India Monthly Manager Views

An Indian Conglomerate Group

Our investment philosophy is to back owners and managers with whom we feel strongly aligned. These owners typically have track records of treating all stakeholders fairly, in both good and bad times. They are ambitious in growing their business, but also risk-aware in their pursuit of growth. In India, we typically find these traits in family-owned companies (commonly referred to as “promoter groups”). Families are able to take a multi-decade view of their business and act counter-cyclically to create value for all shareholders. Our favoured promoter groups are those who recognise the advantages of introducing professionally-run management teams, high-quality boards and other best practices with respect to governance. We follow such changes closely to identify the cultural markers of families which are likely to succeed over time, and others that may be left behind.

This Indian Conglomerate Group was founded in 1897 and has been stewarded by the family successfully across generations. Its current leaders are from the fourth generation of the family. While they lead the group’s governance, the day-to-day operations of each underlying business are led by talented professional managers. This combination of family ownership and professional management has helped build leading businesses in segments ranging from Home & Personal Care products to Residential Real Estate and Animal Feed. The group’s listed holding company owns a 24% stake in a Consumer Products Company, 47% in a Property Company and 62% in an Agribusiness Company. It has a track record of successfully incubating new businesses, such as the Property Company, which was listed in 2010 (current market capitalisation of USD 8.6bn) and the Agribusines Company, which was listed in 2017 (current market capitalisation of USD 1.6bn). We have been shareholders of the listed Group Company for the most part of the last decade.

Recent developments at the company have been encouraging. Its board has been refreshed with four new independent directors as long-standing directors retired. The new board members include the ex-CFO of Novartis India, a partner associated with Fidelity International, the co-founder of a reputed Venture Capital firm and the chairman of a leading Home and Kitchenware brand. Additionally, the Housing Finance business, which was set up in 2020, has been injected by the family into the listed Group Company for a nominal sum, and an executive with significant experience at Citigroup was appointed its CEO. Given the strong reputation of the Group, the housing finance business is able to access funding at attractive rates. Its pilot program with the group’s Property Company has received a strong customer response. Similar to the Property business and the Agribusiness Company, we believe this business has potential to create significant value over the long term.

The listed Group Company’s shareholding in the Consumer Products Company and the Property Company account for 90% of its net asset value. Consumer Products’ growth has been weak in recent years. It recently appointed an executive who has spent over two decades at Unilever as its new CEO. We expect its performance to improve under his leadership. The Property business is benefiting from the consolidation in India’s fragmented real estate industry, as poor-quality local developers lose out to leading brands like this Group. These expectations are reflected in its expensive valuations. In stark contrast, the listed Group Company’s valuations are exceptionally attractive, in our view, at a 62% discount to the value of its stakes in its listed subsidiaries and associates. The family appears to share the same view, having increased its stake in the listed Group Company by 6% since 2019.

*Market value of the Group’s Consumer Products, Properties and Agribusiness, as at 12th November 2021.

**The % of Net Asset Value is adjusted for the standalone net debt. Source: FactSet, BSE India.

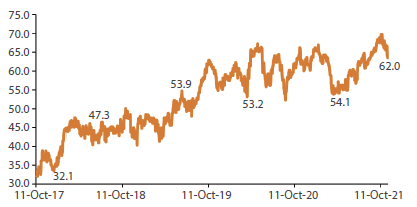

The listed Group Company’s Discount to Net Asset Value since the listing of the Agribusiness

Source: ICICI Securities, 12th November 2021

Performance Commentary¹

The FSSA Indian Subcontinent Fund declined in October. The key contributors to performance were ICICI Bank and Mahindra CIE Automotive.

ICICI Bank rose after it reported strong quarterly results. Its Net Interest Income (NII) rose by 25% and earnings per share (EPS) by 29% over the same period last year. The bank’s asset quality and Return on Assets (ROA) continue to improve steadily.

Mahindra CIE Automotive also rose after it reported strong financial performance. Its revenues grew by 21% and operating profit by 78% over the same period last year. The company benefited from a rebound in automotive demand in both its Indian and European operations, and market share gains. Its efforts to improve operating efficiency over the last year has helped it strengthen its profitability.

The key detractors were Solara Active Pharma and Colgate Palmolive (India).

Solara Active Pharma declined due to concerns about price inflation on its key raw materials. However, our discussions with the management reassured us that the long-term prospects are still bright, with the CEO stating an ambition to grow revenues nearly four-fold over the coming five years.

Colgate Palmolive (India) declined following concerns about rising commodity costs affecting its profitability. It has dominant market share in oral care which affords the company strong pricing power. Colgate has a long track record of improving its profitability consistently. In our view, it will be able to continue improving its profitability over the medium term, as it passes on price increases to consumers and upgrades its product portfolio to more premium products.

1 For illustrative purposes only. Reference to the names of each company mentioned in this communication is merely for explaining the investment strategy and First Sentier Investors does not necessarily maintain positions in such companies. Any fund or stock mentioned in this presentation does not constitute any offer or inducement to enter into any investment activity nor is it a recommendation to purchase or sell any security.

Related insights

- Article

- 3 mins

- Article

- 4 mins

- Article

- 3 mins

*Company data retrieved from company annual reports or other such investor reports. Financial metrics and valuations are from FactSet and Bloomberg. As at 31 October 2021 or otherwise noted.

Important Information

This material is solely for the attention of institutional, professional, qualified or sophisticated investors and distributors who qualify as qualified purchasers under the Investment Company Act of 1940 and as accredited investors under Rule 501 of SEC Regulation D under the US Securities Act of 1933 (“1933 Act”). It is not to be distributed to the general public, private customers or retail investors in any jurisdiction whatsoever.

This presentation is issued by First Sentier Investors (US) LLC (“FSI”), a member of Mitsubishi UFJ Financial Group, Inc., a global financial group. The information included within this presentation is furnished on a confidential basis and should not be copied, reproduced or redistributed without the prior written consent of FSI or any of its affiliates.

This document is not an offer for sale of funds to US persons (as such term is used in Regulation S promulgated under the 1933 Act). Fund-specific information has been provided to illustrate First Sentier Investors’ expertise in the strategy. Differences between fundspecific constraints or fees and those of a similarly managed mandate would affect performance results. This material is provided for information purposes only and does not constitute a recommendation, a solicitation, an offer, an advice or an invitation to purchase or sell any fund and should in no case be interpreted as such.

Any investment with FSI should form part of a diversified portfolio and be considered a long term investment. Prospective investors should be aware that returns over the short term may not be indicative of potential long term returns. Investors should always seek independent financial advice before making any investment decision. The value of an investment and any income from it may go down as well as up. An investor may not get back the amount invested and past performance information is not a guide to future performance, which is not guaranteed.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon First Sentier Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Actual returns can be affected by many factors, including, but not limited to, inaccurate assumptions, known or unknown risks and uncertainties and other factors that may cause actual results, performance, or achievements to be materially different. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and First Sentier Investors undertakes no obligation to publicly update any forward-looking statement.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE PERFORMANCE.

Reference to the names of each company mentioned in this communication is merely for explaining the investment strategy, and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of FSI.

For more information please visit www.firstsentierinvestors.com. Telephone calls with FSI may be recorded.