Please read the following important information for FSSA Global Emerging Markets Focus Fund

• The Fund invests primarily in a diversified portfolio of large and mid-capitalisation equity securities or equity-related securities of companies whose activities predominantly take place in emerging markets and are listed, traded or dealt in on regulated markets worldwide.

• The Fund invests in emerging markets which may have increased risks than developed markets including liquidity risk, currency risk/control, political and economic uncertainties, high degree of volatility, settlement risk and custody risk. Investing in mid-capitalisation companies securities may have lower liquidity and their prices are more volatile to adverse economic developments.

• The Fund's investments may be concentrated in certain countries or regions, single sector which may have higher volatility or greater loss of capital than more diversified portfolios.

• The Fund may expose to China market risk including repatriation risk, uncertainties to PRC taxation policies and risks associated with StockConnects, QFI, the ChiNext market and/or the STAR board. The Fund may also expose to RMB currency and conversion risk.

• The Fund may use FDIs for hedging and efficient portfolio management purposes, which may subject the Fund to additional liquidity, valuation, counterparty and over the counter transaction risks.

• It is possible that a part or entire value of your investment could be lost. You should not base your investment decision solely on this document. Please read the offering document including risk factors for details.

Resilience of the FSSA Global Emerging Markets Focus strategy in the event of a developed markets slowdown

Concerns about high inflation, rising interest rates and the growing probability of a recession in major developed markets are starting to weigh on investor sentiment. However, we are confident in the ability of our portfolio holdings to navigate a US recession, as they have done in the past.

In the FSSA Global Emerging Markets (GEM) Focus strategy we own high-quality businesses which have competitive advantages such as strong brands, distribution advantages, cost leadership, or simply providing a service/product that customers cannot live without. Historically, this has given them pricing power and the ability to preserve margins despite adverse headwinds.

While most of our portfolio holdings are geared towards their domestic markets, a few companies derive part of their business from developed markets, and thus are most exposed to a recession in those parts of the world. Our analysis suggests that out of the non-financial sector holdings in the FSSA GEM Focus portfolio, only five have a meaningful exposure to developed markets (defined here as the US and Europe).

They are all listed below:

- Alsea: A Mexican multi-brand restaurant operator, with 33% of sales come from operations in Europe (mainly Spain). However, the company is profitable and its debt is matched to these cash flows, which mitigates some of the risk.

- TSMC: A global leader in semiconductors – we estimate 74% of sales came from developed markets (via exports). It has started investing in these markets directly (~5% of assets), but the amount is still small.

- Syngene: An Indian clinical research and manufacturing outsourcing company, we estimate that 95% of its sales are from developed market pharmaceutical companies. These have been growing rapidly and should be fairly resilient to any recessionary trends due to the industry’s low penetration of research and development outsourcing and the small scale of the company’s operation.

- Silergy: A leader in analog chips, it exports 40% of sales to developed markets. We believe the company has durable cost and quality advantages, which mean that its market share (less than 4% of the industry) can rise substantially, overcoming any potential recessionary impact for its clients.

- Jollibee Foods: A quick service restaurant chain based in Philippines, it has made acquisitions in developed markets and derives 38% of sales from the US. Operations there have been restructured and debts are matched to the local cash flows. This is a small position in our portfolios (0.2%) and we are monitoring the risks actively.

Few portfolio companies rely on USD funding

As a safe haven currency, historically the US dollar has appreciated against emerging market currencies during recessionary environments, raising the question of whether investors in GEM can still come out ahead despite currency fluctuations.

As a team, we focus on companies with strong business models that can withstand currency headwinds in two ways. Firstly and most importantly, we emphasise conservative balance sheets as one of the primary considerations in our company assessments – our non-financial sector portfolio companies have, on average, net cash balance sheets with -0.9x net debt-to-EBITDA.1

Secondly, for portfolio holdings that have debt on the balance sheet, we prefer long-duration tenures that are matched by operational cash flows in the same currency to avoid any currency mismatches.

Of the non-financial sector holdings, only one company, Alsea, has any material net debt – about 1.9x net debt-to-EBITDA, by our estimates. It had made an acquisition just before the Covid pandemic hit, which not only meant that it took on too much debt, but it also suffered operationally through the lockdowns, with the implication that net debt-to-EBITDA surged. Unfortunately, it was a perfect storm for the business.

However, the business is recovering and is usually highly cash generative under normal operating environments (it generates high margins and is relatively asset light), meaning that its debt is reducing rapidly and its overall leverage ratio should improve.

Furthermore, if one take a closer look at the debt profile, 96% of its outstanding debt is in long-term maturities and in currencies that match the underlying operations (as explained earlier, it has operations in developed markets and as a result, 35% of its gross debt is denominated in EUR/USD), which is why we remain comfortable with the outlook and our investment in Alsea.

Among the 10 banks and insurance companies that we own in our portfolio, only Credicorp, and to a much smaller extent Commercial International Bank Egypt, have any meaningful exposure to USD/EUR/GBP.

These banks have minimal direct operations in the US or Europe; however, their customers sometimes deposit and borrow in foreign currencies, and these banks are always “net long” hard currencies, i.e. their foreign currency deposits are always higher than assets, allowing them to benefit in the event of US dollar strength.

Downside protection in the event of a major risk-off

Given our emphasis on quality companies, we have historically outperformed in more challenging market conditions where due recognition is given to companies with strong franchises, recurring cash flows, and robust balance sheets.

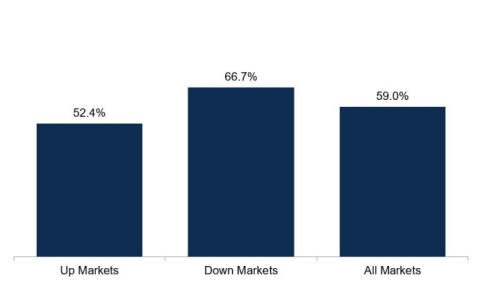

Conversely, as a result of our prudent investment style, we have experienced (and will continue to experience) periods of relative underperformance in strong liquidity-driven or momentum-led markets. Since inception, the FSSA GEM Focus strategy has generally outperformed more often than not in all market conditions, typically showing more frequent outperformance in down markets compared to up markets, as shown below.

Months of outperformance vs. benchmark (as at 31 March 2023)

These figures refer to the past. Past performance is not a reliable indicator of future results. For investors based in countries with currencies other than USD, the return may increase or decrease as a result of currency fluctuations. All performance data for the FSSA Global Emerging Markets Focus Fund Class I (Accumulation) USD. Source for Fund - Lipper IM / First Sentier Investors (UK) Funds Limited. Performance data is calculated on a gross of fees basis and includes income reinvested net of withholding tax. Months of outperformance vs benchmark (MSCI Emerging Markets Index income reinvested net of tax). Source for benchmark – MSCI. Since inception performance figures have been calculated from 01 December 2017.

It is interesting to note that for our non-financial sector holdings, the weighted average appreciation of the US dollar vs. each company’s core business currency over the past five years (i.e. May 2018 to May 2023) has been 14% - although this masks a wide variety of outcomes (for example, the US dollar has appreciated 55% vs. the South African rand, 36% vs. the Brazilian real and 21% vs. the Indian rupee, but has depreciated 8.5% vs. the Mexican peso.

Despite this, the weighted average sales CAGR2 (not cumulative) for these holdings, in US dollar terms, was 13% over five years (CY17-CY22). We believe this characteristic allows our portfolio holdings to produce attractive returns to our clients in US dollar terms over the long term.

Source: Company data retrieved from company annual reports or other such investor reports. Financial metrics and valuations are from FactSet and Bloomberg. As at 31 May 2023 or otherwise noted.

1 Earnings before interest, taxation, depreciation and amortisation

2 Compound annual growth rate

Important Information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of FSI. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of FSI. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of FSSA Investment Managers’ portfolios at a certain point in time, and the holdings may change over time.

In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors and FSSA Investment Managers are business names of First Sentier Investors (Hong Kong) Limited. First Sentier Investors (registration number 53236800B) and FSSA Investment Managers (registration number 53314080C) are business divisions of First Sentier Investors (Singapore).

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.