2 is China’s largest home appliances company and a long-term holding in our portfolios. It had de-rated sharply from its peak in late 2020, even as its earnings continued to grow, before the stock price stabilised in 2023.

Midea’s has shown steady earnings growth but valuations can swing on sentiment

During our visit, we saw the company’s logo on buildings all around us and felt its ubiquitous presence in the city. Most Chinese families already own home appliances, and volumes have plateaued in all three of the large categories (air conditioners, refrigerators and washers). The domestic appliances market has become an oligopoly with Midea, Gree and Haier Smart Home3 holding 60% market share, vs 48% a decade ago. In this mature but more consolidated market, Midea remains no. 1 or no. 2 in every major category, with replacement demand being the dominant driver.

The appliances market is seeing some polarisation, with the high end and low end growing better than mid-range products. While China’s demographic tailwinds are not as strong as before, Midea has invested substantial sums in product development to differentiate its high-end offerings in brands like Colmo, and to take the Midea brand up-market. While like-for-like pricing is declining slightly, this is being off-set by mix improvement. Overall, Midea intends to maintain its healthy operating margins.

Source: Factset, FSSA Investment Managers, as at 14 February 2024.

Midea’s high-end appliances and KUKA robotic arm

Midea’s high-end appliances

Source: FSSA Investment Managers, as at January 2024.

KUKA robotic arm

Source: FSSA Investment Managers, as at January 2024.

In addition, Midea has been focusing on its B2B business, and aims to become a technology company. The company’s automation level doubled to 80% from 2019 to 2023, resulting in cost reductions every year. A small but growing part of its business is KUKA, a German robot maker which Midea acquired in 2016. It makes more than 80% of the robotics in Tesla’s new Shanghai factory and the BYD auto factory4. Its traction among automakers is well-aligned with China’s growing leadership in this area. While the margins here are still low, we think it shows the company’s forward thinking.

Our trip reassured us on Midea’s moat and culture. The company has more than 30 R&D centres and manufactures in 19 cities globally. Despite its large scale and mature growth profile, the operations are efficient, profitable and highly cash-flow generative. Even after factoring in the beleaguered property market and economic uncertainties, we believe 8-10% annual profit growth is achievable in the coming 3 years.

Besides being the dominant domestic player, around 40% of Midea’s sales come from exports, mostly contract manufacturing. As China’s market becomes more mature and competitive, more domestic companies may aim to go overseas. However, this is challenging in practice, so Midea’s success in the global arena speaks to its quality.

Leading consumer companies at lower valuations

Midea is well-positioned to benefit from China’s rising income levels and the premiumisation trend, but a key concern among investors these days is consumption downgrading, or “down-trading”. This is understandable given the negative wealth effect from the declines in China’s property and stock prices, along with high unemployment. However, there were areas where we saw solid demand for premium products. The key difference is that Chinese consumers have become more discerning in their tastes and conscious of value for money.

We have a large weighting in several consumer companies, including Anta Sports, China Resources Beer and China Mengniu Dairy5. These are industry leaders which usually traded at higher multiples than their peers, but were de-rated in the past year. While the market seems to think consumption downgrading is a structural trend, we see it as more of a cyclical headwind. In our view, many companies’ valuations were mispricing their growth potential, so we used this opportunity to add to these high-conviction holdings.

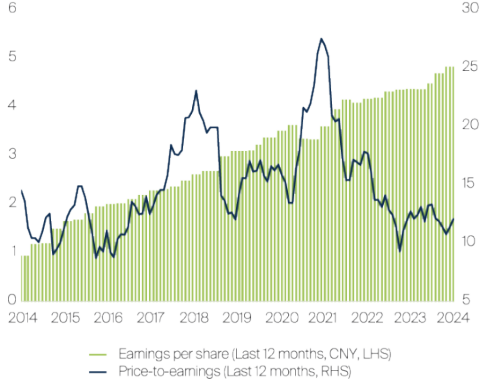

Building a house of brands

Anta Sports was founded in 1991 by Fujian native Ding Shizhong, whose entrepreneur journey started with buying and reselling shoes from his father’s factory. Ding realised early on that having a strong brand could enable premium selling prices. Over time, Anta has become the only major Chinese sportswear company to successfully grow multiple brands in different categories, such as FILA for high-end fashion sportswear and Anta for the mass market.

In 2019, Anta further moved into the high-end sports market, expanding its brands by purchasing the Finnish company Amer sports which owned well-known brands such as Salomon, Arc’teryx, Atomic, Wilson, and Peak Sport. This enabled Anta to cover all sportswear categories – performance, fashion and outdoors. Anta also acquired Descente, the high-end Japanese winter sports company, and Kolon Sport, the Korean outdoor-wear brand.

Track record of growing sales with multiple brands (CNY mn) (replace section)

While still a family-run and majority-owned company, Ding has brought in outsiders to take Anta to the next level. We believe this combination of long-term owners and well-aligned managers, including high-profile hires from Nike, Reebok and Lululemon, has been key to Anta’s success.

More recently, weak consumer demand has been a headwind for the stock, but Anta reported impressive performance at its recent update. Its higher-end brands like Fila, Descente, and Kolon all saw strong sales growth in China during 2023, ranging from high-teens growth for Fila to 60-65% for the other two. This contrasted with the performance of its large domestic peers, which struggled with excess inventory and discounting. The company’s operating margins also improved during the year.

Source: Wind, Euromonitor, Nomura, J.P. Morgan, FSSA Investment Managers as at 14 February 2024. Uses fully consolidated revenue for Amer.

As the company becomes more multi-brand, it is also encouraging to see a strong layer of leaders below the top management. We were impressed by the new Anta brand CEO, Xu Yang, who sounded confident in targeting double-digit sales growth over the next 3 years, which implies acceleration from high single-digit growth in 2023.

Amid the recent encouraging developments, we added to our position at lower valuations. We think Anta’s structural growth thesis is intact, with its house of brands growing and the company entering overseas markets. And in these difficult times, it is important to back the right people.

A leading global brand adding Chinese distribution

China Resources Beer (CRB) is the largest beer company in China with around 30% market share, and its mass-market Snow brand is the world’s largest by volume. CRB has also faced a challenging environment with down-trading pressure, as fewer people seem to be eating out at venues where premium beverages are typically consumed. In the past, the management was able to raise prices across the entire product range, but recently only the products with stronger value proposition or brands have been doing well. On the other hand, we remain optimistic about CRB’s growth potential.

China’s beer market is different from global markets, as volumes have been in decline since 2014. Despite this hurdle, we bought CRB in 2017 as we expected the company to benefit from the premiumisation trend, given its competitive operations. This has been playing out so far – CRB’s share of premium sales has grown to around 20% of turnover, with help from a 2019 merger with Heineken China, and could increase to 25% by 2025.6

China is now Heineken’s second largest market, and it has gained traction in several large coastal provinces, but we think it can continue to gain share – its volume is only 30% of Anheuser Busch’s Budweiser. The brand only officially went nationwide in 2023, and can benefit further from CRB’s extensive sales network. Its volume is expected to grow more than 30% per annum for the next few years, after surpassing 50% growth in 2023.

CRB’s chairman and CEO, Hou Xiaohai, is a passionate and hands-on leader with a clear strategy, focusing on quality growth and profitability in a consolidating industry. His longer-term initiatives include entering the Chinese liquor business with last year’s Jinsha acquisition, and marketing healthier drinks, such as non-alcoholic beverages to target younger people.

Quality dairy products for health-minded consumers

As the Chinese population grows older and richer, nutrition is becoming a greater priority. China Mengniu Dairy is another holding which has faced negative headwinds over the consumption slowdown, but like CR Beer with Heineken, it has a strong premium product – Milk Deluxe, a well-known brand of ultra-high temperature (UHT) milk.

Milk Deluxe has a strong value proposition, using only the highest-quality raw milk from dedicated ranches. It contains more protein than basic milk, and the taste is richer and creamier. Mengniu and key competitor Yili7 combined have spent over RMB50bn in the past decade to promote premium UHT milk, so Chinese consumers recognise the Milk Deluxe brand. Thus it can garner a premium of 50-400% over basic milk.

Mengniu’s profit growth has been driven by the liquid milk business, where UHT milk is the biggest and fastest-growing part. This business favours economies of scale, and the barriers to entry from upstream milk sourcing, marketing spend and channel coverage make it nearly impossible for smaller players to compete. Mengniu and Yili each hold 40-50% of China’s UHT milk market. There is also a trend of continuous premiumisation within UHT milk, and Milk Deluxe holds over 50% market share in premium UHT milk.

Milk Deluxe has delivered 20% compound annual growth rate (CAGR) over 10 years, contributing 30% of Mengniu’s total 2022 revenue, and is highly profitable within Mengniu’s product lines. We believe Milk Deluxe will continue to outgrow the market, given the growing focus on health and wellness in China. However, the company will need to continually upgrade the product quality and value proposition in this weak consumption environment.

Having first bought Mengniu’s stock in 2004, we have been meeting with the management regularly ever since. Amid the market’s pessimism, our recent meetings with CEO Jeffrey Lu have added to our conviction. Since he took office in 2016, he has been consistent in executing Mengniu’s long-term strategy – launching more premium brands to improve the product mix, investing in sales and distribution, and controlling input costs to improve profitability. Recent initiatives include expanding the cheese business and a line of liquid protein supplements to target the sports market.

One area of concern has been Mengniu’s disappointing history of acquisitions, but we were encouraged to hear that there will be no further deals in the foreseeable future. Overall, we think Mr Lu has been candid and reflective about mistakes. He appears focused on building the team and brands rather than chasing growth, and we like his long-term vision.

Conclusion and outlook

Despite concerns around “down-trading” in the near term, we still believe that over the long run, Chinese people will become wealthier amid increasing urbanisation and GDP per capita. As this happens, they will likely want to improve their health and lifestyle, which favours consumer companies with effective premiumisation strategies like Midea, Anta Sports, CR Beer and Mengniu. We have owned these stocks for many years, and they have good track records over the longer term. To us, this reflects well on their management and franchise quality.

Through our regular research trips to China, we look beyond the country’s general economic weakness to find companies that are either bucking the negative trends, or are strengthening their market positions in the down-cycle. We think there are still plenty of quality companies, with strong brands and proven franchises that can achieve decent earnings growth over the long run.

We continue to seek the companies that will become the long-term winners, which are typically the industry leaders of today. And the lower valuation multiples reflect reduced expectations, which makes the potential risk-reward more attractive. As always, we would like to thank you for your support.

Footnotes

1 https://www.azquotes.com/quote/298590

2 A top 10 holding across multiple FSSA’s China strategies, and a consumer company.

3 These are the top 3 home appliances firms in China, by market share.

4 Tesla and BYD are prominent electric vehicle manufacturers, to illustrate the reach of Midea’s factory robotics.

5 Anta, CR Beer and Mengniu are also consumer companies and top 10 holdings across FSSA’s China strategies.

6 Heineken is a prominent global beer brand which has merged its China operations with CR Beer.

7 Yili is Mengniu’s main competitor, and the two companies have a duopoly in China’s dairy market.

Source: Company data retrieved from company annual reports or other such investor reports. Financial metrics and valuations are from FactSet and Bloomberg. As at 14 February 2024 or otherwise noted.

Latest insights

- Article

- 8 mins

- Article

- 5 mins

- Video

- 17 mins

Important Information

This material is solely for the attention of institutional, professional, qualified or sophisticated investors and distributors who qualify as qualified purchasers under the Investment Company Act of 1940 and as accredited investors under Rule 501 of SEC Regulation D under the US Securities Act of 1933 (“1933 Act”). It is not to be distributed to the general public, private customers or retail investors in any jurisdiction whatsoever.

This presentation is issued by First Sentier Investors (US) LLC (“FSI”), a member of Mitsubishi UFJ Financial Group, Inc., a global financial group. The information included within this presentation is furnished on a confidential basis and should not be copied, reproduced or redistributed without the prior written consent of FSI or any of its affiliates.

This document is not an offer for sale of funds to US persons (as such term is used in Regulation S promulgated under the 1933 Act). Fund-specific information has been provided to illustrate First Sentier Investors’ expertise in the strategy. Differences between fund-specific constraints or fees and those of a similarly managed mandate would affect performance results. This material is provided for information purposes only and does not constitute a recommendation, a solicitation, an offer, an advice or an invitation to purchase or sell any fund and should in no case be interpreted as such.

Any investment with FSI should form part of a diversified portfolio and be considered a long term investment. Prospective investors should be aware that returns over the short term may not be indicative of potential long term returns. Investors should always seek independent financial advice before making any investment decision. The value of an investment and any income from it may go down as well as up. An investor may not get back the amount invested and past performance information is not a guide to future performance, which is not guaranteed.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon First Sentier Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Actual returns can be affected by many factors, including, but not limited to, inaccurate assumptions, known or unknown risks and uncertainties and other factors that may cause actual results, performance, or achievements to be materially different. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and First Sentier Investors undertakes no obligation to publicly update any forward-looking statement.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE PERFORMANCE.

Reference to the names of each company mentioned in this communication is merely for explaining the investment strategy, and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of FSI.

For more information please visit www.firstsentierinvestors.com. Telephone calls with FSI may be recorded.