Where is ASEAN's middle class?

The promise of the ASEAN1 region, home to more than 670 million people,2 has been underpinned by the growing middle classes. With a median age of 30, the ASEAN population contains the third largest workforce bloc (after India and China).3 This cohort is expected to continue to earn more and spend more, thus boosting the local economy and creating a virtuous cycle of growth and consumption. But figures from the International Monetary Fund (IMF)4 show that income growth (as measured by GDP per capita) has stalled in recent years; and our company meetings suggest that consumer spending has been weak.

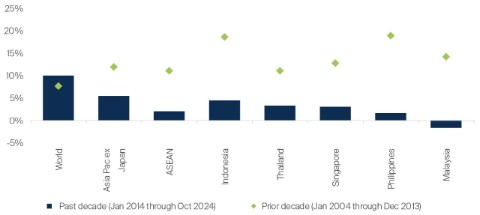

Investors in the region, who enjoyed double-digit annualised returns in the 10 years to the end of 2013, have been disappointed by the paltry returns over the more recent past decade (see chart below). One of the biggest reasons for the economic setback stems from the lack of formal job creation across industries.

Annualised returns in USD

Source: Bloomberg, MSCI, FSSA Investment Managers as at 18 November 2024.

During our visits to Indonesia, Thailand and Malaysia this year, we met with numerous companies reporting weak demand and a K-shaped recovery.5 Upper-middle class consumers showed greater resilience in their spending, which benefited consumer discretionary businesses such as Mitra Adiperkasa (a retailer of sports, fashion, and food & beverage products), Ace Hardware (a home improvement retailer) and Cimory (known for its premium yogurt and processed meat).6

Conversely, households in the lower-middle class and below faced a more challenging environment, having suffered more acutely from strong food inflation coupled with sluggish wage growth and limited job creation. Indonesia’s Central Bureau of Statistics (BPS) reported a decline in the number of Indonesians classified as middle class, dropping from 57 million to 48 million over the past five years (or down from 21% to 17% of the population).7 This shift has impacted demand for several of our portfolio companies, including Unilever Indonesia (which offers personal care, home care, and food & beverage products), Kalbe Farma (a maker of prescription and over-the-counter drugs, as well as nutritional supplements), and Multi Bintang (Heineken’s domestic subsidiary which caters to the Chinese and non-Muslim population in Indonesia).

While Chinese investment into ASEAN has contributed to the region’s growth, it has yielded mixed results on a local scale. Thailand has attracted significant capital from China, especially into electric vehicles (EVs), and we saw numerous roadside billboards for Chinese EVs. But while Thailand’s EV sales have surged, the once vibrant local auto components industry is struggling, as more auto parts are being imported from China. Management at various Thai companies expressed their concerns about domestic manufacturing and job creation as the economy remains stagnant.

In Indonesia too, competition from Chinese EV makers is seen as an existential threat to locally-based companies like Astra, which manufactures and distributes Toyota vehicles. Astra has been de-rated and now trades at the book value of its equity, despite generating healthy mid-teens return on equity (ROE).8 The company has been gaining market share with its strong line-up of hybrid vehicles and believes that they are ideal for customers in places like Indonesia, where charging infrastructure is lacking and resale values are important to car owners. While the market appears sceptical, we maintain our conviction in Astra’s strong franchise, sensible owners and solid balance sheet, and remain optimistic in its potential growth.

Elsewhere in the Indonesian economy, Chinese companies have also been undertaking large infrastructure projects9 like nickel smelters and hydropower plants, but they provide insufficient jobs for local workers. Furthermore, the market has opened up to Chinese firms like BYD and Bytedance (the company behind Tiktok), causing disruption to various sectors. These developments have raised questions about policymakers seemingly prioritising short-term gains over the long-term development of the country and its formal sector.10

With all said and done, there is much to worry about with the gloomy macro and negative headlines. But thankfully, as bottom-up investors our job is to look for and invest in quality businesses. We continue to find companies with strong franchises and high-quality management teams that we are willing to invest in for the long term. The tough macro environment allows us to own such companies at attractive valuations.

Two such companies in the FSSA ASEAN portfolio are Mobile World and Bank of the Philippine Islands.

From electronics retailer to modern grocer

Mobile World (MWG) is Vietnam’s largest electronics retailer, with a growing business in selling groceries. Over the past 18 months, we have increased our investment in MWG, and it is now among the top 10 holdings in the FSSA ASEAN portfolio. We have been impressed by the company’s robust track record of organic growth, its customer-focused culture and the strong alignment with its core management team, which has been in place for two decades. We regard Chairman Nguyen Duc Tai and his team as some of the most capable leaders in Vietnam’s retail landscape.

Founded in 2004, the company initially carved out a dominant presence in the mobile phone market before expanding into consumer electronics and appliances. These sectors were large, fragmented and unorganised, which enabled MWG to become the leader with over 50% market share. Each time, the management team would use a small-scale, trial-and-error approach for the first few years, then expand rapidly once a successful format was discovered, or exit the format if it did not make economic sense. In a recent meeting, management described it as their “low-cost and low-risk approach to new businesses instead of paying dollars to external consultants.” This execution strategy has proven highly effective over the years.

We believe the company’s success can be attributed to its management style, which emphasises delegation and decentralisation. Store managers are empowered to propose new locations and select the products they wish to sell, thereby enhancing the likelihood of success. Staff at all levels are incentivised to ensure customer satisfaction, as customer feedback plays a large role in employee promotions and compensation. The senior management believe this customer centricity will eventually lead to strong shareholder returns. Meanwhile, MWG is resolute in closing underperforming stores that fail to meet expectations during their initial six-month trial period.

After MWG solidified its leadership position in mobile phones, consumer electronics and home appliances, the company ventured into grocery retailing in late 2015 with the Bach Hoa Xanh (BHX) chain. Once again, Mobile World aimed to identify an effective format, integrate modern retail practices and increase profitability through economies of scale. However, this sector has proven more challenging to navigate, due to its large market size (over USD50 billion) and lower penetration of modern trade compared to other ASEAN countries. Key challenges included managing fresh food supply chains and inventories, as well as identifying a scalable and profitable retail format.

Following a period of rapid expansion and losses up until 2021, the management decided to rein in growth and focus on improving unit economics. In recent years, they have become more prudent about capital allocation, after some disappointing expansion efforts in pharmacy and sports/fashion formats. We view this as a positive development that reinforces our belief in the quality and risk awareness of the management team.

With no new store openings in the past two years and improved operational efficiencies, BHX is nearing breakeven. Revenue per store has increased significantly, and we believe the unit economics are now viable and will become more attractive as the business scales. With the necessary ingredients in place to build a substantial grocery retail business, we are excited about MWG’s potential. In other parts of the ASEAN region, we have seen low-cost, market-leading grocery retailers reach significant market capitalisations.

A bank rebuilding its franchise and market share

Each visit to the Philippines serves as a stark reminder of the country’s wide wealth gap, lack of industrial development and numerous inefficiencies, such as traffic congestion and long queues at the airport. Despite the country’s favourable demographics, i.e. a large population of young people, its structural challenges have been a major impediment to many companies on their growth journey.

Nonetheless, there are still a handful of well-run companies with attractive investment characteristics. Philippine Seven, which was mentioned in our last note, is one such company. Another is Bank of the Philippine Islands (BPI), the fourth-largest bank in the country (as of 30 June 2024).

We initiated our position in BPI in late 2021 following a leadership change, and it has since grown to become a significant holding. With over 170 years of history, BPI was once the premier bank in the Philippines, well regarded for its cost efficiency and asset quality. However, it lagged peers like BDO Unibank in the last decade due to poor management, slower growth and loss of deposit market share.

When Jose Teodoro Limcaoco (known as TG) assumed the role of CEO in 2021, the market was sceptical of his ambitions to accelerate growth and increase the ROE to 15% (compared to the 5-year average of 11%). Having been overlooked for the CEO role in 2015, TG was determined to excel in his new position. Compared to his predecessor, he has been more visible and hands-on, frequently visiting branches in the provinces and showing a better understanding of customer needs.

Under his leadership, BPI appears to be on a positive trajectory. Customer acquisition has accelerated, with BPI’s customer base expanding to over 12 million customers from 8.5 million in 2021, a figure that had remained stagnant for the prior decade. This was underpinned by BPI’s robust digital capabilities and recent investments in technology. BPI has since achieved record-high profitability, aided by higher interest rates, and in 2023 the bank met its 15% ROE target while maintaining strong asset quality.

We believe this momentum will continue, given the country’s low credit penetration. Nearly half of the population remains unbanked and lacks access to formal credit, while household debt to GDP is only 11%.11 We are optimistic about BPI’s long-term potential to compound book value per share at attractive rates in such an underpenetrated market.

Other beneficiaries of rising financial inclusion

There are a few other companies which we expect to benefit from increasing financial inclusion in the ASEAN region. We recently initiated a position in Bank Rakyat Indonesia (BRI), a leading micro-finance lender in Indonesia. Microloans and ultra-microloans (small business loans) are a large social contribution to the 37 million borrowers in Indonesia who otherwise lack access to formal credit. BRI has high return on assets (ROA) and a solid, decentralised business franchise that is hard to replicate. We have seen other banks try to manage microloans without success. As a state-owned bank, BRI offers regular microloans as well as subsidised microloans (the consumer pays 7-9%, while the government pays the rest), which generate attractive yields in the region of 16%. Through acquisitions and the government subsidy program, its microloan book has more than doubled in the last 5 years to around USD40 billion and 50% market share.

The bank has experienced a period of asset quality weakness with the cost of credit expected to exceed 3% this year. It overextended credit to small borrowers after Covid, which, combined with the economic challenges for such borrowers, led to higher default rates. The management have acknowledged their mistake, slowed the pace of lending and is focusing instead on collection. We believe credit costs will eventually normalise and return on equity will improve. After the share price declined by more than a quarter from earlier in the year, we thought the risk-reward looked attractive. That said, because of its state ownership, it will likely remain a relatively small position in our portfolio.

We also bought Metrobank, the third-largest bank in the Philippines (as of 30 June 20204). Like BPI, Metrobank is seeing strong growth in retail loans (including credit card loans and auto loans). The valuation, being below book value, appeared attractive, considering its strong deposit franchise, conservative lending practices and low non-performing loans (NPL) ratio.

Metrobank’s ROE has increased with higher rates, though it still lags BDO Unibank and BPI. Its low loan-to-deposit ratio suggests further room for improvement. Metrobank has significantly increased its dividend payout to optimise capital and focus on returns. As they return more capital to shareholders, the management expect the ROE gap to narrow.

Conclusion and outlook

Considering ASEAN’s headline demographics and potential for economic growth, it is not difficult to make a compelling case for investing in the region. However, headwinds such as food price inflation and the influx of Chinese imports have impacted consumer demand and employment opportunities. Looking ahead, we think middle-class consumers are likely to have more disposable income as inflation begins to cool, which could support a cyclical recovery. That said, the structural challenge of weak job growth in the formal sector persists in most countries.

The recent headwinds underscore the need to select high-quality businesses with strong franchises and capable management teams. By backing capable leaders like Philippine Seven’s Jose Victor Paterno, MWG’s Nguyen Duc Tai and BPI’s TG Limcaoco, we believe our portfolio will be resilient amid the volatility. Their long-term orientation should enable them to capture emerging opportunities, while their track records demonstrate the ability and insight to overcome challenges.

Our portfolio companies generate attractive returns on invested capital (ROIC) and high ROE, averaging 37% and 19% respectively on a weighted basis. This has been consistent over time and reflective of them being high-quality businesses. The portfolio’s valuations are attractive as well, with a weighted average forward price-to-earnings in the mid-teens. Irrespective of the macro environment, we remain optimistic about this combination of high-return and resilient businesses, with capable leaders and attractive valuations. Of course, strong economic tailwinds would make us even happier on behalf of our clients.

Thank you for your support. We look forward to your feedback and questions.

Footnotes

1 Association of Southeast Asian Nations

2 Source for population and median age: Economic and Social Commission for Asia and the Pacific, Demographic indicators (2023). Retrieved 26 Nov 2024. https://www.population-trends-asiapacific.org/data/sea.

3 Source: Association of Southeast Asian Nations, Investing in ASEAN 2023 (Dec 2022). https://asean.org/wp-content/uploads/2022/12/investment-report-2023.pdf

4 Source: International Monetary Fund, World Economic Outlook (October 2024), GDP per capita, current prices. Retrieved 26 Nov 2024. https://www.imf.org/external/datamapper/NGDPDPC@WEO/THA/IDN/PHL/VNM/MYS

5 Defined as a recovery in which certain sectors, usually larger companies and public-sector enterprises, recover more quickly while others lag. It often leads to long-term unemployment among lower income groups and greater wealth inequality.

6 Source: All company data herein retrieved from company annual reports or other such investor reports. As at 26 Nov 2024 or otherwise noted.

7 Source: CNA, Indonesia’s middle class population shrinks by close to 9.5 million people (Aug 2024). https://www.channelnewsasia.com/asia/indonesia-middle-class-population-purchasing-power-economy-4577131

8 Source: Financial metrics and valuations are from FactSet and Bloomberg. As at 26 Nov 2024 or otherwise noted.

9 Source: China Briefing, China-Indonesia Closer Economic Ties: Trade and Investment Opportunities (Nov 2024). https://www.china-briefing.com/news/china-indonesia-trade-and-investment-profile-opportunities

10 The formal sector refers to jobs that the government regulates and offers benefits such as social security, health insurance and retirement plans. Examples include jobs in the government, banking, education, healthcare and manufacturing industries.

11 Source: CEIC Data, Philippines Household Debt: % of GDP (June 2024). Retrieved 26 Nov 2024. https://www.ceicdata.com/en/indicator/philippines/household-debt--of-nominal-gdp

Investment insights

- Article

- 8 mins

- Article

- 8 mins

- Article

- 10 mins

Important Information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of FSI. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of FSI. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time.

In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited. First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business divisions of First Sentier Investors (Singapore).

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.