India

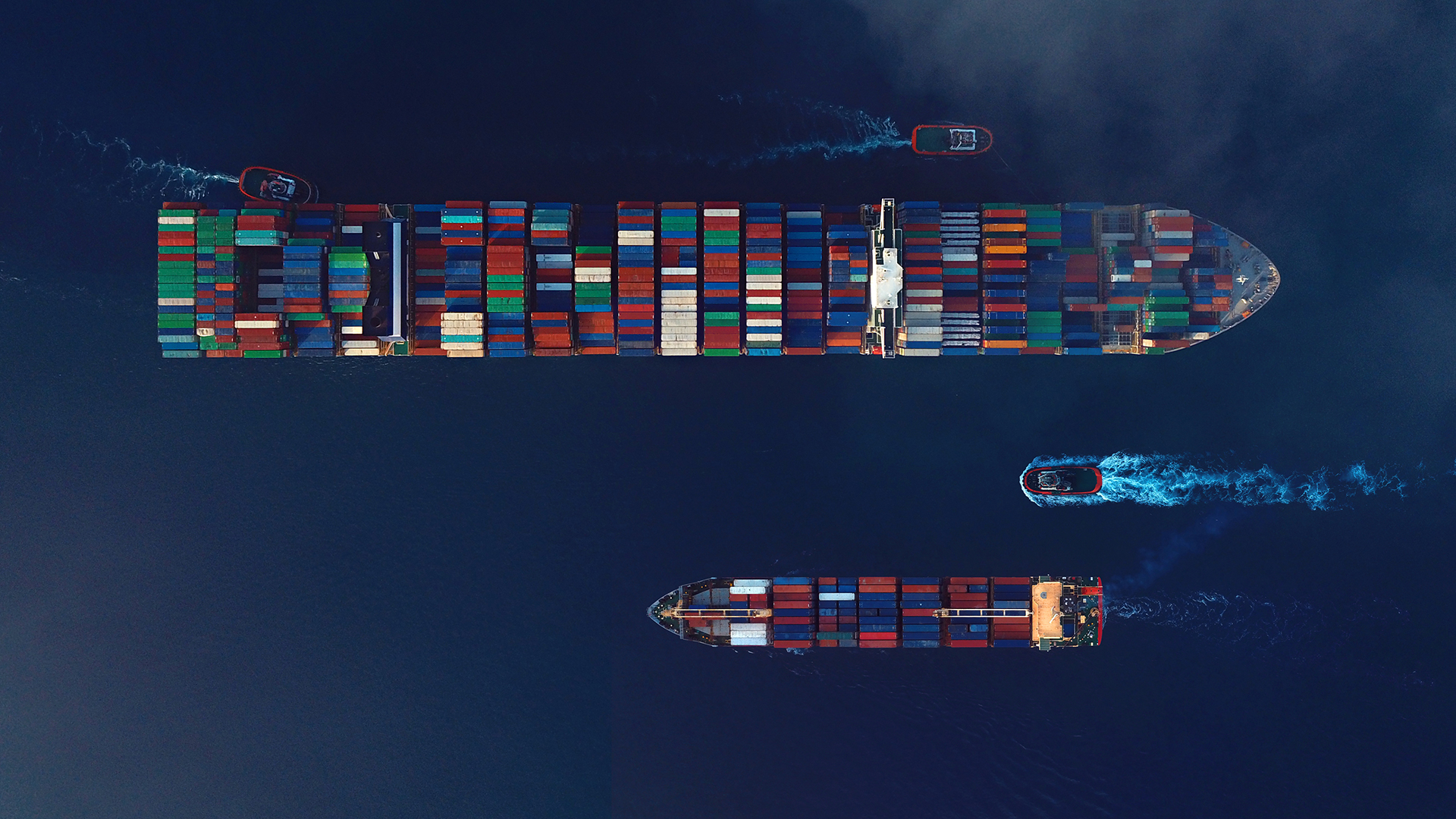

Witness the rise of India with a different perspective.

India’s large population, its rapidly developing metropolises and its rich history of commerce are all contributing to its journey in becoming an economic powerhouse. We have spent the past decades building relationships with high-quality owners and managers in India and have identified, in our view, some of the best growth opportunities in the world.

What we invest in

Aspirational consumer base

Favourable demographics and under-penetrated categories*, lead to well-positioned consumer franchises generating high Returns on Capital Employed (ROCE)**. We believe such dominant franchises will keep gaining market share as the markets formalise as well as premiumise over time.

Infrastructure Improvement

With greater need for better quality infrastructure as the country develops, we believe that suppliers, such as paints and cement companies, will benefit. Well-run companies in these industries typically generate high returns and have low debt compared to infrastructure asset owners.

Financial Inclusion

We believe well-managed private banks should continue to benefit from greater penetration of financial services across India. They should continue gaining market share at the expense of poorly run and under-capitalised state-owned banks.

Undiscounted change

We believe in paying close attention to changes in management and ownership, in inherently attractive businesses undergoing temporary periods of difficulty. This can often lead to meaningful transformations, generating significant value for shareholders.

*Under-penetrated categories mean categories or products and services that are still not widely used by consumers.

**Return on capital employed (ROCE) is a financial ratio that can be used in assessing a company's profitability and capital efficiency.

Our approach to responsible investment

Non-label disclaimer

Our approach to responsible investing has been shaped by an emphasis on stewardship and the belief that quality managers and good governance should ensure that environmental and social concerns are rightfully addressed. We have integrated sustainability analysis into our investment process and engage extensively on environmental, labour and governance issues.

Sustainable investment labels help investors find products that have a specific sustainability goal. FSSA's products do not have a UK sustainable investment label as they do not have a non-financial sustainability objective. Their objective is to achieve long-term capital growth by following its investment policy and strategy.

Investment Insights

- Article

- 5 mins

- Article

- 3 mins

- Article

- 3 mins

Our funds

The Fund invests primarily (at least 70% of its Net Asset Value) in a diversified portfolio of equity securities or equity-related securities issued by companies of the Indian subcontinent. Countries of the Indian subcontinent include India, Pakistan, Sri Lanka and Bangladesh. The Fund concentrates on securities that are listed, traded or dealt in on Regulated Markets in the Indian subcontinent and offshore instruments issued by companies established or operating or have significant interests in the Indian subcontinent and listed on other Regulated Markets.

The Fund invests primarily (at least 70% of its Net Asset Value) in a diversified portfolio of equity securities or equity-related securities issued by companies of the Indian subcontinent. Countries of the Indian subcontinent include India, Pakistan, Sri Lanka and Bangladesh. The Fund concentrates on securities that are listed, traded or dealt in on Regulated Markets in the Indian subcontinent and offshore instruments issued by companies established or operating or have significant interests in the Indian subcontinent and listed on other Regulated Markets.