Please read the following important information for FSSA Indian Subcontinent Fund

• The Fund invests primarily in equity securities and equity related securities in Indian subcontinent which may expose to potential changes in tax, political, social and economic environment.

• The Fund invests in emerging markets which may have increased risks than developed markets including liquidity risk, currency risk/control, political and economic uncertainties, high degree of volatility, settlement risk and custody risk.

• Investing in small /mid-capitalisation securities may have lower liquidity and their prices are more volatile to adverse economic developments.

• The Fund’s investments may be concentrated in a single country/ sector, specific region or small numbers of countries/ companies which may have higher volatility or greater loss of capital than more diversified portfolios.

• The Fund may use FDIs for hedging and efficient portfolio management purposes, which may subject the Fund to additional liquidity, valuation, counterparty and over the counter transaction risks.

• It is possible that a part or entire value of your investment could be lost. You should not base your investment decision solely on this document. Please read the offering document including risk factors for details.

FSSA Indian Subcontinent Fund

Monthly Manager Views - January 2022

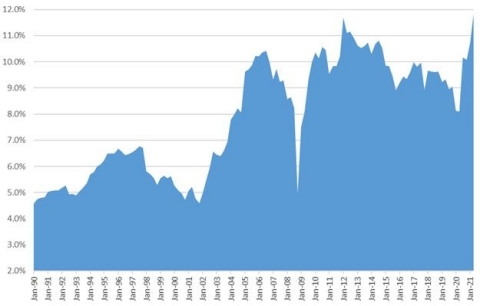

Land, Labour, Capital and Entrepreneurship. These are the well-known “Factors of Production” as defined by classical economists. The Entrepreneur (or Company) is the one that combines these factors to earn a profit. However, in our view, each of these factors has been overly exploited over the past 20-30 years and everything has become secondary to “profit” (to be used interchangeably with “market capitalisation”, albeit the link between the two has grown tenuous in recent years). The chart below, which shows how corporate profits have grown in relation to GDP in the US, captures the trend well – the ratio has more than doubled over 30 years. In other words, the pendulum has perhaps swung too far in favour of capital market participants.

Corporate Profit/GDP - USA (1990-2021)

Source: US Bureau of Economic Analysis, as at 31 January 2021

The true cost of natural resources is only now being assessed, as investors scrutinise aspects like carbon intensity, water use and greenhouse gas emissions, and insist on sustainable development. Interesting things are afoot with respect to labour as well. In the US, the median hourly wage adjusted for inflation has barely changed from 1979 to 2019, whereas the top 10% of earners witnessed a significant jump1. The recent trend of labour union drives and mass strikes, despite record low levels of unemployment in the US, is symptomatic of this problem. And interest rates, as we know, have gone only one way for a very long time. This too, seems to be changing. Finally, tax, though not a factor of production, has also been coming down, with most large multinationals (MNCs) routing profits through tax havens. Again, there has been a backlash against such ‘tax avoidance’ practices. So, all the factors of production are starting to reverse trend, in a way, or at least in the US, the largest economy in the world.

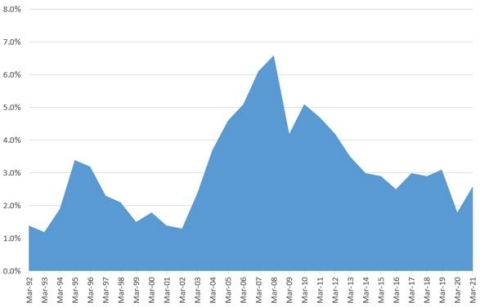

However, the same Profit-to-GDP chart for India (below) looks like a mirror image of the one for the US, at least over the past decade.

Corporate Profit/GDP - India (1992-2021)

Source: Center For Monitoring Indian Economy (CMIE), as at 31 March 2021

Why? The main reason could be a multitude of exogenous shocks to the economy, such as corporate scandals resulting in bureaucratic and credit freezes, demonetisation, the collapse of non-banking financial companies (NBFCs) and the transition to Goods and Service Tax (GST). However, even if we look at the factors of production, they are somewhat different. For one, India has traditionally been a capital-starved economy. Data from the International Monetary Fund (IMF) shows that real interest rates in India have averaged around 4.9% over the past decade, which is significantly above global averages (most developed markets have deeply negative interest rates now). Not only are rates high, availability of credit is relatively scarce given that a huge proportion of the economy still operates in the informal segment. Labour is also a complicated matter in India – whilst it is inarguably cheap, the laws are draconian, which ends up dis-incentivising Indian companies from making large employment commitments. Finally, the Indian government has only recently caught on to the thought that the country’s natural resources were not being valued properly – ergo a massive re-farming of licences for minerals like coal, iron ore and even telecom spectrum over the past decade. Even land has become hard to come by in India recently, with every industrialist we meet lamenting on how long (and how much) it takes to buy clean titles.

India is unique among large economies in the sense that it has yet to see the formalised economy (corporates and capital market participants) benefit in quite the same way as in some others. Our view is that as a result of policy measures taken in the last few years, cyclical factors and global geopolitical constraints, corporate profits in India will be a larger part of the economy in the next decade. That said, we are mindful of the pitfalls that await those companies that exploit some or all factors of production. For one, we try to stay far away from companies that seek to benefit by incurring a massive cost to the environment – polluting industries and mining companies, for example. Similarly, companies that do not value workers and their safety are another no-no (we tend to look at the percentage of contracted staff, injury and fatality track records, etc.). We also believe that companies must earn their social licence to operate, and paying taxes is a big part of that. We take a negative view of companies that design their business model around tax arbitrages or try their best to short-change the exchequer. And finally, we tend to pass on companies that have a poor attitude to debt (those that tend to bet the farm at the top of cycles, don’t recognise duration mismatches, or punt in foreign unhedged debt, for example). We greatly value management teams that recognise the long-term risks involved in all these matters and are willing to learn and even incur short-term costs to make their businesses more sustainable.

1 Economic Policy Institute: State of Working America Wages 2019 by Elise Gould; published February 20, 2020

* Company data retrieved from company annual reports or other such investor reports. Financial metrics and valuations are from FactSet and Bloomberg. As at 31 January 2022 or otherwise noted.

Important Information

Investment involves risks, past performance is not a guide to future performance. Refer to the offering documents of the respective funds for details, including risk factors. The information contained within this document has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy or completeness of the information. Neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this. It does not constitute investment advice and should not be used as the basis of any investment decision, nor should it be treated as a recommendation for any investment. The information in this document may not be edited and/or reproduced in whole or in part without the prior consent of FSI.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of FSSA Investment Managers’ portfolios at a certain point in time, and the holdings may change over time.

This document is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission in Hong Kong. First Sentier Investors is a business name of First Sentier Investors (Hong Kong) Limited.

First Sentier Investors (Hong Kong) Limited is part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.