The India “exposure"

January 2024

We already have (exposure) to India via our Asia and Regional funds.

We often hear this comment from prospective clients who are considering an investment in the FSSA Indian Subcontinent strategy, but are not yet convinced that a dedicated allocation would indeed be worth it. Call us biased, but we have been arguing in favour of a standalone investment in India for many years.

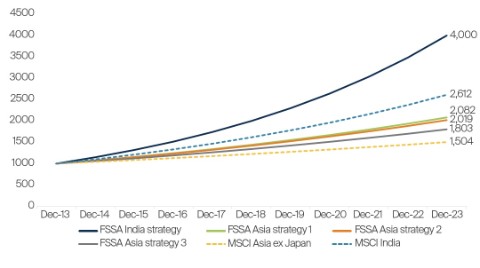

Firstly, consider the numbers. As a team, FSSA has been investing in India since the market first opened to foreign investors (in the early ‘90s); we then launched our dedicated India strategy in 1994. In the decades since, it has been one of our favourite markets to invest in, for reasons we will elaborate on later. As such, our Asia strategies have always typically had a healthy weighting to Indian companies. And yet, there is a significant difference in the returns enjoyed by clients in our regional strategies versus our India strategy.

Source: FSSA Investment Managers, as at 31 December 2023.

For illustrative purposes only; this does not constitute any advice to invest in any investment products.

Now, if we were to break down the returns of our Asia strategies (which of themselves have generated attractive returns over the 10-year period), one would see that India has been the single largest driver of returns. Indeed, for the FSSA Asia strategies that we analysed, India accounted for 30% to 45% of their respective total return over the past decade. While allocating capital to a regional strategy is a reasonable thing to do from a diversification standpoint, we would argue that the best-performing parts of the strategy are diluted (just like a portfolio with too many stocks).

In addition, what one gets, with this exposure to India via regional funds, are usually large companies which are actively traded. Typically, these tend to be a bank, an IT services company and maybe a consumer staples company. While they have kept up with the market they are not the ‘best’ businesses to own in India, in our view, particularly when we look ahead at the next 10-20 years. We believe that the really attractive businesses are still not yet on the radar of regional investors.

To illustrate the point, when we look at the top contributors to performance of the FSSA India strategy over the past decade, companies like Eicher Motors and Blue Star feature prominently.1 However, these Indian companies were not owned in most of FSSA’s regional strategies (for a variety of reasons).

Taking a step back from the discussion, it is perhaps worth revisiting the reasons for our long-term enthusiasm on India. We would make the following five points:

- Large universe of high-quality listed companies

Of the 5,000 or so listed companies in India, about 1,400 have a market capitalisation of more than USD 100m (our minimum size and liquidity threshold). Over the years, our team has met with and analysed close to 1,000 companies in India (just in the last three years, we conducted research on 350 of them). In our view, there are about 200 companies in India that meet our standards of quality (in terms of ownership, management, alignment and franchise strength). This number keeps increasing every year. In contrast, we struggle in other large emerging markets like South Korea (which was, until recently, a bigger weight than India in regional indices) to list even five companies that we deem investible. And this number keeps decreasing!

What is more, these quality Indian companies come from a wide variety of industries, unlike various commodity-driven emerging markets where certain sectors are simply absent from the stock market. According to S&P Global and Morgan Stanley, India is likely to become the world’s third largest economy by 2030, 2 which means that these companies have a large home-market to exploit and are not overly reliant on export demand. This makes us more confident of the ability of these companies to remain relatively insulated from extraneous shocks.

- One of the oldest equity markets globally

India’s Bombay Stock Exchange was established in 1875, making it among the oldest in Asia. The culture of entrepreneurship, and the ability to deal with the opportunities and challenges that come with being a public listed company, has been in place for many decades. As a result, there is an abundance of family-owned business that are listed – it is not uncommon for a public company in India to have more than 50 years of listed history and is now being managed by the third or fourth generation of family members. On the other side of the equation, there is a large (and rapidly growing) domestic asset management industry and retail investor base (i.e., individual shareholders), who tend to be well informed and moderately sensitive to governance issues (albeit not as much as we would like!)

Anecdotally, and in our view, good corporate citizens are typically more common in India. We find the situation markedly different in several Asian countries where the culture of stock ownership and public listing is not yet as ingrained. In some of these large emerging markets, the listed history is relatively short and many businesses are still run by first-generation managers, who might have only experienced a monotonous boom economy for the last two decades and thus lack the resilience that is built up by operating under tough conditions – something that Indian companies combat almost every day.

- Large businesses hiding in small market capitalisations

The sheer scale of India’s population (1.4 billion people)3 and the still nascent stage of several industries in the country means that the market leaders are quite small in comparison to regional and global peers. For example, per the International Energy Agency (IEA), it is estimated that China has 860 million air conditioners installed versus around 80 million in India (2023 figures).4 The top three listed air conditioner manufacturers in China have a combined market capitalisation of USD 105bn (as at January 2024), whereas the top listed companies in India are tiny in comparison – Blue Star, for example, a leading player with 13% industry market share, has a market cap of just USD 2.6bn. We have been shareholders of Blue Star for the last 10 years in the FSSA India strategy and think that the best period for the business is yet to come, despite its seemingly high valuations.

We come across many such examples in India, across several industries; and more importantly, are often able to identify the ultimate winners early. This gives us the conviction to hold on to our positions and perhaps add to them when market conditions permit.

- Engaged and accessible owners and management teams who are return-on-capital conscious

The most important difference between India and many other emerging markets is that India has always been capital starved (with relatively high interest rates in general) and the government has rarely been explicitly supportive of private entrepreneurs. In fact, for a long time we used to joke that Indian companies grow at night when the government is sleeping. This apparent headwind has become a tailwind under the current business-friendly regime. Furthermore, Indian managers are keenly aware of the availability of capital and its cost. This means that the best-managed Indian companies operate with high returns on capital employed (ROCE) – and even middle-level managers might be able to dissect the drivers of ROCE in the business. Thus, it is possible to have meaningful conversations about capital allocation in India – something that is hard to do in places where the gravity has been switched off for years (i.e., either the cost of capital is negligible or is freely available via state diktat).

These constructive discussions are not restricted to the capital allocation process. Our engagements on issues like board independence and effectiveness, remuneration policies, succession, quality of financials, related-party transactions, etc., tell us a lot about the culture of a company. To become convinced about being a long-term shareholder, we believe it is absolutely vital to feel aligned with the culture and be comfortable with the management quality. This allows us to stay invested through thick and thin. In general, high-quality entrepreneurs in India are comfortable engaging with minority shareholders (like ourselves) and cherish this constructive exchange of views from long-term minded investors. This goes a long way in helping to develop conviction in our holdings as compared to other markets where the conviction in a business is often directly correlated to its share price!

- Governance standards and minority shareholder protection have consistently improved

Our experience of investing across emerging markets suggests that the Indian market is ahead of peers when it comes to the protections that are in place for minority shareholders. Whether it is privatisation rules/tag-along rights, approvals for related-party transactions, mandatory independence rules for boards, mandatory disclosures of shareholdings and pledges, etc., we are able to sleep well at night owning the average Indian company. We can say from some rather painful and frustrating experiences that that is not necessarily true for many other emerging markets.

How do you justify the valuations?

Finally, this is another question we often encounter from clients and prospects. It is true that India has historically been an expensive market (some of it is justified, in our view, as explained above). However, we acknowledge that the past few years in particular have witnessed higher valuations.

Admittedly, there is a huge amount of froth in some pockets of the market, where we believe investors could get hurt. But that is not true for the entire market. For instance, the weighted average 12-month forward price-to-earnings (P/E) ratio for the FSSA Indian Subcontinent strategy is 25x. When measured against its own history (5-year average of 22x P/E), this does not seem overly concerning. The portfolio’s weighted-average return on equity (ROE) of 21% and anticipated earnings CAGR5 of 17% should also be supportive in the medium term.

Most investors like to be contrarian and we are no different. We thought, while writing this piece on “why India is attractive as a long-term allocation in client portfolios” that this could, ironically, mark the near-term peak of the market. All the exuberant signs point towards that. The important question, however, is whether we have confidence in the businesses we own to emerge as the respective winners in their industries – and therefore have a long runway of growth ahead of them. We do; and that is why we would happily add to our positions on market weakness rather than second-guess ourselves.

We have spent the past decades building relationships with high-quality owners and managers in India and have identified, in our view, some of the best compounding growth opportunities in the world. This conviction compels us to highlight the idea of a separate allocation to the India market on top of an Asia or regional strategy– so that our clients can realise the maximal benefit from what we believe to be a great next few decades for businesses in India.

Source: Company data retrieved from company annual reports or other such investor reports. Financial metrics and valuations are from FactSet and Bloomberg. As at 23 January 2024 or otherwise noted.

Footnotes

1 Top contributors to performance in the Consumer Discretionary and Industrials sectors, over 10 years to 31 December 2023. Eicher Motors is no longer held in the portfolio.

https://www.morganstanley.com/ideas/investment-opportunities-in-india

3 Source: World Bank Databank, as at 2022 https://data.worldbank.org/indicator/SP.POP.TOTL?locations=IN

4 Source: IEA, Global air conditioner stock, 1990-2050, IEA, Paris https://www.iea.org/data-and-statistics/charts/global-air-conditioner-stock-1990-2050 , IEA. Licence: CC BY 4.0

5 Compound annual growth rate