This is a financial promotion for The FSSA Global Emerging Markets Strategy. This information is for professional clients only in the UK and EEA and elsewhere where lawful. Investing involves certain risks including:

- The value of investments and any income from them may go down as well as up and are not guaranteed. Investors may get back significantly less than the original amount invested.

- Currency risk: the Fund invests in assets which are denominated in other currencies; changes in exchange rates will affect the value of the Fund and could create losses. Currency control decisions made by governments could affect the value of the Fund's investments and could cause the Fund to defer or suspend redemptions of its shares.

- Emerging market risk: Emerging markets tend to be more sensitive to economic and political conditions than developed markets. Other factors include greater liquidity risk, restrictions on investment or transfer of assets, failed/delayed settlement and difficulties valuing securities.

For details of the firms issuing this information and any funds referred to, please see Terms and Conditions and Important Information.

For a full description of the terms of investment and the risks please see the Prospectus and Key Investor Information Document for each Fund.

If you are in any doubt as to the suitability of our funds for your investment needs, please seek investment advice.

Adhering to the Fundamentals of Investing in Global Emerging Markets

Over the past few years, global emerging market (GEM) investors have dealt with a series of challenges, including a surging pandemic, local lockdowns and widespread travel restrictions. Now, an escalating conflict between Russia and Ukraine has raised fears that this could spill over into Europe and beyond. Sanctions against Russia have roiled equity and bond markets and increased commodity prices, with growing concerns about the wider contagion to global markets.

Against this backdrop, FSSA’s portfolio managers discuss their views on how to mitigate risk in these circumstances. The team’s long-established investment process suggests that focusing on quality companies — and taking a longer-term view — can help investors keep calm through the turbulence.

Given your beliefs on adhering to the fundamentals of investing, can you summarise your investment process? What changes did you make to the portfolio due to the Russia-Ukraine conflict?

We had no investments in Russia prior to the invasion. We have always found it hard to invest in Russia given our focus on governance and quality. Our due diligence process seemed always to uncover someone close to Russian President Vladimir Putin as being part of a company’s ownership and this was a difficult roadblock for us to overcome. As a result, we have not had to make any changes to our portfolios due to the Russia-Ukraine fallout.

As a team, we have been following the same investment approach over the last 30 years. In summary, we take a long-term view; we research companies from the bottom up; and we focus on quality in terms of governance and business fundamentals.

Our search for quality starts with people — assessing their track record of how they executed strategies as well as how they are incentivised. We look for people who are risk-aware and humble, like Sandeep Bakhshi, CEO of ICICI Bank, or CEOs that look after broader set of stakeholders, like Joey Wat, CEO of Yum China, which has one of the most generous employee benefit programs in China. We also like managers who are forward-looking, like MercadoLibre’s CFO Pedro Arnt, who is known for his lack of complacency in the role.

Next, we look for alignment of interests. We want to see simple corporate structures and long-term-minded owners who are on the same page as minority shareholders. We generally do not like companies that have complicated structures, cross-holdings, dual share classes which benefit one set of owners versus the others, or companies under state ownership because their interests are somewhat different from ours.

Thirdly, we focus on boards and their composition. Ultimately, they are responsible for business strategy, capital allocation and incentive structures. Therefore, it is important for the board to be majority independent, with reputable directors who have experience serving in other organisations and are likely to stand up for minority investors when things go wrong.

Among our holdings, Syngene International, a biotechnology manufacturing company in India, is a good example of this — the board is majority independent with only the owner and the CEO on the board as insiders. The remaining directors come from a diverse background of reputable organisations.

Company example: Syngene International (India)

Source: Company reports or website.

How do you assess franchise quality?

While governance is paramount, there are several examples of companies which have the highest standards of governance but operate average-quality franchises and are sometimes very poor allocators of capital. To assess franchise quality, we look for three main things.

Firstly, we tend to focus on companies that benefit from domestic demand and have circular long-term growth drivers such as demographics, urbanisation, productivity catch-ups, or import substitution. These companies tend to operate in smaller industries, but from experience and observing other economies, we know that these industries tend to become larger as incomes grow.

Secondly, each of our holdings should have a clearly defined competitive advantage. For example, airports operate as a legal monopoly — they are retail businesses with captive consumers (there is nowhere to go while waiting for a flight) that tend to come from the higher income segments of society.

Another of our holdings, JD.com, has advantages in economies of scale that are passed on to customers in the form of lower prices, which then sets up a virtuous cycle of growth. Colgate-Palmolive in India, or quickservice restaurant (QSR) brands such as Domino's, have competitive advantages in their strong brands — they are significant moats in terms of what they represent to customers and the premium they can therefore charge.

Finally, we look for companies with high cash generation. We dislike companies that need large amounts of capital to grow cash flows. We focus on asset intensity, working capital, and eventually free cash flow generation as a metric.

How do you incorporate environmental, social and governance (ESG) issues into your process?

While we do not explicitly label our funds as ESG, sustainability has been intrinsic to our investment process for the last 30 years. We think about sustainability and ESG in the same way that we think about quality — to us it amounts to the same thing, in terms of alignment of interests, dealing with the environment, paying the right amount of tax, and taking care of employees and societies. After we assess a company’s governance structure, the next pertinent question might be, “What is the major risk for this company from an environmental and social point of view?”

It is worth pointing out that we focus on the spirit and not the letter of the issue. We are not swayed by glossy sustainability reports — we look at what the company is actually doing and their response to our engagements with the management team. We want to be sure that they mean what they say in their sustainability reports, rather than it being a box-ticking approach to improve their scores from ESG ratings companies.

We take a partnership approach and focus on whether a company’s direction of travel is positive. We do not screen out companies or pass judgement on negative behaviour. But we do ask, “What are the best ESG practices for a company like this?” so that we can partner with the management and suggest improvements in their standards of operation. In our view, the good companies tend to listen.

Our view is that clients will demand more of companies and those that ‘get’ sustainability will perform better and gain market share over those that choose to ignore it.

How did this process – and adhering to the fundamentals – help you navigate the pandemic?

It was very challenging in the early stages of the pandemic, given the unprecedented lockdowns and uncertainty. Close to 50% of the portfolio were in affected sectors, such as banks, QSR restaurants and travelrelated companies. We conducted many meetings with management teams during that period, which led us to realise that despite the crisis our holdings should benefit in the long run — especially relative to their competitors. Two examples come to mind: Alsea and HDFC Bank.

Alsea

Alsea is the leading Starbucks and Domino's operator in Latin America. The company was severely hit by lockdowns, which forced many of its stores to close temporarily. However, after speaking to the management team, we believed Alsea would come out of the situation better than some of its peers — we discovered that around 15% of its competitors were forced to shut down permanently.

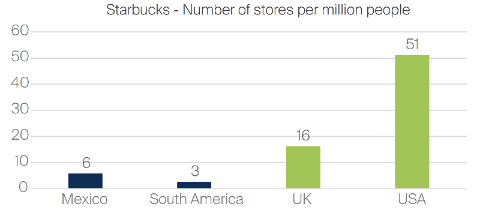

We believe Alsea is a great business, with a CEO-founder at the helm and attractive long-term growth prospects. In Mexico there are only six Starbucks stores per million people; in South America, that figure drops to just three stores. This compares to 16 Starbucks stores per million people in the UK and 51 in the US — which implies plenty of room to grow.

Strong brands with high payback (30% ROI) and room to grow

Source: Company materials, FSSA Investment Managers. Data as at 31 December 2021.

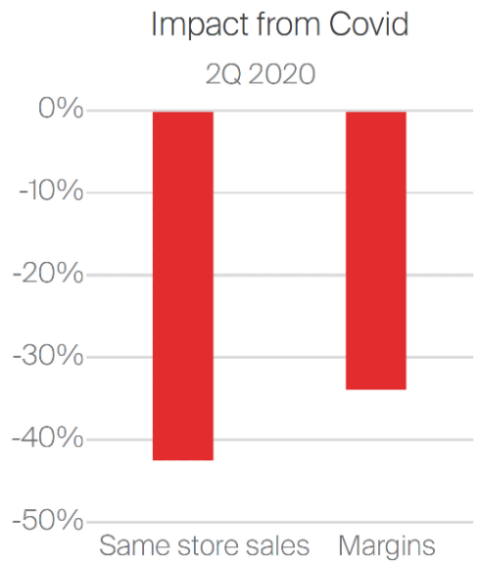

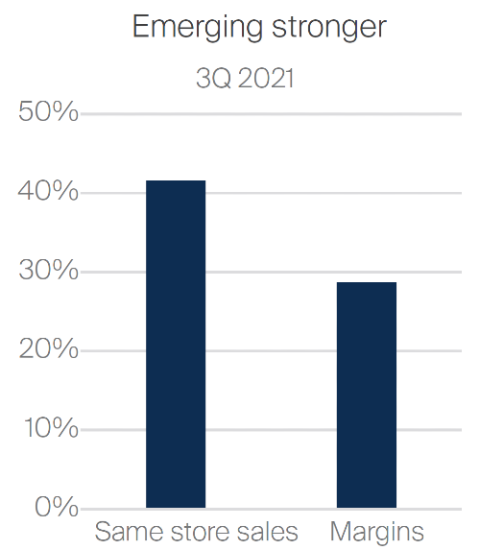

Equally important, Alsea initiated a significant cost-cutting program during the pandemic — they approached their suppliers and landlords and was able to renegotiate many of their contracts. We took the view that this would set them up for higher margins after the pandemic subsided — and this is what has happened. From deeply negative same-store sales and margins during the early stages of the pandemic, Alsea posted a significant turnaround by the third quarter of 2021.

While the crisis was indeed negative for Alsea in the short term, our conviction in its management and business model made us more positive on its longer-term prospects. We added to Alsea during its weaker period.

Source: Company materials, FSSA Investment Managers. Data as at 31 December 2021.

HDFC Bank

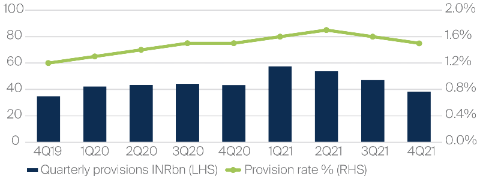

At the height of the pandemic, India came to a standstill for four months. HDFC Bank's customers had zero revenues and there were serious questions about how they would pay their interest costs. However, HDFC Bank’s actual provision rates did not rise much during that period, while deposits accelerated significantly. In our view, that is another feature of well-managed and reputable banks. During periods of stress, there is a flight to safety and depositors move their savings to banks that they believe are better placed.

Provisioning was relatively steady…

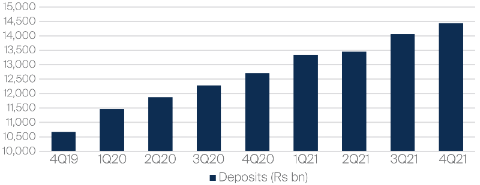

... while deposit growth accelerated

Source: Company materials, FSSA Investment Managers. Data as at 31 December 2021.

In fact, this is typical of all the banks we have invested in across other markets within our strategy: they generally have industry-leading deposit franchises, which gives them a cost of funds advantage during tough times. They have risk-aware and countercyclically-minded management teams, and they usually come out of crises with higher market share, better returns and an improved customer base.

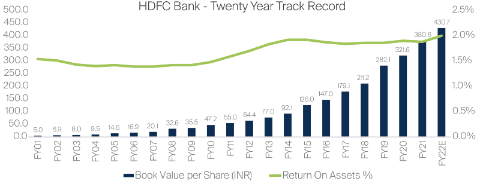

We have been invested in HDFC Bank for nearly two decades and we saw these advantages come to the fore during the global financial crisis (GFC) in 2008, the taper tantrum in 2013 and again during the lockdowns over the last one and a half years in India. Meanwhile, as shown in the chart below, it has compounded its book value per share (BVPS) at a rate of more than 20% year-on-year and has continued to maintain a high return on assets, animportant metric for a bank.

With our views on the quality of HDFC Bank — and having spoken with the CEO — we concluded that it should emerge from the pandemic stronger than ever.

HDFC Bank - Twenty Year Track Record

Source: Bloomberg, FSSA Investment Managers. Data as at 8 March 2022.

How is the portfolio currently positioned?

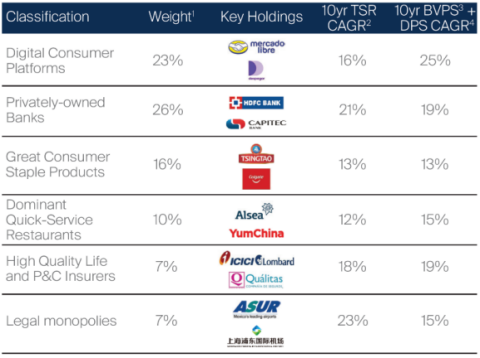

We look for companies that can sustainably compound cash flows at high rates of return — and we find that these kinds of companies are more prevalent in certain industries. As such, we own digital consumer platforms relating to e-commerce and online travel, privately-owned banks, consumer staples products, dominant QSRs, high-quality insurers and legal monopolies (like airports). Although we have close to 90% of the portfolio invested in these broader buckets, we do not invest thematically — these allocations are simply the result of the team’s bottom-up approach.

The common denominator across our holdings is that they all benefit from strong tailwinds and competitive dynamics that allow them to generate attractive returns and deliver strong shareholder returns over the long term, driven by operational perform

We look for companies that can sustainably compound cash flows at high rates

1Calculated as the simple average.

2Total Shareholder Return Compound Annual Growth Rate.

3Book Value Per Share.

4Dividend Per Share Compound Annual Growth Rate.

Source: Company reports and website, FSSA Investment Managers, as of 1 March 2022.

There is a high proportion of banking and financial services in the portfolio. Will a rising interest rate environment hurt that segment?

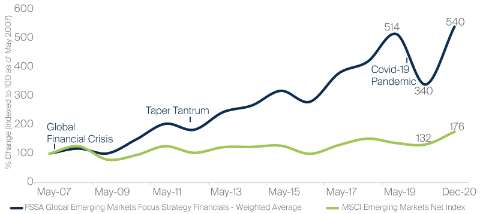

No, quite the contrary. Banks typically make more money in a higher interest rate environment. However, for the financials in our portfolio, it doesn’t matter so much. Over the past decade or more, as interest rates fluctuated but generally trended downwards, our financial holdings have still significantly outperformed (see the chart below). They are able to take deposits at a very low rate and lend at a higher rate — and collect the spread in between. We own some well-run private sector banks in the portfolio, like HDFC Bank mentioned earlier, but we do not take a view on where interest rates are going. The underlying businesses are solid enough to warrant an investment in these banks irrespective of where interest rates are.

Total shareholder return for FSSA GEM financials (weighted average) vs Benchmark*

*MSCI Emerging Markets Net Index

Source: FSSA Investment Managers, Bloomberg. Data is as at 1 March 2022. FSSA GEM financials refers to holdings that are in the financial sector in the FSSA Global Emerging Markets Focus Strategy portfolio.

Within companies that generate high returns, what makes these sustainable in the longer term? How do you forecast the erosion of returns based on greater competition?

As mentioned earlier, we always look for strong competitive advantages (such as the deposit franchises at banks), which can make returns sustainable. Another example is digital consumer platforms. One of our larger investments is JD.com — its competitive advantage is really its size relative to peers, and this continues to expand every year.

JD’s key strategy is called “scale economies shared”. As the company grows larger, it improves its negotiating power against suppliers, which is then passed on to customers and ensures that they come back and buy even more. As JD continues to grow, its scale relative to peers should continue to expand.

Regarding the erosion of returns from competitors, take TravelSky as an example of how we look at the issue. The company provides a backend service for airline ticketing, a highly concentrated industry that can be considered a legal monopoly. Globally, only four companies provide this service and they have proven to be good operators in terms of generating high returns on capital employed. Because of the network and scale effects, it would not make sense for an airline to create its own ticketing software and compete with the established players. We believe no airline would be willing to risk its ticketing business with a new entrant, no matter how low the pricing is.

How do you account for the increased political and regulatory risk and therefore the valuation of emerging markets equities?

We are not top-down investors; but we believe it is naive to look only at a company in isolation. For each of our portfolio holdings, we conduct a bottom-up assessment of what we think the business will generate in annualised returns over the next five years. Then we rather simplistically look at the key macro or geopolitical risks in the country.

We look at historical trends such as currency depreciation over the last 10 years and whether we think that is likely to decelerate or accelerate. For instance, if we are looking at a Brazilian consumer company and the Brazilian real has depreciated by roughly 6% annualised over the last 10 years, then we would want that company to generate returns 6% or 7% higher than what we could get in another country without that currency risk.

In China, regulation is a risk that we consider, but in terms of investment opportunities we prefer to look at companies that are below the radar and not situated in highly political or sensitive industries like financials or property, or other sectors where they might not be aligned with the longerterm interests of the Party.

Going back to the Russia-Ukraine conflict, what are your thoughts on China and the contagion risk from Russia?

We do not have a crystal ball, but our general view is that the contagion risk from Russia to China looks unlikely. We believe things would have to escalate significantly, which would be not in anyone's interest.

There is a lot of nervousness around China and not just on the contagion risk from Russia — there are also risks around the delisting of American Depositary Receipts (ADRs) and Omicron is now spreading in China in a more significant way.

Regarding the noise about ADRs being delisted, again we think a compromise is likely to be reached. However, in some ways this is quite irrelevant. Many of the Chinese companies listed in the US have a dual share class in Hong Kong which is fully fungible and easily convertible. Therefore, to us this does not affect the underlying fundamentals of a business.

With respect to Omicron, we believe it is likely to have a near-term toll on economic activity. But as we have seen repeatedly over the last two years, at some point China will come through the other side of it too.

Chinese equities and particularly those with US listings are now trading at levels not seen since the euro crisis or the GFC, which means that for investors like us with a longterm horizon, we believe now might not be a bad time to start looking at these companies again.

There is a link between the oil price and how Indian stocks tend to perform. Could you share your views on that?

Historically, oil prices going above USD 100 meant bad news for Indian equity markets, as was the case when this happened in 2008 and briefly in 2013. But two things are different now. Because of reforms over the past decade, India's fiscal status is much better in terms of how much tax is collected. The economy is being formalised at a rapid pace, owing to reforms like the Goods and Services Tax (GST) and other measures. Tax collections are beating estimates month after month, which is a good sign.

Foreign exchange reserves are now the highest they have ever been, close to USD 620bn at the last count, so imports are fully covered and India's external debt is very low compared to a decade ago. Foreign Direct Investment (FDI) flows have been averaging over USD 60-70bn in recent years and they continue to do so.1

While high oil prices could have an impact, it does not make a difference to the way we invest over the medium term. Going back to HDFC Bank, we have seen it continue to perform well even when the oil price spiked. For highquality companies in India it may not be a tailwind, but we believe it is also not the headwind that some might expect.

Emerging markets have underperformed developed markets for almost a decade. Why do you think this might change?

We believe one has to be careful about saying whether this or that will outperform. We invest with an absolute return mind-set, rather than relative to developed markets or other benchmarks. That being said, we do not think US equity market performance will be quite as significant in the next five to 10 years. Historically-low interest rates are starting to rise, US equity valuations seem extended, and the commodity slump over the previous decade should not be as much of a drag on emerging markets. Meanwhile, valuations in emerging markets look much more attractive than before. Overall, we remain confident in the longer-term prospects of our businesses from a bottom-up perspective.

Source: Company data retrieved from company annual reports or other such investor reports. Financial metrics and valuations are from FactSet and Bloomberg. As at 29 March 2022 or otherwise noted.

Important information

This material is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should conduct your own due diligence and consider your individual investment needs, objectives and financial situation and read the relevant offering documents for details including the risk factors disclosure. Any person who acts upon, or changes their investment position in reliance on, the information contained in these materials does so entirely at their own risk.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication but the information contained in the material may be subject to change thereafter without notice. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material .

To the extent this material contains any expression of opinion or forward-looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at First Sentier Investors.

Past performance is not indicative of future performance. All investment involves risks and the value of investments and the income from them may go down as well as up and you may not get back your original investment. Actual outcomes or results may differ materially from those discussed. Readers must not place undue reliance on forward-looking statements as there is no certainty that conditions current at the time of publication will continue.

References to specific securities (if any) are included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. Any securities referenced may or may not form part of the holdings of First Sentier Investors' portfolios at a certain point in time, and the holdings may change over time.

References to comparative benchmarks or indices (if any) are for illustrative and comparison purposes only, may not be available for direct investment, are unmanaged, assume reinvestment of income, and have limitations when used for comparison or other purposes because they may have volatility, credit, or other material characteristics (such as number and types of securities) that are different from the funds managed by First Sentier Investors.

Selling restrictions

Not all First Sentier Investors products are available in all jurisdictions. This material is neither directed at nor intended to be accessed by persons resident in, or citizens of any country, or types or categories of individual where to allow such access would be unlawful or where it would require any registration, filing, application for any licence or approval orother steps to be taken by First Sentier Investors in order to comply with local laws or regulatory requirements in such country.

This material is intended for ‘professional clients’ (as defined by the UK Financial Conduct Authority, or under MiFID II), ‘wholesale clients’ (as defined under the Corporations Act 2001 (Cth) or Financial Markets Conduct Act 2013 (New Zealand) and ‘professional’ and ‘institutional’ investors as may be defined in the jurisdiction in which the material is received, including Hong Kong, Singapore and the United States, and should not be relied upon by or be passed to other persons.

The First Sentier Investors funds referenced in these materials are not registered for sale in the United States and this document is not an offer for sale of funds to US persons (as such term is used in Regulation S promulgated under the 1933 Act). Fund-specific information has been provided to illustrate First Sentier Investors’ expertise in the strategy. Differences between fund-specific constraints or fees and those of a similarly managed mandate would affect performance results.

About First Sentier Investors

References to ‘we’, ‘us’ or ‘our’ are references to First Sentier Investors, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group (MUFG). Certain of our investment teams operate under the trading names FSSA Investment Managers, Stewart Investors and Realindex Investments, all of which are part of the First Sentier Investors group.

This material may not be copied or reproduced in whole or in part, and in any form or by any means circulated without the prior written consent of First Sentier Investors.

We communicate and conduct business through different legal entities in different locations. This material is communicated in:[1]

• Australia and New Zealand by First Sentier Investors (Australia) IM Limited, authorised and regulated in Australia by the Australian Securities and Investments Commission (AFSL 289017; ABN 89 114 194311)

• European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson’s Quay, Dublin 2, Ireland; reg company no. 629188)

• Hong Kong by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong

• Singapore by First Sentier Investors (Singapore) (reg company no. 196900420D) and has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors (registration number 53236800B) is a business division of First Sentier Investors (Singapore).

• Japan by First Sentier Investors (Japan) Limited, authorised and regulated by the Financial Service Agency (Director of Kanto Local Finance Bureau (Registered Financial Institutions) No.2611)

• United Kingdom by First Sentier Investors (UK) Funds Limited, authorised and regulated by the Financial Conduct Authority (reg. no. 2294743; reg office Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB)

• United States by First Sentier Investors (US) LLC, authorised and regulated by the Securities Exchange Commission (RIA 801-93167).

• Other jurisdictions, where this document may lawfully be issued, by First Sentier Investors International IM Limited, authorised and regulated in the UK by the Financial Conduct Authority (registration number 122512; registered office 23 St. Andrew Square, Edinburgh, EH2 1BB number SC079063).

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Investors Group

[1] If the materials will be made available in other locations, seek advice from Regulatory Compliance.

Related

/// Call-to-action component to come ///