China equities: Quality and patience go a long way

In the second article of this three-part series, Martin Lau, managing partner and lead portfolio manager of the FSSA China Growth strategy, discusses the importance of keeping a long-term mindset and valuation discipline as the strategy celebrates its 30th anniversary this year.

During my career over the past 20-plus years, there have been two major lessons. The first is to focus on bottom-up analysis and hold on to quality companies. Sentiment could turn extremely positive or negative, which I experienced first-hand during the Asian Financial Crisis in the late 1990s, the bursting of the tech bubble in the early 2000s, and the Global Financial Crisis (GFC) in 2008. But the key driver of share prices over the long term is the ability for companies to generate value, by growing their earnings or net asset value.

The second lesson is to remain disciplined and not be carried away by greed or fear. I have seen the same market trade at 60x price-to-earnings (PE) and 5x PE. This means when the market is fearful, we need to be more courageous, and when the market is irrationally bullish, we should tread carefully.

Going against the crowd can be difficult, especially in this environment with steep interest rate hikes in the US, the Russia-Ukraine conflict, weakness in Chinese property and rolling Covid lockdowns. We are not macro investors, nor can we predict how such events will play out. But while every crisis is different, the ingredients are often the same – they all relate to human nature.

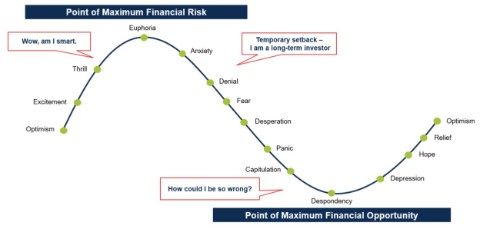

The below chart helps to put things in perspective. As we reflect on the prevailing emotions around Chinese stocks over the past year, we appeared to be closer to the bottom than the top. Therefore, we have added to our high-conviction core holdings.

Where are we in the cycle?

Importance of discipline

Source: FSSA Investment Managers

Focus on quality as bottom-up investors

Somewhat unique to our investment process is the amount of time we spend meeting with management teams – we hold more than 1,500 meetings a year. Rather than build complex financial models, we try to gain conviction around a company’s competitive moat, sustainability of earnings growth, and the management’s integrity. An acid test of our conviction is whether we would buy more of a stock if the price halves.

Amid the recent headwinds, we have continued to meet with companies to see how they adapt. We believe the best companies tend to emerge stronger from setbacks, as we saw with a dairy company holding following the 2008 melamine scandal, or a Hong Kong-based power tools maker after the US housing market crashed during the GFC.

Our focus on quality also helps to avoid losses. If the management are not honest, they will find ways to take advantage of minority shareholders. China has given us plenty of scandals, as in the case of Chaoda Modern Agriculture, Gome, Luckin Coffee and more recently, Evergrande.

These incidents all point to a lack of integrity, in the form of fraudulent financials, insider trading, or bribery. To form a clear assessment in our company meetings, we also read between the lines and observe the nuances of their culture. Is there a domineering leader? Do they treat their employees well, and care about the broader society? We view any mistreatment of other stakeholders as a clear red flag.

Keep a long-term horizon

We believe the growth in company earnings is what ultimately drives share prices over the long term, as seen in the below chart. One needs both patience and conviction to reap such rewards, so when we add a stock to the portfolio, we hold on to it for the long term. All of our top 10 holdings have been in the portfolio for more than 10 years. As the adage goes, “It's not about timing the market, but time in the market.”

For example, after a large SOE bank in our portfolio was first listed in Hong Kong in 2006, the share price went nowhere for a number of years. Headwinds included the GFC and concerns around non-performing loans (NPLs). But despite these concerns, the company’s earnings have risen and so has the stock price, performing better than most Chinese banks over the long term. This is largely due to its track record of prudent risk management and organic growth in assets without the need for outside capital. Recently, we have added to our holdings amid attractive valuations.

China Merchants Bank share price and earnings since 2007

* Earnings per share

Source: Factset, FSSA Investment managers, February 2023

Similarly, we have been shareholders of a major internet company since 2005, and it has performed well over the long term. We have always found the management to be stable and down to earth. They have consistently focused on user experience and executed better than their peers, building up strong moats through major apps. While the company is unlikely to repeat its past growth due to its sheer size, we expect it will achieve 10-15% sales growth per annum in the coming 3 to 5 years, given the potential to monetise its existing apps. Therefore, we saw the recent pessimism as a buying opportunity.

Our major internet holding’s stock is cheap relative to history

Price-to-book ratio

Sources: Factset, FSSA Investment Managers as of February, 2023

Maintain valuation discipline

Besides our focus on quality and investing for the long term, valuation discipline has always been part of our investment philosophy. Maintaining this discipline can be difficult in practice, but it helps that the team has experienced various cycles and seen the market rebound from extreme pessimism. In hindsight, the best buying opportunities usually arose when the economy was at its worst, like during SARS in 2003.

As investors, part of our job is to consider opposing views to the crowd. In the property sector, for instance, the prevailing negative sentiment is constraining new investments and supply, which means new opportunities could arise as demand catches up. Another example is China’s ‘common prosperity’ agenda, which has raised the regulatory standards in sectors like education, internet, healthcare and property. We think share prices have factored in these challenges; in fact the regulations can help these industries improve. Companies will need to be more disciplined with spending, and the ones with stronger franchises should gain market share.

The other side of valuation discipline is avoiding hot, crowded areas of the market. Given our team’s experience, we are naturally cautious and sceptical. Some people may see this as a drawback, but we believe this conservative attitude has saved us more often than not. For example, we avoided lossmaking internet and electric vehicle companies, which meant missing out on gains during ebullient periods, but conversely protected our capital when the market sentiment turned.

Conclusion

China has always been opaque in areas like policy-making, which can lead to big surprises and market volatility. Whether we have seen the bottom will only become clear in hindsight. Until then, we continue adhering to our investment discipline by focussing on quality, keeping a long-term horizon, and constantly challenging one another, lest we get carried away by our own greed and fear.

Related readings

- Article

- 8 mins

- Article

- 8 mins

- Article

- 8 mins

Source: Company data retrieved from company annual reports or other such investor reports. Financial metrics and valuations are from FactSet and Bloomberg. As at February 2023 or otherwise noted.

Important Information

This material is solely for the attention of institutional, professional, qualified or sophisticated investors and distributors who qualify as qualified purchasers under the Investment Company Act of 1940 and as accredited investors under Rule 501 of SEC Regulation D under the US Securities Act of 1933 (“1933 Act”). It is not to be distributed to the general public, private customers or retail investors in any jurisdiction whatsoever.

This presentation is issued by First Sentier Investors (US) LLC (“FSI”), a member of Mitsubishi UFJ Financial Group, Inc., a global financial group. The information included within this presentation is furnished on a confidential basis and should not be copied, reproduced or redistributed without the prior written consent of FSI or any of its affiliates.

This document is not an offer for sale of funds to US persons (as such term is used in Regulation S promulgated under the 1933 Act). Fund-specific information has been provided to illustrate First Sentier Investors’ expertise in the strategy. Differences between fund-specific constraints or fees and those of a similarly managed mandate would affect performance results. This material is provided for information purposes only and does not constitute a recommendation, a solicitation, an offer, an advice or an invitation to purchase or sell any fund and should in no case be interpreted as such.

Any investment with FSI should form part of a diversified portfolio and be considered a long term investment. Prospective investors should be aware that returns over the short term may not be indicative of potential long term returns. Investors should always seek independent financial advice before making any investment decision. The value of an investment and any income from it may go down as well as up. An investor may not get back the amount invested and past performance information is not a guide to future performance, which is not guaranteed.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon First Sentier Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Actual returns can be affected by many factors, including, but not limited to, inaccurate assumptions, known or unknown risks and uncertainties and other factors that may cause actual results, performance, or achievements to be materially different. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and First Sentier Investors undertakes no obligation to publicly update any forward-looking statement.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE PERFORMANCE.

Reference to the names of each company mentioned in this communication is merely for explaining the investment strategy, and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of FSI.

For more information please visit www.firstsentierinvestors.com. Telephone calls with FSI may be recorded.