Experience over hope for Asian markets

“The future is as full of promise as it is fraught with uncertainty.”

Lee Kuan Yew, former Singapore Prime Minister.1

Back to the future, again?

At the turn of the century, Lee Kuan Yew made this remark about the challenges Singapore was facing in terms of the forthcoming knowledge, as opposed to the existing industrial, economy. He could have easily been talking about emerging markets broadly, or indeed reflecting on the human condition in general.

These days all of us, market participants or not, seem almost entirely focused on uncertainty rather than promise. Perhaps it is social media connecting everybody, which has ironically made societies and people ever more anxious, extreme and unhappy? Such matters are beyond the scope of this commentary, but markets are a social construct, so perhaps they are not without relevance.

Emerging markets, as a concept marketed to investors, have always been about promise. But, latterly they seem to more resemble Samuel Johnson’s quip about second marriages, as “a triumph of hope over experience.”2

Charles de Gaulle made much the same point in the 1960s, when he observed, “Brazil is the country of the future and always will be.”3 While this pertains to one of the BRICs4 (more marketing-speak), it could well apply to the entire emerging-markets asset class these days.

So, what gives; as markets continue to chew up money and spit out nothing but disappointment? Well, whisper it softly, but it has already been a lost decade. Hence returns (including our own), in an absolute sense, have been quite mediocre. You could say that risk-free rates have been zero, with inflation quiescent, but that is no longer true and emerging markets carry their own particular risks… as we are finding out all over again.

Give me anything, as long as it’s technology

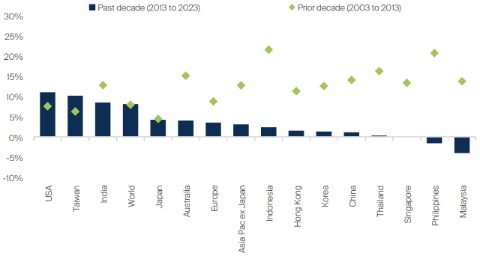

You would have to go back further, to the prior decade (2003-13), when Asia was rebounding from the 1997 Asian crisis, to find returns that made it worth all the trouble. India has continued to deliver high absolute returns throughout (though lower in the last decade), while sector-wise, technology has been the answer to everything. In markets, just as in life, we are all wedded to our new toys. In the last decade, the technology sector has compounded at circa 15% per annum.5

Everything else, by comparison, looks like it has been a waste of effort. Country-wise, Taiwan has thrived and globally the US looks increasingly like the only game in town. You can make a case for a global allocation, but that is over half America (which has been largely driven by the “Magnificent Seven”6 companies) these days.

Back in Asia, a few countries like China have managed to compound at low single-digit levels, but some countries’ returns, including the Philippines and Malaysia, have actually been negative in US dollar terms.

Annualised returns in USD

Source: Bloomberg, MSCI, FSSA Investment Managers as at 31 October 2023.

These relatively paltry returns have broadly come, as in America, with higher levels of debt. In some places the old 1990s economic model has been super-charged, as investments have ramped up and marginal returns on capital have declined. It is not an attractive or sustainable model. Hence, today we find ourselves with more questions than answers. In China, to compound matters, “Politics continues to move to the Leninist left; the economy to the Marxist left; and Chinese foreign and security policy to a much more assertive nationalist right,” as Australian diplomat and former politician Kevin Rudd put it.7

China remains Asia’s economic engine and this matters greatly. Debt, demographics, demand and now decoupling have all piled on, resulting in capital exiting the region and expectations crumbling.

It has been difficult to remain sanguine and not get caught up in the tumult, but as we all know, that is when people typically do stupid things. That’s the point of having a strong philosophy and process – it provides a solid anchor when all is chaos. In that sense, while everything looks truly dreadful, one must focus resolutely on the bottom-up opportunity set of companies. After all, much of this bad news is perhaps already well discounted.

Portfolio activity

In line with our comments six months ago, portfolio turnover in the FSSA Asian Growth strategy has declined further. In the 12 months to end-October, portfolio turnover was only 10%. This compares with a 3-5 year number of more like 20%. We believe it is a good reflection on our current portfolio positioning, following earlier efforts to double down on quality, particularly with respect to balance sheets.

Perhaps more surprising is that there have, so far, not been more opportunities to deploy capital into even better and now cheaper companies. To date, despite all the raucous and dramatic headlines, the decline in markets has been orderly and broad-based. The only real exception has yet again been the year-on-year recovery, as well as persistent outperformance, of the technology sector.

We made only one new investment in the last six months, adding Tencent, while we sold LG Household & Healthcare (LG H&H). LG H&H was a round trip. We bought it during the dark days of Covid, with a view to a subsequent recovery of profits. We have had concerns about its China inventory for a while, with implications for longer-term brand integrity, given the company’s facilitation of parallel and grey imports.

With a weak demand recovery in China and greater competition, as well as erosion of margins, we lost conviction and sold. Subsequent results, as well as a change in CEO, have done little to improve things. While we were fortunate to avoid a capital loss here, we have continued to hold on to Shiseido. Its China business is struggling due to competition and macro concerns around foreign brands (particularly Japanese, due to Fukushima water releases), along with a generally weak local consumption environment.

Resilience, with some notable exceptions

As a sign of the times, Shiseido’s third quarter profits halved, with travel-retail declining by 25%. Growth in Japan, the Americas, Europe and the rest of Asia was unable to offset the short-fall in China, where sales are down 9%, and related travel demand.

More importantly, the group cut their fiscal year (FY) 2023 forecast by one-third, which implies losses in the last quarter of the year as they restructure and cut costs. The forward price-to-earnings ratio (PER) is in the mid-20s, which, despite the sell-off, is hardly compelling. The company will clearly take some time to recover.

Other portfolio changes were relatively minor. We added a bit to Unilever Indonesia as the results have continued to be mixed amid a multi-year turnaround. Product market shares are beginning to recover, but this will take some time to materialise into higher profits. We added to a few China positions as well, such as China Mengniu Dairy and China Resources Beer (CRB) on weakness.

China Mengniu and CRB appear to be executing well. While Shiseido may be an indicator of China’s poor economic environment, on the other hand, China Mengniu shows how much some valuation multiples have compressed. The company is trading on a forward PER of just 13x, a 20-year low. In the past, we have always found consumer staples companies to be relatively defensive in terms of the sustainability of profits and share prices. This time around, so far, there has been little discernment in the market’s sell-off.

Modest additions to other holdings included Axis Bank in India, where a turnaround in the company’s fortunes is now quite evident, as well as Kalbe Farma in Indonesia. Kalbe’s recent results have been mixed, with a sharp slow-down in sales of nutraceuticals (vitamins) and over-the-counter drugs post-Covid. However, a greater focus by the government on security of supply, as well as the successful roll-out of a national health insurance scheme, should generate attractive tailwinds for the next 3-5 years.

Tencent

When investors broadly ask whether something is investable, we can safely assume that quite a lot of bad news is already discounted. Such sentiment has, as usual, made us try to approach China constructively from a bottom-up point of view. As noted, we added to existing holdings, but in something of a departure, we also bought China’s leading e-commerce, e-payments and social media company – Tencent.

Besides being China’s dominant super-app, we like the alignment with the founder shareholders, given the absence of dual-class voting shares, a simple Hong Kong listed structure and all in one company. Capital management has been sound, too, with judicious early-stage technology investments, subsequently partly monetised to the benefit of all shareholders. Recent results have also been reassuring.

Tencent (unlike many of its peers) has largely managed to stay out of the headlines, though a variable interest entity (VIE) structure has always been wrapped around circa half of the profits (the gaming business). A while ago, the group made a USD 15bn “donation” to the Chinese government in aid of the “common prosperity” campaign, which is not great. These issues have kept us away in the past, but now with a forward FY24 PER of 20x (on a GAAP basis) and generally high levels of antipathy among investors, we believe the risks are adequately discounted.

Like many companies in China, we believe the market’s forecasts of mid-teens earnings growth are probably still too high, but we expect total returns (including dividends and share buybacks) to approach double digits. There is nothing wrong with steady utility-like growth, with the sustainability of these returns likely to compound in excess of nominal GDP growth. Today, the risk appears asymmetric, with mainland China’s technology sector having already seen a rigorous degree of top-down regulatory and policy attention.

TSMC & technology

Technology-laden Taiwan, in general, has otherwise continued to do well despite all the fears and geopolitical concerns, demonstrating the perils of a top-down approach to stock investing (which we don’t do). Thankfully, Taiwan Semiconductor (TSMC) is still the largest holding in the strategy and we added to the position modestly over the last six months.

That said, in a recent meeting an observer argued that we did not seem to like the company very much because it was an “underweight position.” We get the point, from a relative perspective, but at just under a 7% position it is already as large a single position as we have ever held in the history of the fund.

In fact, as TSMC diversifies geographically and capital expenditure increases, there are grounds for expecting lower marginal returns on capital. Having plants outside Taiwan are certainly going to dilute returns. That said, the valuation still looks attractive with signs that profits are recovering, though earnings seem unlikely to surpass the FY22 high until FY25.

Mediatek, which has been more cyclical, has recovered as well. Somewhat unfortunately, we had already sold the last of our position in the first half of the year. It was once a 6% position, with the bulk of the holding sold at much higher levels. It is indeed difficult, if not impossible, to buy such cyclical companies at the bottom and sell at the top. We struggle with such dexterity and thus seldom buy such companies unless the odds seem highly asymmetrical.

Historically TSMC’s business (and share price) has been more cyclical, but its technological lead (in terms of its chips’ processing speed and power consumption), as well as its business alignment with clients, has continued to strengthen its competitive position. We cannot think of a better way to gain exposure to the technological disruption defining modern life today. Perhaps ARM or ASML would be comparable, but they are both more expensive.

Advantech, which supplies industrial computers for automation globally, has continued to execute as we hoped and remains a significant position. Largan, the lenses manufacturer and Apple supplier, contributed positively as well. For a long time, we considered it a mistake, but a modest improvement in performance coupled with a lower valuation has driven renewed interest. It is perhaps a good example of persevering, in an effort to look through to better times when a company is under pressure. These things are only ever clear in hindsight. If we are right, it’s lauded as conviction, and if not, it’s derided as over-commitment.

While we have always been concerned by the very high profitability, what made it easier to hold on to Largan was the strong net-cash balance sheet and family ownership. In addition, the market had already de-rated the company to a low-teens manufacturing-type price-to-earnings multiple. The margin has proven remarkably resilient, indicating its technological prowess and the inability of Apple to readily substitute cheaper suppliers.

Jardine Matheson

We have owed Jardine Matheson (JM) for many years and continue to have material exposure to the group via Dairy Farm (DFI) and Jardine Cycle & Carriage (JCNC). JCNC’s economics are driven by Astra, the sprawling Indonesian conglomerate that dominates the auto sector there with the Toyota franchise. Astra’s profits have recovered well and we are enthusiastic about the country’s prospects. Dairy Farm appears to be on the mend, too, with third-quarter profits sharply better (growing by over 80% year-on-year).

Overall, the Jardine Matheson group is trading resiliently, though there is little overall growth. The company seems attractively valued, with a forward PER of 6-7x and a similar dividend yield in percentage terms. The group has been buying back shares, cancelling circa 7% of the capital in the last couple of years. The problem, it seems, is Hong Kong. Historically, profits have been roughly equally split between Southeast Asia and North Asia.

Today, the contribution from North Asia (and this mostly means Hong Kong) remains under intense pressure. There has been little real recovery, with pre-Covid conditions increasingly seen as a high rather than a readily attainable base. We believe Hongkong Land (which is about 25% of the group’s value) looks especially vulnerable to the new economic and geopolitical environment. Given such an assessment, as well as our other exposure to recovery and growth (through DFI and JCNC), we have sharply cut back our JM position to just over 1%.

Portfolio metrics

Given the lack of portfolio turnover, as well as recent market behaviour, the valuation metrics of the overall portfolio are, unsurprisingly, broadly unchanged (albeit slightly better). While the portfolio’s return on equity (ROE) remains at 20%, the top 10 holdings (which comprise 46% of the fund), have reverted back to an average ROE of 24%. We believe this is a good indication of the portfolio’s quality and is something to be celebrated, given that the market ROE is just 11%8.

The overall PER (next 12 months) of the portfolio has fallen slightly to 19x, but we think this number needs to be treated with some care. Sell-side forecasts still seem broadly too high, particularly in China. There is a view that this does not matter, as everybody knows the numbers are wrong.

However, we are still seeing some negative earnings surprises and sharp subsequent downturns in share prices, with Yum and Shiseido being two recent prominent examples. We do not anticipate much overall earnings growth in the current year, but expect some recovery in FY24.

The country and sector weightings for the strategy have remained consistent, with India at 33% and China supposedly at 12%. We still believe that the strategy’s real economic exposure to China is as high as 40%. Companies like Nippon Paint and Shiseido, for example, have historically derived 50% of sales in China. As the markets have diverged, we have been trimming our holdings in India and adding in China. To date, this has been a fool’s errand, but it still seems like a sensible discipline when we see opportunities. Meanwhile, Association of South East Asian Nations (ASEAN) exposure remains at 14%.

Other than India, without a recovery in China, there is little scope for growth in the region. Our exposure to the consumer sector remains substantial, with staples at 23% and discretionary at 8%. The economic weighting is even higher at close to 40%, when you include the likes of Techtronic, Jardine Cycle & Carriage and Jardine Matheson.

The fund’s technology exposure has risen, and though it is an outcome, that’s probably a good thing, with our purchase of Tencent doubling the weighting in communication services (internet and e-commerce). Besides Tencent, we own Naver, where the news is much improved and the new management team (CEO and CFO) appear to be executing well. We have been here before with Naver and we still think it is an attractive business. Overall, the technology exposure is now 28%, while financials, which is mostly Indian banks, remains at 24%.

Mistakes & laggards

On some days, it can seem like everything we have done over the last six months has been a mistake. China has continued to fall and economic conditions have further deteriorated. In that sense, it is probably a good thing that we have not done very much.

That’s the reassuring thing about cleaving to a 35-year-old proven philosophy and process. We have confidence it works. In the meantime, markets will always do their best to push us to act in a short-term and emotional manner, particularly at times when events become somewhat extreme.

Now is surely such a time, with a seismic shift in inflation and interest-rate expectations coming hard after a once in a hundred-year (no hyperbole) pandemic. It is perhaps unsurprising that it has been hard going. On China in particular, it would be easy to follow the consensus view that even if it is investable, it is too hard.

Instead, we have leant strongly against this sentiment, forcing ourselves to take a 3-5 year view. We believe (and hope) that pragmatism will eventually prevail when it comes to policy-making. At times of extremes, such a reversion usually seems like the least likely outcome; but when markets have fallen and they are at their most scary, in truth they are often (and in hindsight) at their most attractive.

Like many, perhaps our biggest mistake has been to expect conditions to return to the more orderly status quo in a reasonably timely fashion. That looks like an increasingly untenable position, as there are plenty of grounds for suspecting that it really is different this time.

That seems to be the case in Hong Kong, with the governance of the city remarkably changed. This has had a very tangible, as well as ongoing, impact on confidence, investment and valuations. Retail sales remain 25% below their highs, as well as below the levels of 2019.

With the leadership of Hong Kong now holding such a strong executive position, it would seem reasonable to expect positive policy intervention to resolve some of the city’s long-standing issues, in respect of, say, housing and the general prosperity of the populace. However, as in China, it seems security continues to trump all.

It is true that Hong Kong has recovered somewhat compared to the previous lows and profits are rebounding. However, much business has been lost to Singapore and the sustainable growth outlook now looks quite a lot lower as the city has become markedly less vibrant and open. To borrow and paraphrase Dean Acheson’s famous quote on the British Empire; Hong Kong is losing its international city, but has yet to find a role.9

In terms of companies, DFI Retail Group (Dairy Farm) has continued to be a drag. The group’s specific problems have been mostly resolved, but Hong Kong’s loss of momentum remains overwhelming and debilitating. As we stated six months ago, the worst is certainly past, but the outlook is still quite challenging.

Outlook & conclusion

“The key is not to predict the future, but to prepare for it.”

Pericles, politician in ancient Greece10

We long ago gave up trying to predict the future. In fact, these days it seems that even if you knew the future, you would still end up losing money. The second derivative, or how the market responds to news, is often counterintuitive. It depends on how participants are positioned and what is already discounted, by comparison to what subsequently actually happens.

Today, the future seems rather bleak, but this is clearly the consensus view. It has been discounted to a large extent, per the brutal performance of the markets in the last 6-12 months. The fundamentals have deteriorated too, with investment and confidence themselves a product of expectations. There is a feedback loop where expectations can drive reality, which George Soros rather grandly called reflexivity.

This is partly why people remain bearish long after things have already begun to improve, something that is only clear in hindsight. In terms of preparing for the future, we have already done perhaps all we can and hence we have lately done little new. Our preparation is to have been well diversified, to have been broadly sceptical about growth and valuations in China, and to have focused on the sustainability and predictability of earnings.

The other necessary homework for more difficult times is balance-sheet strength. By and large, while share prices have collectively been weak, the underlying businesses in the portfolio (with a few exceptions) have held up about as well as we might have expected. We often look at the businesses that we own and while there might always be something wrong, we have generally struggled to find better things to do with our clients’ capital.

One prerequisite for higher returns is often lower prices. After a decade of poor Asia Pacific performance, there are surely grounds for optimism. Another well-known observation is that nothing destroys returns faster than abundant capital. That has been very visibly true in China. On the other hand, slower growth (at the GDP and company top-line levels) could paradoxically pave the way for higher shareholder returns. It might be considered an ironclad law of emerging markets – the greater the enthusiasm, generally, the worse the actual returns.

In a tougher environment, the better companies tend to strengthen their position and gain market share. This is often why quality outperforms in bear markets. To date this has not been the case, but as things shake out, we see no reason why this long-held observation will not turn out to be true yet again. In that sense we are relatively optimistic.

In our view, the quality (viz. the financial metrics) of the underlying portfolio has seldom been better, while the valuation looks quite attractive. After a decade of “nothing returns” from Asia Pacific, one might be forgiven for looking forward to better things, despite (and ironically because of) the current cacophony of negativity and doom.

When James Cameron began searching for the Titanic, he said: “Hope is not a strategy. Luck is not a factor. Fear is not an option.”11 We can all agree that hope is not much of a strategy and while fear is always an option, it is not particularly conducive to constructive thinking, or judicious investing. On the other hand, in life and in investing, luck is always a factor.

True, it has not been long and valuations may move lower still. Regardless of our analysis, we know that we are seldom able to pick the exact bottom unless lady luck smiles upon us. Historically, even in my lifetime (having grown up in the 1970s), conditions have been considerably more adverse and yet the world generally moved upwards and onwards, albeit in fits and starts.

There are always reasonable grounds for greater optimism, as well as thinking constructively, when extreme pessimism is anchored by lower valuations. Our approach, despite all the noise, is similarly anchored by our unchanging philosophy and process, which might best be characterised by inverting Samuel Johnson’s quip on second marriages, as the triumph of experience over hope. As always, we would like to thank you for your patience and trust in these trying times.

1 https://www.goodreads.com/quotes/10192878-the-future-is-as-full-of-promise-as-it-is

2 https://www.goodreads.com/quotes/1301825-a-second-marriage-is-a-triumph-of-hope-over-experience

3 https://en.wikiquote.org/wiki/Talk:Brazil

4 Brazil, Russia, India and China.

5 Source: Bloomberg, MSCI, FSSA Investment Managers as at 31 July 2023.

6 Apple, Tesla, Microsoft, Alphabet, Nvidia, Amazon.com and Meta Platforms.

8 Refers to the MSCI Asia Pacific-ex Japan index, data from Bloomberg as at 20 November 2023.

9 https://www.oxfordreference.com/display/10.1093/acref/9780191843730.001.0001/q-oro-ed5-00000015

10 https://www.th-nuernberg.de/en/facilities/fraunhofer-research-groups/future-engineering/

11 https://www.goodreads.com/quotes/1023787-hope-is-not-a-strategy-luck-is-not-a-factor

Source: Company data retrieved from company annual reports or other such investor reports. Financial metrics and valuations are from FactSet and Bloomberg. As at 20 November 2023 or otherwise noted.

Important Information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of FSI. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of FSI. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time.

In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors, FSSA Investment Managers, Stewart Investors, Realindex Investments and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited. First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), Realindex Investments (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business divisions of First Sentier Investors (Singapore).

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.