China - what's in store for 2021?

Martin has been with FSSA Investment Managers for more than 18 years, starting with the firm as Director, Greater China Equities in 2002. Martin is the lead manager of a number of FSSA strategies such as the FSSA China Growth Strategy and FSSA Asian Equity Plus Strategy to name a few.

This Q&A was adapted from a live webcast Martin did in January.

2021 will be a year of recovery. This is not surprising given last year’s economic downturn. If vaccines are being rolled out gradually during the year, we believe the economy will recover, especially those sectors that have been hit hard like travel. Hong Kong’s travel sector declined by 99.9% last year so there really isn’t much room left to decline.

In terms of the overall market, we believe the year will provide an opportunity for more balanced market growth, including cyclical stocks and shares whose value took a hit last year. As the economy recovers, shares in other sectors will become more attractive and not restricted to just a few sectors like last year, where only a handful of shares accounted for the majority of the returns. We have started to see signs of change in the past two months, hence why we expect this year to be different.

Although we still expect the year to continue to be impacted by a complex political climate, new US President, Joe Biden, is more predictable than his predecessor and unlikely to resort to extreme policies. Having said that, we do not believe that Biden will cancel all the executive orders issued by Trump, as the Sino-US relationship is a sensitive political topic. I do not think any politician would be in a rush to make radical foreign policy changes during their first days in office.

As a team, we will take a more cautious approach this year. 2020 was slightly unusual in that investors were very confident in the market despite the high valuations. As companies whose prices have increased 80- to 100-fold – mostly new companies – release their earnings, it will be interesting to see if they do indeed meet the expectation. We do not necessarily think that we will see a fall in share prices, including in the Chinese markets, but do believe that the returns may be lower than last year; and as conservative investors, we need to be more cautious when deciding on which stocks to purchase.

US equities vs. bonds

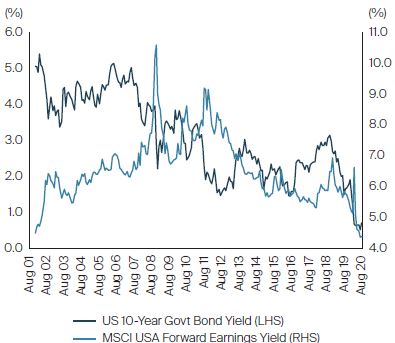

If we look at the US bond yields, they are currently around 1%. During periods when anything can give a 1% return, you might think everything is cheap. Comparatively, if we look at Hong Kong properties, would you say that it is expensive? If cash deposit rates are at 0.2%, a rental property that could yield 2% is definitely better. Hence, it really depends on what happens to interest rates.

The one thing investors should be aware of is that despite the expected economic recovery, no one is predicting higher interest rates (unlike previous recoveries). This is because the economy is still in a precarious situation. Therefore, compared to bonds, I believe equities still offer better value for money. For example, the yield from a CK Hutchison Holdings (a blue chip company) bond is around 1.6% to 1.7%, but the dividend yield is more than 5%.

Source: Bloomberg, Datastream, FactSet, MSCI, Macquarie, as at 29 August 2020

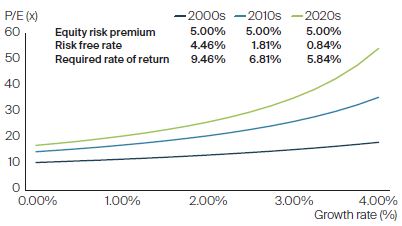

“Correct” P/E ratio at given rates of growth

This chart shows a different way to approach the issue: in an age of ultra-low interest rates, why have share prices increased so much? We call this an ‘academic’ approach, examining trends from a mathematical perspective. Assuming the risk premium stays constant at 5%, we can calculate a reasonable price-to-earnings ratio based on the different US 10-Year Treasury yields. The bright green line is 2020 – when the yield on US 10-Year Treasury bonds is 1%, and a company is growing at a rate of 4%, it can trade at a price-to-earnings ratio of 50. That might sound very high, but of course it’s just a hypothetical scenario where the 10-year bond yield is 1%.

Source: FactSet, FSSA IM, as at 29 August 2020. Risk free rates based on Hong Kong 10-yr bond rates.

How China stacks up against competitors

Source: Morgan Stanley, as at 2019.

China remains an attractive manufacturing base. One of the most important events last year was the completion of Tesla’s largest manufacturing site in Shanghai, a project which took just a year to complete. Last year, almost one third of Tesla’s vehicles were produced at its Shanghai factory. The significance of this event is not because it is Tesla, or because it relates to the electric vehicle market, but because in the past, China’s manufacturing industry was mainly associated with shoes and textiles, and lately iPhones. People did not expect China to manufacture cars that would be exported to the European market, or that a Tesla factory could be built from scratch in just a year.

Another of China’s long-term advantages is its ‘engineering competitiveness’. The days of China as a cheap source of labour are gone – but at the same time, the salary of a well-qualified Chinese engineer may be just one-half or two-thirds of the salary of a US-based engineer. As a result, some sectors of the Chinese economy have started to grow quite rapidly, such as pharmaceuticals, software, semiconductors and the automotive industry. If we examine the reasons why Huawei has been so successful, it is essentially a reflection of China upgrading its manufacturing industry - a key aim of the latest and previous Five-Year Plans led by President Xi.

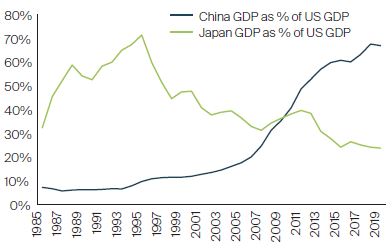

China GDP now 67% of US GDP – similar to Japan in mid-90s

Source: US Department of Commerce, China’s Ministry of Commerce, Bloomberg, FactSet, National Bureau of Statistics, World Bank, FSSA Investment Managers, as at 30 June 2020

There are historical precedents for the current political climate. Those who were around during the 1980s would know that the US and Japan were involved in numerous trade disputes during that time. The US levied high tariffs on Japanese car imports, which dealt a heavy blow to the Japanese automotive industry. China’s gradual rise now places the country in a similar position, as its GDP is roughly 70% of the US’s GDP. The US is the world’s largest economy in terms of GDP, which has led to a political and economic wrestling match with its biggest rivals – previously Japan and now China. The US does not want to be overtaken - that is why it has imposed sanctions on companies such as Huawei, which has a 5G market share of more than 50%. As such, we can safely infer that the US will introduce further measures towards China.

Having said that, if we look at the impact of trade sanctions on the Japanese economy at the end of the 1980s and the beginning of the 1990s, in some respects they were good for the economy. Toyota is a case in point – it is still the world’s largest car manufacturer, yet at the same time, produces its cars in the US. The company used local resources to support its global expansion and maintained its status as an industry leader. I am sure that some Chinese companies will be able to do the same and emerge stronger, despite the prospect of sanctions.

In response to the problems caused by globalisation, today we are faced with the threat of populism. People now have a different perception towards globalisation, both in the US and elsewhere. We will monitor how politicians respond, but I do not think that we will see a major change. I am particularly concerned about inequality, which the pandemic has escalated to greater levels. As long-term investors, we will be paying close attention to how governments respond to this issue over the next 5 to 10 years.

In the latest Five-Year Plan (China’s fourteenth), the government has announced plans to reduce the country’s vulnerability to and dependence on the global economy, achieve self-sufficiency and boost domestic consumption. The government has also introduced subsidies to boost purchases of home appliances and cars. We believe that this trend will continue over the next 5 to 10 years. As the Chinese economy develops and income rises, people will start to think how they can improve their quality of life. Hence, in sectors such as consumer spending, education and tourism, the potential for growth is clear even before the pandemic.

In line with that, we can also expect to see increasing average selling prices. China is home to some of the cheapest beers, and in the past, no one would buy instant noodles that cost more than 1 RMB. However, over the past three years, we have witnessed an interesting trend – the emergence of a market for high-end products. Now there are craft beers selling for 10 or even 20 RMB. In the past, a rice cooker would cost several hundred RMB, but following the arrival of smart technology, some smart appliances now cost much more. I believe this trend has the potential to have a direct impact on company profits and increase returns for shareholders.

Another trend that we are seeing is the increasing popularity of domestic brands. As the younger generations see their living standards and incomes improve, they will start to become more confident about Chinese brands. You can see this from the success of domestic sports brands such as Li-Ning and Anta or cosmetic brands such as Perfect Diary and Pechoin. We believe the trend will continue in the future and there will be more homegrown brands such as Huawei or Xiaomi.

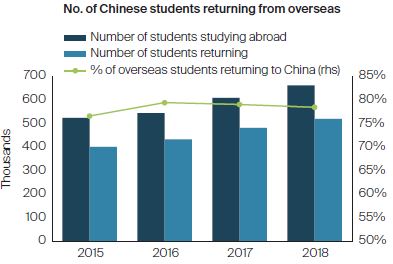

Overseas students are returning to China

Lastly, there are now almost 600,000 Chinese graduates returning from overseas university each year. If you looked at the background of executive-level staff in Chinese-listed companies, you will see that many of them have worked or studied overseas before returning to China to start their own businesses. We believe this trend will help to boost China’s technological capacity.

Source: National Bureau of Statistics, Five IP Offices, Wind, FactSet, as at 30 June 2020

Lastly, there are now almost 600,000 Chinese graduates returning from overseas university each year. If you looked at the background of executive-level staff in Chinese-listed companies, you will see that many of them have worked or studied overseas before returning to China to start their own businesses. We believe this trend will help to boost China’s technological capacity.

Huawei’s R&D has tripled and now on par with global peers

Source: National Bureau of Statistics, Five IP Offices, Wind, FactSet, as at 30 June 2020

If we look at the R&D expenditure of Chinese tech companies, it has increased over the years and is becoming comparable to the likes of Apple and Samsung. Of course, not all R&D projects will be successful but from an investor’s perspective, it is interesting to see where the focus is and what kind growth opportunities it entails.

We have invested in several Chinese tech companies but our tech investments are not restricted to just internet companies, because I believe that over the next few years, we will start to see new technologies being used in other sectors such as retail and food. Companies will use these new technologies to cut costs, and the definition of the tech sector will become increasingly broad.

At the end of last year, as a team, we conducted a virtual offsite to review the decisions that we had made during the year and we concluded that we made one right decision as well as one wrong decision.

When the stock market was in panic mode in March and April last year, everyone was saying that the economy was suffering from an unprecedented shock and that the situation would only get worse. If there were 100 cases today, there might be 1000 cases tomorrow.

We decided to exclude the year in our company analysis as we knew that the profits would be poor regardless of the outcome. Instead, we focused on companies that would be worthwhile investing in up to 2025 and had strong balance sheets to keep them afloat even if other companies went bankrupt. We also identified companies that we thought were significantly undervalued and invested in these companies while prices were low.

On the other hand, in hindsight, instead of focusing our efforts on valuation and finding undervalued companies, perhaps we should have invested in growth stocks, such as internet companies and electric vehicle companies, as they have exceeded expectations. It is easier to look back on past events, but we have to remember that we are conservative investors.

We have been expecting increased regulations, though we did not expect the measures to be quite as stringent. Regulations are not unique to China. Even tech giants such as Facebook or Google are targeted every one or two years and forced to attend hearings. In the eyes of many governments, the internet has become a powerful tool, especially if you look at events in the US. Even a user’s comment may have far-reaching effects. This is a concern for governments, especially in China, where the government may be more inclined to introduce regulatory controls.

If we look at the e-commerce sector, it is unlikely that one company would develop a monopoly as the competition is fierce. There are various companies in the industry – Alibaba, JD.com, Pinduoduo, so there is not a monopoly to speak of. However, after last year, some internet companies may adopt a more cautious growth strategy, which I believe may be beneficial for profits as companies would not have to keep spending huge amounts of money to fund their expansion or to entice new users.

We have been observing the electric vehicle sector as well as software services and cloud computing. However, as long-term investors, we need to decide whether the industry is as promising as people think and whether the companies have built an economic moat.

As an example, the smartphone industry experienced rapid growth in the past, but companies such as Nokia and Motorola that produced the older generation of phones eventually disappeared.

In the future, semiconductor chips and lenses could play the most important role in the smartphone sector. In the electric vehicle sector, it could be car batteries and glass, which we have been keeping an eye on too. We have also applied the same lens to the solar power industry – though we believe when everyone starts producing solar panels, there might be a risk of oversupply.

Over the years, electric vehicle stocks may have increased 11-fold but we must take a long-term approach and examine what kind of growth these companies will benefit from. For example, last year China produced 1.5 million new electric vehicles and the government has announced that 20% of vehicles in China will be electric by 2025 or 2030. We are confident about these forecasts – that said, does that really mean everyone will see 20-fold returns?

When the market is focused on a particular theme – what we call a thematic market – we must be cautious and think outside of the box and not have a herd mentality.

We have never doubted the online trend. The online trend has been huge over the last 10 years and companies such as Tencent have always been among our largest holdings. Tencent listed on the stock market in 2004, and we became shareholders in 2005.

Things are a slightly more complicated with Alibaba, because it listed much later and was already a large company then. The company has been the subject of debate for quite a while – not just since last year. I have always believed that Alibaba is a quality company with a great philosophy, as demonstrated by its 80% market share. However, over the past few years, there have been some concerns. For example, the company’s market share has dropped from 80% to 65% due to competitors such as Pinduoduo and JD.com. Not to mention, the recent regulatory issues.

However, because of that, the valuation has become more attractive recently and we felt that it was a good opportunity to add more to our holdings.

I think there are two key points here. You can look at the fundamentals, and then you have to consider what happens in reality. Theoretically, if you look at the fundamentals, sanctions should not have a serious long-term impact on a company. The long-term value of a Chinese company is not directly related to whether it has US-based investors. Of course, if the company has lots of business in the US, then that is another story.

The only companies we really invest in are Chinese companies focused on the domestic market. When the sanctions were imposed and share prices dropped, it actually presented an opportunity to increase our holdings. When shares in China National Offshore Oil Corporation were at their lowest, the dividend yield was 8%. For China Mobile, the dividend yield went as high as 7.8%, so in some respects, these shares were an excellent buy.

However, in reality, there are lots of investors, particularly fund managers and institutional investors, who find it difficult to increase holdings in these companies when share prices fall significantly. That’s because foreign investors, US investors, US custodian banks, US regulators and overseas fund platforms are likely to object to this positioning, and clients will ask lots of questions.

First of all, valuations are often expensive – you can see that with companies that have a P/E ratio of 20, 30 or more.

In theory, popular brands have high valuations, while those who manufacture for others (contract manufacturers) should be cheaper. For example, Nike’s valuation should be higher than Yue Yuen because Yue Yuen is just a contract manufacturer. In other words, there is a premium for brands that have a high market share. If we look at the sports wear industry, the leading brands are not Chinese companies but rather Nike or Adidas. Even if these Chinese companies increase their market share, the bigger companies will still have a higher P/E ratio.

We do not normally invest in consumer brands that have a very high P/E ratio. If we look at our top 10 largest holdings, they are mostly consumer-oriented companies, and we have been investing in these companies for the past decade or so. The P/E ratios of these companies is around 20 or so – they have become more expensive recently. In the past, the P/E ratio was only around 10. However, this does not mean that they are inferior to the more expensive companies. Our team compares valuations – we call this “valuation conscious”. We do not purposefully look for cheap companies, but experience has taught me that companies that have unusually high valuations might not perform as well as you expect.

There are both short-term and long-term considerations here. If we look at our China strategies, A-shares account for around 35% to 50% of the portfolio, a figure that has been steadily increasing over the last decade. 10 years ago, it might have only been 5%. There is a simple reason for this. The A-shares market is huge. When we are deciding how much to invest, in addition to looking at a company’s valuation, we also consider how much trust we have in the company. There are many companies on the A-shares market, but not all of them are quality companies. Some of them go off the radar after a couple of years. If you only look at the market cap and ignore all the other considerations, the A-shares market should account for about 50% to 60% of our portfolio, but unfortunately not all companies meet our requirements.

I have been following the Chinese market for the last two to three decades. Based on my experience, the best time to invest is when everyone else thinks the market is bad. Actually, around three years ago, many people were concerned about a hard landing, a property bubble, bad loans, zombie companies and oversupply, so they were not very optimistic about the A-shares market. Yet in my opinion, China is a huge market with huge potential. Every so often, people would say how the Chinese economy is in a great or terrible state. I am more of an optimist – that does not mean that I am extremely bullish, but I do not see a bubble either.

In recent months, people have rushed to invest in newly-listed companies. However, if you look at what happens afterwards, more than 90% of Chinese-listed companies are actually trading for less than the IPO price. Why is that? If you were a quality company, why would you wait until today to list on the stock market? Has today’s market become so attractive that all companies want to go public?

I am sure that there are some quality companies out there among the newcomers, but we prefer to adopt a cautious approach. That does not mean that we do not think these companies have potential, rather we like to think of it as getting to know a new friend – it takes time to gradually learn more about them. Same for newly-listed companies - there is an element of risk.

Besides that, there is lots of capital flowing into markets at the moment, which has both upsides and downsides. On the upside, share prices have increased and companies have found it easier to access financing. On the downside, too much capital can result in oversupply. It also drives down returns within an industry. For example, in the electric vehicles industry, everyone is raising capital. However, what can companies do with all this influx of capital? They will only compete with each other to expand production. Internet companies would spend huge amounts on acquiring new users. It is the same with the cloud computing industry and the education industry – they are all raising lots of capital. When you see things from this perspective, large amounts of capital can be detrimental. When capital is in short supply, everyone cuts capacity and prices increase. When there is too much capital, the opposite happens, but of course no one is talking about this at the moment. However, this is something that people should consider over the next one to two years.

Source: Company data, as at February 2021

Important Information

The information contained within this document is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. Neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this document.

This document has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this document without obtaining specific professional advice. The information in this document may not be reproduced in whole or in part or circulated without the prior consent of FSI. This document shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of FSSA Investment Managers’ portfolios at a certain point in time, and the holdings may change over time.

In Hong Kong, this document is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this document is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

First Sentier Investors and FSSA Investment Managers are business names of First Sentier Investors (Hong Kong) Limited. First Sentier Investors (registration number 53236800B) and FSSA Investment Managers (registration number 53314080C) are business divisions of First Sentier Investors (Singapore). The FSSA Investment Managers logo is a trademark of the MUFG (as defined below) or an affiliate thereof.

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.