Taking stock of five years managing the FSSA Global Emerging Markets strategy

Portfolio Manager Q&A

When did you enter the investments industry and what attracted you to portfolio management?

I started my career more than 18 years ago as a developed markets consumer analyst. It was a great introduction to investing – the consumer sector is extremely broad so I was able to gain experience across many sub-industries and look at a wide variety of companies.

Being focused on developed markets gave me a good grounding in terms of understanding companies from a complete stakeholder perspective. I learnt about company culture, the value chain and how each company interacts with society, as well as best practice in terms of long-term shareholder strategy, corporate governance and incentivisation models.

In 2007 I became an Asia specialist and started covering global emerging markets (GEM) a couple of years after that. This was a natural progression as many of the growth opportunities for global consumer companies at that time were in the less developed parts of the world. Over the decade 2001-10, Asia had some the world’s fastest-growing economies. China’s GDP was growing at an average of 10% a year, while India was growing at 7% a year1. The region was booming and capital was flowing eastwards.

1 Source: https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG

How did you develop your investment philosophy? How has it evolved over the past 18 years?

I was fortunate to have good mentors in the early days. They taught me that you have to take a balanced approach, be humble and have respect for the market. There are also a few investment books that have influenced my thinking. Warren Buffet’s annual shareholder letters and Poor Charlie’s Almanack: The Wit and Wisdom of Charles T. Munger are full of insightful views on companies and investing.

I also enjoy reading books about history and political systems – for instance, Why Nations Fail by Acemoglu and Robinson is a great book on these topics. And I highly recommend William N. Thorndike Jr’s modern classic, The Outsiders, which features eight unconventional CEOs and how the decisions they made (mainly related to capital allocation) led to outstanding returns for investors.

Joining FSSA I found that there was significant overlap in the team’s investment philosophy and my own approach to investing. We are active investors, we take a bottom-up, research-driven approach to find the best businesses in the region to invest in, and we have a long-term mind-set.

What qualities do you look for in company management teams?

Good corporate governance is the most essential quality we look for. To us, it is a binary issue – either the corporate governance is good enough or it is not investable. If the management team is weak or misaligned or if there is a dishonest controlling shareholder, this can destroy a company’s investment case. As such, the most important trait that we look for in management teams is stewardship. Simply put, there can be no question around management integrity and alignment.

After that, we look for operational excellence and great capital allocators – independent thinkers, whose approach is long term and at times countercyclical. By looking at the management’s track record, we can see whether they have been able to consistently deploy capital to earn high, incremental returns. Finally, we look for the right culture and evidence that the company looks after its many stakeholders, including the environment and the broader society it operates in.

Can you explain your portfolio construction process? How do you generate new ideas?

When I first joined FSSA in 2016, I was given time to embed myself into the team and learn about the culture. I got to know the team’s Asia, Greater China and India strategies and learnt about the companies we’ve invested in. We then launched the FSSA Global Emerging Markets Focus strategy a year later in December 2017 – it consists of the team’s best ideas distilled into 40-45 companies.

We generate new stock ideas by meeting companies. As a team, we conduct more than 1,500 meetings a year to learn about each business and the risks and opportunities it faces. Our goal in these meetings is to find quality companies that we can buy and hold for at least 3-5 years. We are purely bottom-up investors, so portfolio construction starts with a blank sheet of paper, i.e. we don’t think about overweights or underweights relative to an index.

As mentioned above, the quality of the management is the most important characteristic we look for. Then we assess a company’s franchise, financials and valuations. Companies should have above-average sales growth and pricing power, strong cash flows and balance sheets, and ideally, sit within industries that enjoy high barriers to entry and have a high degree of visibility on the competitive outlook.

Putting all of this together, we believe our portfolio holdings are some of the best companies in emerging markets and should be able to compound cash flows sustainably and at high rates over the medium to long term.

2Calculated as the simple average. 3Total Shareholder Return Compound Annual Growth Rate. 4Book Value Per Share. 5Dividend Per Share Compound Annual Growth Rate.

Source: Company reports and website, FSSA Investment Managers, as of 30 Sep 2022. The Total Shareholder Return is calculated in Local Currency terms from 30 Sep 2012 to 30 Sep 2022 (or from the IPO date). Companies discussed above are all holdings within the FSSA Global Emerging Markets Focus Strategy as of 30 Sep 2022 and which meet the industry/business group classification definition provided above. Two representative holdings were selected for each group; additional portfolio holdings may be included in each group. Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. Numbers may not add up to 100% due to rounding. Past performance is not indicative of future performance.

In your experience, are some GEM markets more fruitful for stock-picking than others? Conversely, are there any markets that you avoid completely?

India is perhaps where we have found the most investment opportunities. The quality of companies is high and there are many alternatives within a sector to choose from. For example, among the Indian private-sector banks, we own ICICI Bank, HDFC Bank and Kotak Mahindra Bank – they generate high returns on equity and have grown their loan books and deposit franchises despite the challenges in the broader economy. With more than half of India’s population still unbanked, we believe the long-term opportunity for these banks is significant. They are widely owned in the team’s Asia ex-Japan and India strategies too.

We have also found many good companies in China. The market is large and deep with more than 5,000 companies to choose from. While investing in China is not without risk, we try to mitigate those concerns by investing only in companies with appropriate governance structures and strong management teams. Our most recent investment, Chinese local spirits (“baijiu”) producer Sichuan Swellfun, is a good example of this. It is 63%-owned by Diageo, the UK-headquartered leader in the global spirits industry, which ensures that governance standards are high and befitting of Diageo’s strong reputation.

We also like South Africa and Brazil despite the challenging macroeconomic and political situation. Like in other tough operating environments, there are still businesses there that have enviable track records of compounding capital. In South Africa, a good example is Capitec Bank, a leading private sector bank which has been able to buck the country’s challenging economic trends. It has done so through a combination of strong execution by its management team, a customer-first mind-set with consistent innovation and scale benefits, and a favourable market structure with large incumbents who have been slow to react for fear of disrupting their own profit pools.

In Brazil, after more than a decade of economic turmoil and political instability, valuations in recent years meant that investors were not being compensated for the relatively higher risks the country faces – and we have been disciplined in this regard, having negligible exposure until fairly recently. Latterly with the market sell-off, some companies looked reasonably attractive and we purchased a small position in TOTVS, a leading Brazilian software company that we have been following for quite some time. It is the dominant enterprise resource planning (ERP) software provider in Brazil with nearly 50% market share.

In contrast, we have avoided Russia as well as any country where the political climate makes investing difficult, or where the macro is overly negative (for example, Turkey). Even before the Russia-Ukraine conflict we had not owned any Russian companies for several years. There were few quality companies we would consider investing in, especially with the ever-intervening state, opaque company structures, stretched balance sheets and a lack of transparency on managerial decisions.

How is the FSSA GEM portfolio different to peers?

Our portfolio is high conviction and relatively concentrated – there are just 41 companies in the FSSA GEM Focus strategy and around 73% of the portfolio is concentrated in the top 20 holdings. We have a mid-cap bias as we believe smaller companies with proven business models have more capacity to grow – they are not constrained by the law of large numbers.

Overall our portfolio holdings generate high returns on capital employed, are highly cash generative and have strong balance sheets. We believe they offer attractive compounding opportunities over the long term – our analysis suggests they can grow earnings at 13-15% CAGR on a weighted average basis.

How has the strategy performed over the past five years?

The strategy has performed reasonably well and we are generally happy with the returns, albeit with a few mistakes made. For example, in 2019 the Argentina elections led to an increasingly messy and highly unpredictable situation for the country. Banks were particularly hard hit in light of inflation fears and currency devaluation.

We previously owned Argentine bank Grupo Financiero Galicia, as our meetings with the CEO and several members of the senior management team pointed to a culture that we liked and a franchise that was inherently strong – the bank had averaged 37% return on equity (ROE) for the previous 5-year period and its performance was underpinned by its deposits franchise. However, despite the bank doing well operationally, intense currency headwinds meant that we subsequently sold at a loss. This has been our single largest detractor since inception.

We were also somewhat wrong-footed by the Covid-19 pandemic, given our investments in companies in the services sector in less developed countries. While we still believe these businesses are attractive from a longer-term perspective (driven by demographics, urbanisation and productivity catch-ups), the reality is that these countries had fewer resources to deal with the pandemic, which delayed the recovery for restaurants and tourism, etc.

On the positive side, MercadoLibre was one of the top contributors to performance over the past five years. As Latin America’s leading e-commerce company, sales have grown nearly eight-fold over the past five years, while free cash flow (FCF) has grown five-fold, from USD200m in 2017 to an estimated USD1bn in 2022. This has driven the 28% CAGR6 total shareholder return over this period.

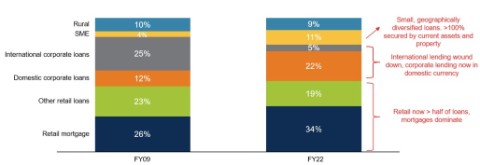

ICICI Bank and Tsingtao Brewery also added to performance. We bought ICICI Bank in 2019, after meeting the then-new CEO, Sandeep Bakhski, and seeing evidence of change in the aggressive, sales-driven culture of the past. This included exiting high-risk lending segments, simplifying incentive structures and replacing the majority of the board with better-quality independent directors. Since then, ICICI Bank has delivered strong loans growth, improved asset quality and higher returns.

ICICI Bank now chooses low risk lending

ICICI Bank loan mix

Source: Company filings

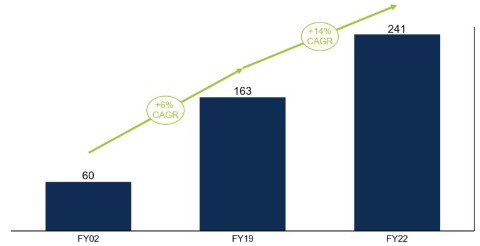

The result is a massively improved record of book value per share compounding in recent times despite Covid-19

ICICI Bank, book value per share (INR)

Source: Company filings

Tsingtao Brewery is well known to the FSSA team and has been a long-time holding in our China portfolios. It was purchased for the GEM portfolio in 2019. As one of the oldest and most famous beer brands in China, Tsingtao is the poster child of ownership reforms (where strategic investors buy stakes in China’s state-owned enterprises). Such reforms are usually beneficial to shareholder returns as the new investors appoint board members and introduce management stock options to incentivise better performance.

While the first decade of private ownership was characterised by brand building, its strategy in more recent years has been to focus on efficiencies and improving profitability. It has closed down plants and launched high-end products (such as Tsingtao Draft, IPA and Pilsner) to tap into the premiumisation trend in China’s beer market. Since then, margins have improved, and higher sales volumes and selling prices have contributed to faster bottom-line growth.

6 Compound annual growth rate

Looking ahead at the next five years, why should investors be looking at GEM now? How attractive are valuations currently?

We believe our portfolio holdings have decent long-term growth prospects and valuations are now quite attractive (particularly in China and compared to the US). These quality businesses have proven management teams and competitive advantages that allows them to capitalise on the long-term secular trends that exist across emerging markets.

Whether it is the formalisation of the Indian economy, the continued financialisation of the South African population or the growing adoption of enterprise resource planning software in Brazil, there are plenty of growth opportunities to tap into. Yet, these kinds of businesses are often not well represented in broader indices and therefore we believe a bottom-up active investment approach has much value to add.

While the emerging markets asset class may be going through a challenging period at the moment, we believe great management teams usually find ways to deliver outstanding returns to long-term-minded shareholders. The group of companies we own have strong cash flows and balance sheets, with a proven ability to navigate through stormy weather.

Additionally, as long-term investors, one of the key attributes in our search for quality companies is sustainable business models that are attractive not only from a 1-2 year perspective, but throughout the business cycle. Once the investment case has been established, it’s time to step away from the trading desk. We believe it is better to take a long-term ownership view and benefit from the compounding effect, rather than try to time the market.

Any final words?

I think that it is a privilege to be working in this field, spending my time researching companies and putting together a portfolio of our best ideas. At FSSA, we are all passionate about investments and it is great fun to go into work every day and collaborate with like-minded colleagues.

There is no complacency on our team and everyone is focused on the same end-goal, which is to find the best companies to invest in to generate decent absolute returns for our clients. Furthermore, there are no egos on the team – we have a flat team structure and are incentivised to put the team ahead of individual. It’s quite a unique culture and I think it is truly one of our long-term competitive advantages.

Source: Company data retrieved from company annual reports or other such investor reports. Financial metrics and valuations are from FactSet and Bloomberg. As at 30 November 2022 or otherwise noted.

Important information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of FSI. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of FSI. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of FSSA Investment Managers’ portfolios at a certain point in time, and the holdings may change over time.

In Hong Kong, this document is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this document is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

First Sentier Investors and FSSA Investment Managers are business names of First Sentier Investors (Hong Kong) Limited. First Sentier Investors (registration number 53236800B) and FSSA Investment Managers (registration number 53314080C) are business divisions of First Sentier Investors (Singapore).

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.