High-quality financials in emerging markets

Our investment philosophy is based on the simple belief that the best way to create wealth is by owning high-quality businesses for the long term. As quality growth investors, we specifically look for companies with outstanding management teams, attractive growth opportunities, sustainable business models and strong competitive advantages that ultimately lead to consistently strong financial performance. We refer to these businesses as "structural compounders." Often, they are found among the leading consumer, financial or services companies in less developed regions, where the low penetration rates of many goods and services provide a favourable long-term demand backdrop. Additionally, the high level of informality in many of these countries serves as a barrier to entry, resulting in a less competitive environment. As a result, dominant companies with brand, distribution or scale advantages can often generate above-average sales growth, with pricing power that leads to high and steady margins and, ultimately, attractive free cash flow generation, which in turn should lead to high returns for the owners of these assets.

One group of companies that fits our quality criteria particularly well is high-quality financials. As a team, we have been investing in these types of companies for many years. They are a significant part of the Global Emerging Markets (GEM) strategy and currently make up 28% of the portfolio.1 We define high-quality financials primarily as plain vanilla banks (simple financial intermediaries, often supported by a strong deposit franchise or a specific loan niche), positioned in markets with low financial inclusion which allows them to generate high margins and returns across the cycle. Typically, these banks are more defensive than the average peer and often benefit from the same drivers as consumer companies (demographics, urbanisation, productivity improvements, etc.), which facilitates strong secular demand for their services.

Whilst the leveraged nature of any bank makes them inherently riskier than non-leveraged businesses, we believe that the typical operational risks impacting financials (for example, being on the wrong side of the interest rate cycle, or excessive loan growth achieved by compromising lending standards) have been mitigated for many of our holdings, as evidenced by their track record over the past 20 years. The banks that we own have performed substantially better than their traditional emerging market (and developed market) peers over the cycle; and are ahead of the average emerging market company as well.

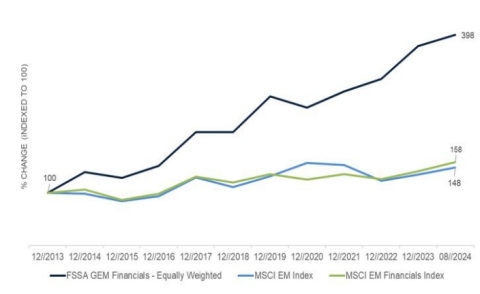

In fact, on average, the aggregate book value per share of our holdings (assuming dividends were reinvested) has compounded at 14% in US dollar terms since the beginning of 2014 and has generated average return on assets of 2.6% – despite the Covid pandemic in 2020-22 and a substantial slowdown in many emerging markets in 2014-16.2 Likewise, the long-term share price returns for this period have been equally impressive. An equally-weighted portfolio of our financial holdings would have risen 298% in aggregate compared to 48% for the MSCI Emerging Market Index and 58% for the MSCI EM Financial Index.

Source: FSSA Investment Managers, MSCI. Indexed to 100 at 31 December 2013, through to 31 August 2024.

What kind of traits would characterise our financial holdings? To begin with, their management teams are seasoned bankers known for acting prudently throughout the cycle. Specifically, we look for countercyclical management teams that are risk-aware and think about strategy over the longer term. They must be willing to leave some upside on the table if that is the right thing to do from a long-term perspective, even if it means foregoing profit in the near term. On that point we look for KPIs.3 that prioritise asset quality and a strong liability franchise, rather than attempts to grow the loan book at the expense of long-term returns. Management experience and incentive structures are among the key determining factors we assess, and we take comfort in the fact that the average tenure of the CEOs at our financial holdings is 26 years (as detailed in the chart).4 Whilst having endured multiple cycles and market environments is no guarantee for the future, we find confidence in their long operational track records.

Source: Company materials

Source: Company materials

Source: Company materials

A high and sustainable rate of return for a bank is typically the function of a strong deposit franchise dominated by current accounts and savings accounts, as these usually carry the lowest cost of funding. The banks we own in the portfolio have these traits. This is important for two reasons. First, it makes the overall business more stable and predictable. Second, due to lower funding costs, these banks can be more selective in the types of clients they take on and the loans they accept, further mitigating risks over the cycle (see charts on deposit market share and non-performing loans). This is especially true for banks that operate in high interest rate environments, where the funding cost advantage becomes even more pronounced.

An underappreciated advantage of having seasoned, counter-cyclically minded managers at the helm of banks that have established trust in the minds of customers, is that in times of stress they are the beneficiaries of a “flight to safety”. They receive low-cost deposits and inflows just when it is most advantageous, allowing them to gain market share profitably. Given the periodic shocks to the banking systems in most emerging markets, it is no surprise that this set of companies persistently gain a larger share of the profit pool.

Thus, we believe that over an economic cycle, high-quality banks are some of the best companies to invest in for attractive long-term risk-adjusted returns. One of the latest additions to the strategy in this category is the Mexican bank, Regional.

Regional is the 10th largest bank in Mexico, with roughly 2% market share in loans and deposits. It is the holding company for Banregio, a full-service bank targeting mainly small-to-medium enterprises (SMEs), and Hey Banco, a digital bank that services individuals and smaller businesses. Regional was founded in 1994 in Monterrey, Nuevo León, by brothers Jaime A. and Manuel G. Rivero Santos. The Rivero family is one of the original banking families in Monterrey and part of the group that founded Banco Mercantil de Monterrey in the late 19th century, the predecessor to Banorte. In 1993 the Rivero family raised USD 56m from a group of Monterrey-based investors and commenced banking operations the following year. Although the bank doesn’t have a controlling shareholder today, it has been dominated by the Rivero family since its inception. Today the family owns 30% through a trust. Other Monterrey families hold 26%, and the remaining 44% is free float.

Source: Company materials

Source: Company materials

Regional specialises in SME lending in the most dynamic areas of Mexico, leaving aside states with high informality and low banking penetration. For example, Nuevo León and its capital city, Monterrey, are well known for their high industrial concentration and as one of the most developed states in Mexico. Last year Nuevo León accounted for 5% of Mexico's population but contributed 9% of its total gross domestic product (GDP). Regional is the market leader in Nuevo León and has 25% market share, with 40% of its total loan book from the region.

Regional's management team is well seasoned in the banking business – this has been a guiding principle since the bank's foundation. The bank looks for individuals with 20+ years in the industry, recruiting them from larger institutions that seek higher decision-making authority within a smaller organisation. Despite being a small bank, Regional's long-term track record since listing in 2011 is strong. Asset quality has remained in check (its 10-year average non-performing loans (NPL) ratio was 1.5%, which is best-in-class), and book value has compounded at 17% since the initial public offering (IPO), without any equity raisings. This is largely due to its risk-aware culture and superior SME franchise, which should have many good years ahead of it, in our view.

Regional is conservatively run and prides itself on its "long-term relations, which strengthen customer loyalty, resulting in stable credit quality and higher profitability." During the tequila crisis in 1994-95, it was one of the few banks that did not need to raise capital, and during the global financial crisis in 2008-09, it was praised by the regulator for being one of the three most liquid banks in the country. More recently, during the Covid-19 pandemic, NPLs did not exceed 1.8% in any quarter. Moreover, Regional's track record shows uninterrupted profit generation – it has never recorded a loss in its almost 30-year history.

Structurally, Mexico is one of the most attractive banking markets in emerging markets due to the size of the economy, low financial penetration and the consolidated nature of the banking sector. As the second-largest economy in Latin America (after Brazil) with a GDP per capita only exceeded by Chile, Mexico’s debt-to-GDP penetration is on par with levels typically seen in Africa and less-developed Southeast Asian countries (which are a lot less affluent on a per capita basis). The low penetration of credit is due to the high informality of the job market (more than half of the working population is not enrolled in the social security system) and a longstanding distrust of banks among many Mexicans.

But this is gradually changing. Over the past 20 years, private debt-to-GDP in Mexico has increased from 25% of GDP to 40%,5 yet it remains significantly lower than almost any other emerging market. The low penetration is across all segments (commercial, mortgage and consumer), but SME lending, which is Regional’s focus area, is particularly low. The Mexican central bank estimates that SME lending is less than 2% of GDP – there are only half a million SMEs in Mexico that borrow from the banking sector (out of an SME population of 8 million), which implies plenty of room to grow.

Despite being a smaller player in the Mexican banking sector, we believe Regional’s focus on high-margin SME lending along with its prudent risk culture offers attractive growth potential. At the time of purchase, Regional was trading at a price-to-earnings ratio of 6x 2024e (i.e., based on estimated earnings for 2024) and a price-to-book ratio of 1.2x, which we believe offers solid long-term value given the bank’s strong track record and future growth prospects.

While Mexico is currently experiencing a wobble (due to outgoing President Andrés Manuel López Obrador’s attempts to push through controversial “reforms” before leaving office in October), we believe the longer-term tailwinds from its proximity to the US and nearshoring opportunities won’t be derailed. This will continue to formalise the economy and benefit companies which offer consumer and financial services to the expanding middle class and smaller businesses. We remain confident in the strength of our company holdings in Mexico and have used this opportunity to add to our positions over the past few months.

Outlook

While investing in emerging markets is not without its challenges, we believe it is difficult to be optimistic about global markets without maintaining a positive view on emerging markets. The global economy is increasingly driven by emerging market growth, and we expect this trend to accelerate in coming years. The FSSA GEM Focus portfolio remains focused on businesses with proven management teams and structurally competitive advantages that allow them to capitalise on long-term secular trends across the emerging markets universe. For example, the formalisation of the Indian economy, the rising level of financial inclusion in South Africa and the growing adoption of Enterprise Resource Planning(ERP) systems by Brazilian SMEs represent compelling long-term growth opportunities. These types of businesses are often underrepresented in broad market indices, and thus we believe a bottom-up active investment approach has much value to add.

Although China remains a contested market, we have become increasingly more constructive given the sharp derating over the past three years. We continue to focus on quality businesses with strong governance structures and exposure to China's resilient middle class rather than state-owned companies operating in sectors like banks, property and insurance. India has been a key component of the strategy since inception, given its concentration of high-quality companies with strong management teams and the numerous secular growth opportunities. Yet the India market has risen a long way in recent years, with market capitalisation-to-GDP now standing at around 140% – rather high for what is largely a domestic demand-driven economy. While we still believe in the long-term potential of our holdings in India, we have used the recent euphoria in share prices to pare the positions in some of them.

The portfolio continues to offer attractive compounding opportunities, with our analysis indicating that our holdings should generate earnings growth of 16% CAGR6 on a weighted average basis over the medium term. Given this growth outlook, the portfolio’s aggregate valuations of 6% free cash flow yield and 21x on a price-to-earnings basis seem reasonable and attractive to us. This gives us confidence in the portfolio’s ability to deliver attractive long-term returns, both on an absolute basis and relative to the broader markets.

In this letter, we have tried to cover points which we thought might be of interest to the strategy’s investors. If there are any questions or feedback concerning the strategy, our approach, or operations, we would welcome hearing from you.

Thank you for your support.

Footnotes

1 Portfolio data in this article are as at 31st August 2024 unless noted otherwise.

2 Source: Financial metrics and valuations in this article are sourced from FactSet and Bloomberg. As at 31st August 2024 unless noted otherwise.

3 Key performance indicators

4 Source: Company data in this article are retrieved from company annual reports or other such investor reports. As at 31st August 2024 unless noted otherwise.

5 Source: International Monetary Fund, data as at 2022 https://www.imf.org/external/datamapper/PVD_LS@GDD/MEX?zoom=MEX&highlight=MEX

6 Compound annual growth rate.

Investment insights

- Article

- 4 mins

- Article

- 6 mins

- Article

- 4 mins

Important Information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of FSI. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of FSI. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time.

In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited. First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business divisions of First Sentier Investors (Singapore).

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.