Navigating the challenges and opportunities as China targets net zero

Client update - November 2021

China made headlines for watering down coal reduction targets during COP261, but we think the criticism is unfair. The nation’s own targets set by President Xi Jinping last year – for peak emissions before 2030 and carbon neutrality by 2060 – are still ambitious and noteworthy considering China’s faster economic growth compared to developed countries.

Much of China’s carbon-intensive activities over the years, especially in manufacturing, had been outsourced from the West. This makes China’s goals more impressive, considering the scale of change the country needs to make while retaining many of its core industries. And more domestic companies are taking steps to reduce emissions, which suggests the direction of travel is positive and still gathering steam.

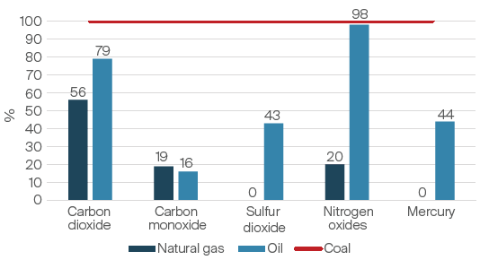

China leads the world in use of renewable energies, but their adoption is constrained by recent subsidy cuts, lack of energy storage facilities, and sources of renewables such as solar and wind farms being far from urban consumption centres. Natural gas can play a key role in bridging the transition from fossil fuels to renewables, because it’s much cleaner than coal and crude oil. However, gas has its drawbacks, such as methane leaks and other waste along the supply chain.

1 26th Conference of the Parties of the United Nations Framework Convention on Climate Change

Emissions from combustion relative to coal

Source: EIA, Wood Mackenzie, 2019.

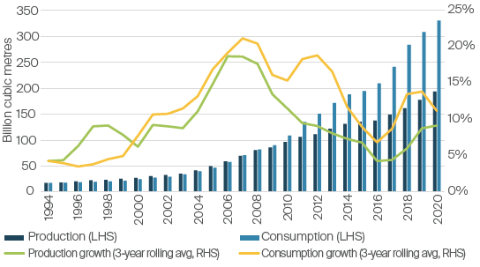

China’s policy targets include increasing natural gas in its energy mix, so gas volumes will continue to grow across power generation, heating and industrial applications as coal declines. Wood Mackenzie, an energy consultancy group, expects China’s gas consumption to grow by an average of 5.5% a year between 2020 and 2030, before eventually peaking in the mid-2040s. More conservative estimates put the peak at around 15 years from now, which is still a decent runway in our view.

Evolving from gas distribution to integrated energy solutions

ENN Energy, a long-time holding in some of our China strategies, is a privately-owned gas distributor which offers a useful perspective on the country’s energy transition. While no company is perfect, we believe ENN Energy sets a good example within the fossil fuels industry. The company is proactively reducing emissions, while its core business is positioned to benefit from both gas demand growth and the broader decarbonisation drive.

China’s natural gas consumption has outpaced production

Source: BP Statistical Review of World Energy, 2021.

Our investment case for ENN is supported by its track record of strong execution and operational outperformance vs. peers such as CR Gas and Towngas China; consistent profit growth driven by its core gas distribution business, with 15% annual growth expected over the medium term; and consistent increases in dividend payouts. From 2001 to 2020, revenue, earnings per share (EPS) and book value per share (BVPS) have compounded at average rates of 35%, 21% and 21% respectively.

We also like the company’s improving business mix. Two decades ago, it had just a handful of projects while 80% of revenue came from connection fees, which are one-off sales. More recently this segment has decreased to less than 10% of the total, outpaced by other segments with more sustainable earnings such as retail gas sales and the Integrated Energy Business.

Perhaps most significant is senior management’s willingness to listen to our suggestions and discuss issues openly. We’ve been engaging with the company for many years, having met them more than 50 times since the early 2000s, and have been a shareholder for at least a decade. Some of the suggestions we’ve made include reducing their related party transactions, improving data disclosure, setting firm ESG targets, and increasing the diversity of its employees and managers to include more women in the workforce. They have made some improvements but more needs to be done.

ENN seems well aware of the need to transform their business, as natural gas use may peak in the next 15 or so years. Given our long investment horizon, we also need to pay attention to what happens beyond this. The company recently published a multi-faceted plan that can be broadly categorised into defensive and offensive measures – in other words, reducing their own emissions and other waste, and providing customers with low-carbon solutions to become more environmentally-friendly and compliant with tightening global and local regulations.

Some of the measurable goals they have announced include reducing combined Scope 1 and 2 greenhouse gas emissions, lowering the methane from natural gas production, and switching their transportation fleet to only use clean fuel vehicles. Certain tools ENN employs such as software for efficient routing of their deliveries and alerts for methane leakages in their pipelines can also become revenue-generating offerings.

In recent years the company has positioned itself as an energy solutions provider, and the nascent Integrated Energy Business should expand from 10% to 20% of revenue by 2025. The major areas of focus include energy storage, carbon capture, hydrogen energy, geothermal energy, and converting biomass waste into fuels. By allocating capital and innovating across these emerging fields, ENN is aligning with increasing demands to better cope with the negative impacts of climate change.

Reducing emissions in our investment portfolios

Looking at the big picture, we are engaging more with our companies to reduce their emissions, but this is still in the early stages. The task is complex with plenty of grey areas and room for debate on how to move forward. While ESG has always been a focus for us, we are mindful of greenwashing and following the letter rather than the spirit of new regulations and industry standards.

As active, benchmark-agnostic investors, we seek to make a positive contribution to climate change action by engaging with our portfolio companies to lower their emissions over time, rather than simply selling high-carbon contributors within our portfolios. Our philosophy is to assess the net effect of a company’s environmental impact alongside its broader sustainability, and to engage heavily on the improvements that can be achieved.

Developed countries may need to mature in their thinking and face the reality that blame will not solve the problem – engagement and support will. It is easy to sit back and criticise Asia, but as investors on the ground, we are able to consider the many nuances and interests at stake. How can the world balance economic development and improvement in quality of life with the need to decarbonise? We believe the pragmatic approach we have taken with ENN is one pathway to this goal.

Natural gas is a medium-term bridge to net zero emissions as renewables cannot become the entire energy mix overnight. The company’s core business is well positioned for the transition years ahead, while its projects under development suggest it’s evolving in the right direction. We believe our long-term relationship with ENN demonstrates our engagement philosophy – to travel well, rather than to arrive.

Source: Company data retrieved from company annual reports or other such investor reports. Financial metrics and valuations are from FactSet and Bloomberg. As at 31 October 2021 or otherwise noted.

Important Information

The information contained within this document is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. Neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this document.

This document has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this document without obtaining specific professional advice. The information in this document may not be reproduced in whole or in part or circulated without the prior consent of FSI. This document shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of FSSA Investment Managers’ portfolios at a certain point in time, and the holdings may change over time.

In Hong Kong, this document is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this document is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

First Sentier Investors and FSSA Investment Managers are business names of First Sentier Investors (Hong Kong) Limited. First Sentier Investors (registration number 53236800B) and FSSA Investment Managers (registration number 53314080C) are business divisions of First Sentier Investors (Singapore). The FSSA Investment Managers logo is a trademark of the MUFG (as defined below) or an affiliate thereof.

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.