Adhering to the fundamentals of investing in Global Emerging Markets

Fund Manager Q&A - April 2022

Over the past few years, global emerging market (GEM) investors have dealt with a series of challenges, including a surging pandemic, local lockdowns and widespread travel restrictions. Now, an escalating conflict between Russia and Ukraine has raised fears that this could spill over into Europe and beyond. Sanctions against Russia have roiled equity and bond markets and increased commodity prices, with growing concerns about the wider contagion to global markets.

Against this backdrop, FSSA’s portfolio managers discuss their views on how to mitigate risk in these circumstances. The team’s long-established investment process suggests that focusing on quality companies — and taking a longer-term view — can help investors keep calm through the turbulence.

Given your beliefs on adhering to the fundamentals of investing, can you summarise your investment process? What changes did you make to the portfolio due to the Russia-Ukraine conflict?

We had no investments in Russia prior to the invasion. We have always found it hard to invest in Russia given our focus on governance and quality. Our due diligence process seemed always to uncover someone close

to Russian President Vladimir Putin as being part of a company’s ownership and this was a difficult roadblock for us to overcome. As a result, we have not had to make any changes to our portfolios due to the Russia-Ukraine fallout.

As a team, we have been following the same investment approach over the last 30 years. In summary, we take a long-term view; we research companies from the bottom up; and we focus on quality in terms of governance and business fundamentals.

Our search for quality starts with people — assessing their track record of how they executed strategies as well as how they are incentivised. We look for people who are risk-aware and humble, like Sandeep Bakhshi, CEO of ICICI Bank, or CEOs that look after broader set of stakeholders, like Joey Wat, CEO of Yum China, which has one of the most generous employee benefit programs in China. We also like managers who are forward-looking, like MercadoLibre’s CFO Pedro Arnt, who is known for his lack of complacency in the role.

Next, we look for alignment of interests. We want to see simple corporate structures and long-term-minded owners who are on the same page as minority shareholders. We generally do not like companies that have complicated structures, cross-holdings, dual share classes which benefit one set of owners versus the others, or companies under state ownership because their interests are somewhat different from ours.

Thirdly, we focus on boards and their composition. Ultimately, they are responsible for business strategy, capital allocation and incentive structures. Therefore, it is important for the board to be majority independent, with reputable directors who have experience serving in other organisations and are likely to stand up for minority investors when things go wrong.

Among our holdings, Syngene International, a biotechnology manufacturing company in India, is a good example of this — the board is majority independent with only the owner and the CEO on the board as insiders. The remaining directors come from a diverse background of reputable organisations.

Company example: Syngene International (India)

Source: Company reports or website.

How do you assess franchise quality?

While governance is paramount, there are several examples of companies which have the highest standards of governance but operate average-quality franchises and are sometimes very poor allocators of capital. To assess franchise quality, we look for three main things.

Firstly, we tend to focus on companies that benefit from domestic demand and have circular long-term growth drivers such as demographics, urbanisation, productivity catch-ups, or import substitution. These companies tend to operate in smaller industries, but from experience and observing other economies, we know that these industries tend to become larger as incomes grow.

Secondly, each of our holdings should have a clearly defined competitive advantage. For example, airports operate as a legal monopoly — they are retail businesses with captive consumers (there is nowhere to go while waiting for a flight) that tend to come from the higher-income segments of society.

Another of our holdings, JD.com, has advantages in economies of scale that are passed on to customers in the form of lower prices, which then sets up a virtuous cycle of growth. Colgate-Palmolive in India, or quick-service restaurant (QSR) brands such as Domino's, have competitive advantages in their strong brands — they are significant moats in terms of what they represent to customers and the premium they can therefore charge.

Finally, we look for companies with high cash generation. We dislike companies that need large amounts of capital to grow cash flows. We focus on asset intensity, working capital, and eventually free cash flow generation as a metric.

How do you incorporate environmental, social and governance (ESG) issues into your process?

While we do not explicitly label our funds as ESG, sustainability has been intrinsic to our investment process for the last 30 years. We think about sustainability and ESG in the same way that we think about quality — to us it amounts to the same thing, in terms of alignment of interests, dealing with the environment, paying the right amount of tax, and taking care of employees and societies. After we assess a company’s governance structure, the next pertinent question might be, “What is the major risk for this company from an environmental and social point of view?”

It is worth pointing out that we focus on the spirit and not the letter of the issue. We are not swayed by glossy sustainability reports — we look at what the company is actually doing and their response to our engagements with the management team. We want to be sure that they mean what they say in their sustainability reports, rather than it being a box-ticking approach to improve their scores from ESG ratings companies.

We take a partnership approach and focus on whether a company’s direction of travel is positive. We do not screen out companies or pass judgement on negative behaviour. But we do ask, “What are the best ESG practices for a company like this?” so that we can partner with the management and suggest improvements in their standards of operation. In our view, the good companies tend to listen.

Our view is that clients will demand more of companies and those that ‘get’ sustainability will perform better and gain market share over those that choose to ignore it.

How did this process – and adhering to the fundamentals – help you navigate the pandemic?

It was very challenging in the early stages of the pandemic, given the unprecedented lockdowns and uncertainty. Close to 50% of the portfolio were in affected sectors, such as banks, QSR restaurants and travel-related companies. We conducted many meetings with management teams during that period, which led us to realise that despite the crisis our holdings should benefit in the long run — especially relative to their competitors. Two examples come to mind: Alsea and HDFC Bank.

Alsea

Alsea is the leading Starbucks and Domino's operator in Latin America. The company was severely hit by lockdowns, which forced many of its stores to close temporarily. However, after speaking to the management team, we believed Alsea would come out of the situation better than some of its peers — we discovered that around 15% of its competitors were forced to shut down permanently.

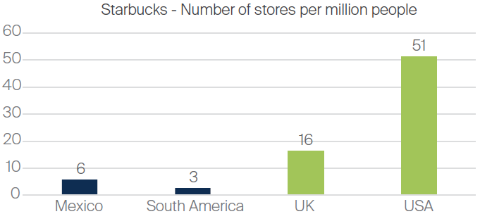

We believe Alsea is a great business, with a CEO-founder at the helm and attractive long-term growth prospects. In Mexico there are only six Starbucks stores per million people; in South America, that figure drops to just three stores. This compares to 16 Starbucks stores per million people in the UK and 51 in the US — which implies plenty of room to grow.

Strong brands with high payback (30% ROI) and room to grow

Source: Company materials, FSSA Investment Managers. Data as at 31 December 2021.

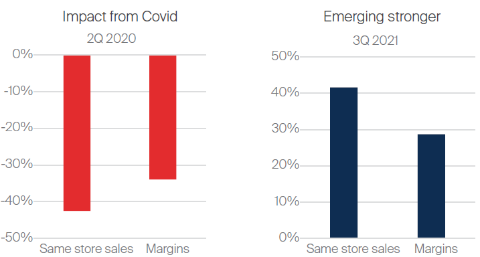

Equally important, Alsea initiated a significant cost-cutting program during the pandemic — they approached their suppliers and landlords and was able to renegotiate many of their contracts. We took the view that this would set them up for higher margins after the pandemic subsided — and this is what has happened. From deeply negative same-store sales and margins during the early stages of the pandemic, Alsea posted a significant turnaround by the third quarter of 2021.

While the crisis was indeed negative for Alsea in the short term, our conviction in its management and business model made us more positive on its longer-term prospects. We added to Alsea during its weaker period.

Source: Company materials, FSSA Investment Managers. Data as at 31 December 2021.

HDFC Bank

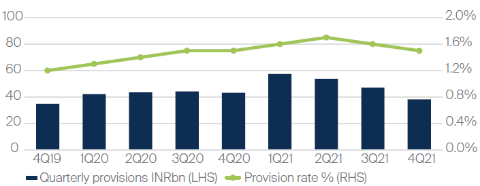

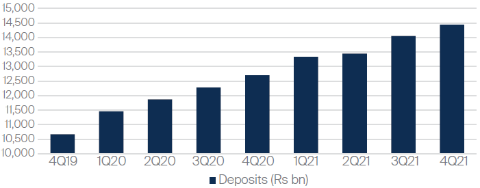

At the height of the pandemic, India came to a standstill for four months. HDFC Bank's customers had zero revenues and there were serious questions about how they would pay their interest costs. However, HDFC Bank’s actual provision rates did not rise much during that period, while deposits accelerated significantly. In our view, that is another feature of well-managed and reputable banks. During periods of stress, there is a flight to safety and depositors move their savings to banks that they believe are better placed.

Provisioning was relatively steady…

… while deposit growth accelerated

Source: Company materials, FSSA Investment Managers. Data as at 31 December 2021.

In fact, this is typical of all the banks we have invested in across other markets within our strategy: they generally have industry-leading deposit franchises, which gives them a cost of funds advantage during tough times. They have risk-aware and countercyclically-minded management teams, and they usually come out of crises with higher market share, better returns and an improved customer base.

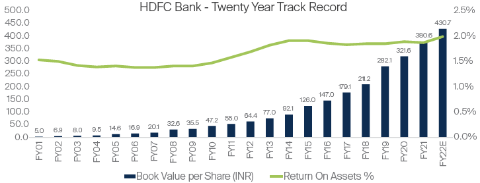

We have been invested in HDFC Bank for nearly two decades and we saw these advantages come to the fore during the global financial crisis (GFC) in 2008, the taper tantrum in 2013 and again during the lockdowns over the last one and a half years in India. Meanwhile, as shown in the chart below, it has compounded its book value per share (BVPS) at a rate of more than 20% year-on-year and has continued to maintain a high return on assets, an important metric for a bank.

With our views on the quality of HDFC Bank — and having spoken with the CEO — we concluded that it should emerge from the pandemic stronger than ever.

Source: Bloomberg, FSSA Investment Managers. Data as at 8 March 2022.

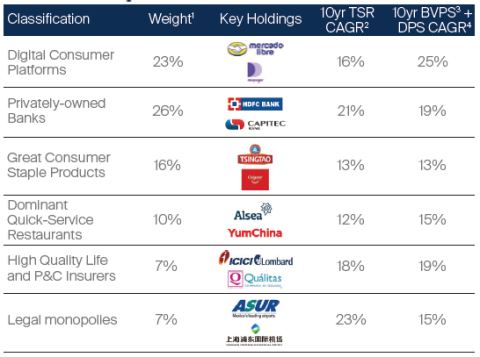

How is the portfolio currently positioned?

We look for companies that can sustainably compound cash flows at high rates of return — and we find that these kinds of companies are more prevalent in certain industries. As such, we own digital consumer platforms relating to e-commerce and online travel, privately-owned banks, consumer staples products, dominant QSRs, high-quality insurers and legal monopolies (like airports). Although we have close to 90% of the portfolio invested in these broader buckets, we do not invest thematically — these allocations are simply the result of the team’s bottom-up approach.

The common denominator across our holdings is that they all benefit from strong tailwinds and competitive dynamics that allow them to generate attractive returns and deliver strong shareholder returns over the long term, driven by operational performance as seen in the book value plus dividend growth.

We look for companies that can sustainably compound cash flows at high rates

1 Calculated as the simple average.

2 Total Shareholder Return Compound Annual Growth Rate.

3 Book Value Per Share.

4 Dividend Per Share Compound Annual Growth Rate.

Source: Company reports and website, FSSA Investment Managers, as of 1 March 2022.

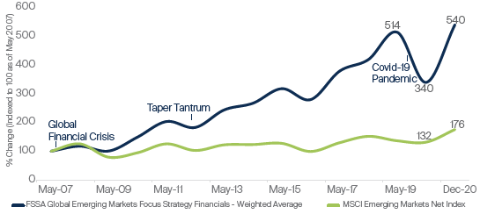

There is a high proportion of banking and financial services in the portfolio. Will a rising interest rate environment hurt that segment?

No, quite the contrary. Banks typically make more money in a higher interest rate environment. However, for the financials in our portfolio, it doesn’t matter so much. Over the past decade or more, as interest rates fluctuated but generally trended downwards, our financial holdings have still significantly outperformed (see the chart below). They are able to take deposits at a very low rate and lend at a higher rate — and collect the spread in between. We own some well-run private sector banks in the portfolio, like HDFC Bank mentioned earlier, but we do not take a view on where interest rates are going. The underlying businesses are solid enough to warrant an investment in these banks irrespective of where interest rates are.

Total shareholder return for FSSA GEM financials (weighted average) vs Benchmark*

*MSCI Emerging Markets Net Index

Source: FSSA Investment Managers, Bloomberg. Data is as at 1 March 2022. FSSA GEM financials refers to holdings that are in the financial sector in the FSSA Global Emerging Markets Focus Strategy portfolio.

Within companies that generate high returns, what makes these sustainable in the longer term? How do you forecast the erosion of returns based on greater competition?

As mentioned earlier, we always look for strong competitive advantages (such as the deposit franchises at banks), which can make returns sustainable. Another example is digital consumer platforms. One of our larger investments is JD.com — its competitive advantage is really its size relative to peers, and this continues to expand every year.

JD’s key strategy is called “scale economies shared”. As the company grows larger, it improves its negotiating power against suppliers, which is then passed on to customers and ensures that they come back and buy even more. As JD continues to grow, its scale relative to peers should continue to expand.

Regarding the erosion of returns from competitors, take TravelSky as an example of how we look at the issue. The company provides a backend service for airline ticketing, a highly concentrated industry that can be considered a legal monopoly. Globally, only four companies provide this service and they have proven to be good operators in terms of generating high returns on capital employed. Because of the network and scale effects, it would not make sense for an airline to create its own ticketing software and compete with the established players. We believe no airline would be willing to risk its ticketing business with a new entrant, no matter how low the pricing is.

How do you account for the increased political and regulatory risk and therefore the valuation of emerging markets equities?

We are not top-down investors; but we believe it is naive to look only at a company in isolation. For each of our portfolio holdings, we conduct a bottom-up assessment of what we think the business will generate in annualised returns over the next five years. Then we rather simplistically look at the key macro or geopolitical risks in the country.

We look at historical trends such as currency depreciation over the last 10 years and whether we think that is likely to decelerate or accelerate. For instance, if we are looking at a Brazilian consumer company and the Brazilian real has depreciated by roughly 6% annualised over the last 10 years, then we would want that company to generate returns 6% or 7% higher than what we could get in another country without that currency risk.

In China, regulation is a risk that we consider, but in terms of investment opportunities we prefer to look at companies that are below the radar and not situated in highly political or sensitive industries like financials or property, or other sectors where they might not be aligned with the longer-term interests of the Party.

Going back to the Russia-Ukraine conflict, what are your thoughts on China and the contagion risk from Russia?

We do not have a crystal ball, but our general view is that the contagion risk from Russia to China looks unlikely. We believe things would have to escalate significantly, which would be not in anyone's interest.

There is a lot of nervousness around China and not just on the contagion risk from Russia — there are also risks around the delisting of American Depositary Receipts (ADRs) and Omicron is now spreading in China in a more significant way.

Regarding the noise about ADRs being delisted, again we think a compromise is likely to be reached. However, in some ways this is quite irrelevant. Many of the Chinese companies listed in the US have a dual share class in Hong Kong which is fully fungible and easily convertible. Therefore, to us this does not affect the underlying fundamentals of a business.

With respect to Omicron, we believe it is likely to have a near-term toll on economic activity. But as we have seen repeatedly over the last two years, at some point China will come through the other side of it too.

Chinese equities and particularly those with US listings are now trading at levels not seen since the euro crisis or the GFC, which means that for investors like us with a long-term horizon, we believe now might not be a bad time to start looking at these companies again.

There is a link between the oil price and how Indian stocks tend to perform. Could you share your views on that?

Historically, oil prices going above USD 100 meant bad news for Indian equity markets, as was the case when this happened in 2008 and briefly in 2013. But two things are different now. Because of reforms over the past decade, India's fiscal status is much better in terms of how much tax is collected. The economy is being formalised at a rapid pace, owing to reforms like the Goods and Services Tax (GST) and other measures. Tax collections are beating estimates month after month, which is a good sign.

Foreign exchange reserves are now the highest they have ever been, close to USD 620bn at the last count, so imports are fully covered and India's external debt is very low compared to a decade ago. Foreign Direct Investment (FDI) flows have been averaging over USD 60-70bn in recent years and they continue to do so.1

While high oil prices could have an impact, it does not make a difference to the way we invest over the medium term. Going back to HDFC Bank, we have seen it continue to perform well even when the oil price spiked. For high-quality companies in India it may not be a tailwind, but we believe it is also not the headwind that some might expect.

Emerging markets have underperformed developed markets for almost a decade. Why do you think this might change?

We believe one has to be careful about saying whether this or that will outperform. We invest with an absolute return mind-set, rather than relative to developed markets or other benchmarks. That being said, we do not think US equity market performance will be quite as significant in the next five to 10 years. Historically-low interest rates are starting to rise, US equity valuations seem extended, and the commodity slump over the previous decade should not be as much of a drag on emerging markets. Meanwhile, valuations in emerging markets look much more attractive than before. Overall, we remain confident in the longer-term prospects of our businesses from a bottom-up perspective.

Source: Company data retrieved from company annual reports or other such investor reports. Financial metrics and valuations are from FactSet and Bloomberg. As at 29 March 2022 or otherwise noted.

Important Information

References to “we” or “us” are references to First Sentier Investors (FSI). The FSSA Investment Managers business forms part of First Sentier Investors, which is a global asset management business that is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group.

In Hong Kong, this document is issued by First Sentier Investors (Hong Kong) Limited (FSI HK) and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this document is issued by First Sentier Investors (Singapore) (FSIS) whose company registration number is 196900420D. In Australia, this information has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (FSI AIM).

This document is directed at persons who are professional, sophisticated or wholesale clients and has not been prepared for and is not intended for persons who are retail clients. The information herein is for information purposes only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation. Some of the funds mentioned herein are not authorised for offer/sale to the public in certain jurisdiction. Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time.

Any opinions expressed in this material are the opinions of the individual authors at the time of publication only and

are subject to change without notice. Such opinions: (i) are not a recommendation to hold, purchase or sell a particular financial product; (ii) may not include all of the information needed to make an investment decision in relation to such a financial product; and (iii) may substantially differ from other individuals within First Sentier Investors.

Please refer to the relevant offering documents in relation to any funds mentioned in this material for details, including the risk factors and information on requirements relating to investor eligibility before making a decision about investing in such funds. The offering document is available from First Sentier Investors and FSI on its website and should be considered before any investment decision in relation to any such funds.

Neither MUFG, FSI HK, FSIS, FSI AIM nor any of affiliates thereof guarantee the performance of any investment or entity referred to in this document or the repayment of capital. Any investment in funds referred to herein are not deposits or other liabilities of MUFG, FSI HK, FSIS, FSI or affiliates thereof and are subject to investment risk, including loss of income and capital invested.

To the extent permitted by law, no liability is accepted by MUFG, FSI HK, FSIS, FSI AIM nor any of their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that we believe to be accurate and reliable, however neither the MUFG, FSI HK, FSIS, FSI AIM nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of FSI.

Any performance information has been calculated using exit prices after taking into account all ongoing fees and assuming reinvestment of distributions. No allowance has been made for taxation. Past performance is not indicative of future performance.

Copyright © First Sentier Investors (Australia) Services Pty Limited 2022

All rights reserved.