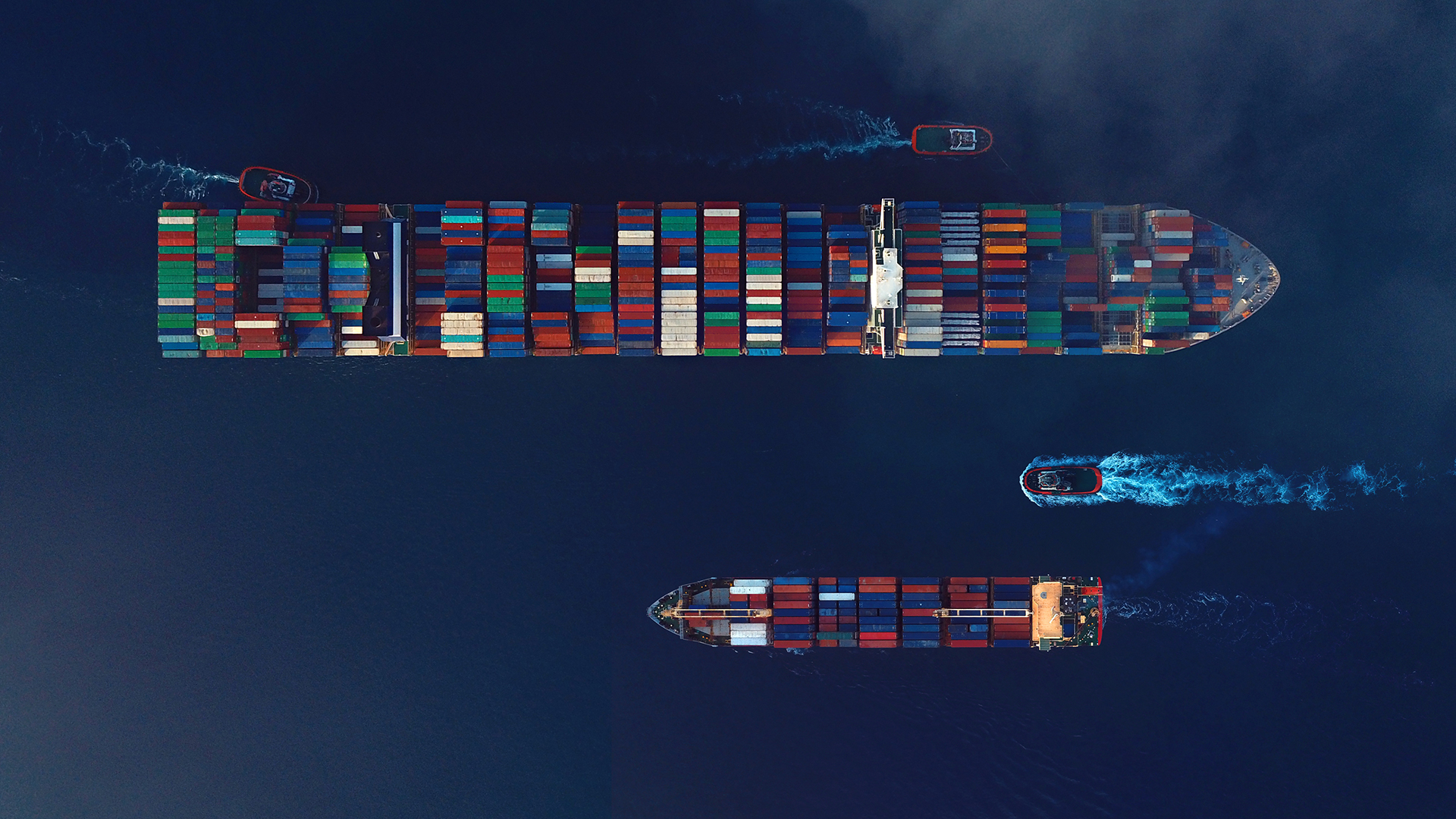

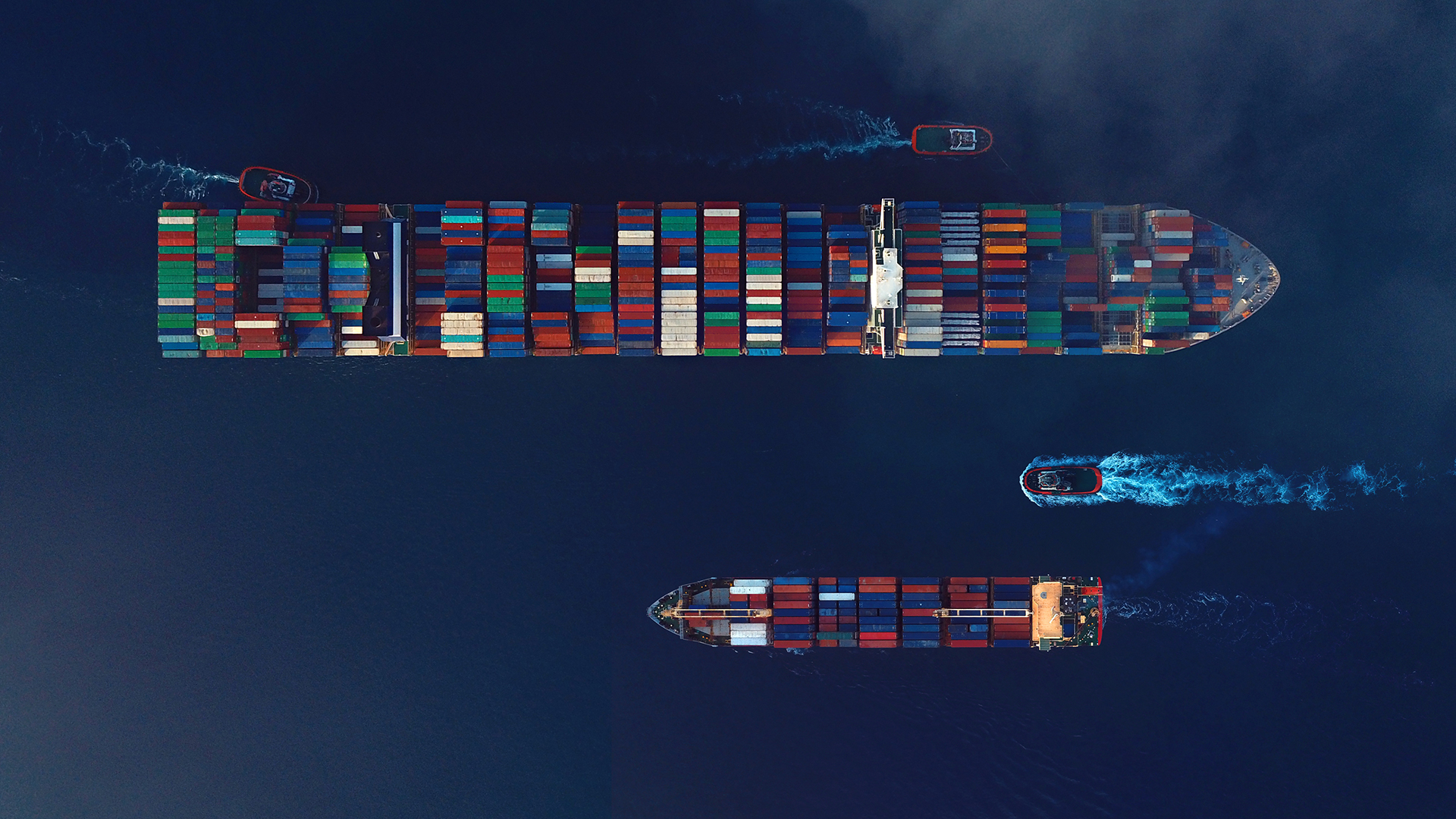

Our views on US tariffs

News about US reciprocal tariffs have rocked global markets, as President Trump announced sweeping import taxes that were far higher and affected a much broader swathe of countries than expected.

- 5 mins

News about US reciprocal tariffs have rocked global markets, as President Trump announced sweeping import taxes that were far higher and affected a much broader swathe of countries than expected.