Please read the following important information for First State Asia Opportunities Fund

• The Fund invests primarily equity and equity-related securities in Asian Region (excluding Australia, New Zealand and Japan).

• The Fund’s investments may be concentrated in a single sector, country, specific region or small numbers of countries /companies which may have higher volatility or greater loss of capital than more diversified portfolios.

• The Fund invests in emerging markets which may have increased risks than developed markets including liquidity risk, currency risk/control, political and economic uncertainties, high degree of volatility, settlement risk and custody risk.

• The Fund may expose to China market risk including repatriation risk, uncertainties to taxation policies and risk associated with StockConnects. The Fund may also expose to RMB currency and conversion risk.

• Investing in securities of small/mid-capitalisation companies may have lower liquidity and more volatile prices to adverse economic developments.

• The Fund may use FDIs for hedging and efficient portfolio management purposes, which may subject the Fund to additional liquidity, valuation, counterparty and over the counter transaction risks.

• It is possible that a part or entire value of your investment could be lost. You should not base your investment decision solely on this document. Please read the offering document including risk factors for details.

Global Emerging Markets

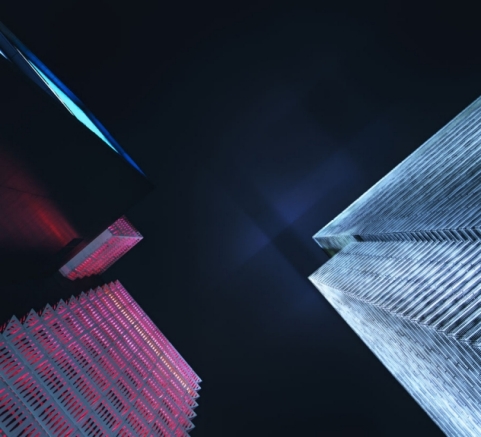

Tap into the world’s growth engine with a different perspective.

The global economy is increasingly being driven by emerging markets growth. We expect this trend to accelerate in the coming years. With our long-established investment process and decades of investing in the region, we have found plenty of high-quality companies in emerging markets – but taking an active approach is key.

What we invest in

Dominant consumer franchises

With favourable demographics and low consumption per capita – particularly in Southeast Asia and India – we believe dominant consumer franchises can offer good growth potential over the long term.

Strong alignment, innovative culture

Decisions taken by company management in both good and bad times can significantly affect its long-term outlook. We look for strong alignment with management and a culture that embraces innovation.

High quality financials

As income levels rise, we believe credit penetration in emerging markets will continue to increase. We aim to back the most efficient and risk-aware financial franchises to gain market share through the cycles.

Internet and technology

Rising smartphone usage, young demographics and large pools of IT talent have led to burgeoning technology markets. With an ability to reinvest at high rates, we believe market leaders will continue to increase their market share and generate long term growth.

Our approach to responsible investment

Non-label disclaimer

Our approach to responsible investing has been shaped by an emphasis on stewardship and the belief that quality managers and good governance should ensure that environmental and social concerns are rightfully addressed. We have integrated sustainability analysis into our investment process and engage extensively on environmental, labour and governance issues.

Sustainable investment labels help investors find products that have a specific sustainability goal. FSSA's products do not have a UK sustainable investment label as they do not have a non-financial sustainability objective. Their objective is to achieve long-term capital growth by following its investment policy and strategy.

Investment Insights

- Article

- 6 mins

- Article

- 4 mins

- Article

- 6 mins

Our funds

The Fund aims to achieve long term capital appreciation and invests primarily in a diversified portfolio of large and mid-capitalisation equity securities or equity-related securities of companies whose activities predominantly take place in emerging markets and are listed, traded or dealt in on regulated markets worldwide.

The Fund aims to achieve long term capital appreciation and invests primarily in a diversified portfolio of large and mid-capitalisation equity securities or equity-related securities of companies whose activities predominantly take place in emerging markets and are listed, traded or dealt in on regulated markets worldwide.