China equities: Quality and patience go a long way

In the second article of this three-part series, Martin Lau, managing partner and lead portfolio manager of the FSSA China Growth strategy, discusses the importance of keeping a long-term mindset and valuation discipline as the strategy celebrates its 30th anniversary this year.

During my career over the past 20-plus years, there have been two major lessons. The first is to focus on bottom-up analysis and hold on to quality companies. Sentiment could turn extremely positive or negative, which I experienced first-hand during the Asian Financial Crisis in the late 1990s, the bursting of the tech bubble in the early 2000s, and the Global Financial Crisis (GFC) in 2008. But the key driver of share prices over the long term is the ability for companies to generate value, by growing their earnings or net asset value.

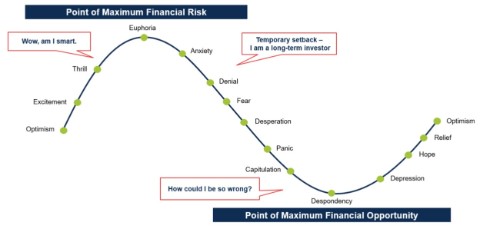

The second lesson is to remain disciplined and not be carried away by greed or fear. I have seen the same market trade at 60x price-to-earnings (PE) and 5x PE. This means when the market is fearful, we need to be more courageous, and when the market is irrationally bullish, we should tread carefully.

Going against the crowd can be difficult, especially in this environment with steep interest rate hikes in the US, the Russia-Ukraine conflict, weakness in Chinese property and rolling Covid lockdowns. We are not macro investors, nor can we predict how such events will play out. But while every crisis is different, the ingredients are often the same – they all relate to human nature.

The below chart helps to put things in perspective. As we reflect on the prevailing emotions around Chinese stocks over the past year, we appeared to be closer to the bottom than the top. Therefore, we have added to our high-conviction core holdings.

Where are we in the cycle?

Importance of discipline

Source: FSSA Investment Managers

Focus on quality as bottom-up investors

Somewhat unique to our investment process is the amount of time we spend meeting with management teams – we hold more than 1,500 meetings a year. Rather than build complex financial models, we try to gain conviction around a company’s competitive moat, sustainability of earnings growth, and the management’s integrity. An acid test of our conviction is whether we would buy more of a stock if the price halves.

Amid the recent headwinds, we have continued to meet with companies to see how they adapt. We believe the best companies tend to emerge stronger from setbacks, as we saw with China Mengniu Dairy following the 2008 melamine scandal, or Techtronic after the US housing market crashed during the GFC.

Our focus on quality also helps to avoid losses. If the management are not honest, they will find ways to take advantage of minority shareholders. China has given us plenty of scandals, as in the case of Chaoda Modern Agriculture, Gome, Luckin Coffee and more recently, Evergrande.

These incidents all point to a lack of integrity, in the form of fraudulent financials, insider trading, or bribery. To form a clear assessment in our company meetings, we also read between the lines and observe the nuances of their culture. Is there a domineering leader? Do they treat their employees well, and care about the broader society? We view any mistreatment of other stakeholders as a clear red flag.

Keep a long-term horizon

We believe the growth in company earnings is what ultimately drives share prices over the long term, as seen in the below chart. One needs both patience and conviction to reap such rewards, so when we add a stock to the portfolio, we hold on to it for the long term. All of our top 10 holdings have been in the portfolio for more than 10 years. As the adage goes, “It's not about timing the market, but time in the market.”

For example, after China Merchants Bank (CMB) listed in Hong Kong in 2006, the share price went nowhere for a number of years. Headwinds included the GFC and concerns around non-performing loans (NPLs). But despite these concerns, CMB’s earnings have risen and so has the stock price, performing better than most Chinese banks over the long term. This is largely due to CMB’s track record of prudent risk management and organic growth in assets without the need for outside capital. Recently, we have added to our holdings amid attractive valuations.

China Merchants Bank share price and earnings since 2007

* Earnings per share

Source: Factset, FSSA Investment managers, February 2023

Similarly, we have been shareholders of Tencent since 2005, and it has performed well over the long term. We have always found the management to be stable and down to earth. They have consistently focussed on user experience and executed better than their peers, building up strong moats through major apps like WeChat. While the company is unlikely to repeat its past growth due to its sheer size, we expect it will achieve 10-15% sales growth per annum in the coming 3 to 5 years, given the potential to monetise its existing apps. Therefore, we saw the recent pessimism as a buying opportunity.

Tencent has scope to monetise its WeChat app, while the stock is cheap relative to history

Ad revenue per hour (US$)

Price-to-book ratio

Sources: Factset, Questmobile, Morgan Stanley, FSSA Investment Managers as of February, 2023

Maintain valuation discipline

Besides our focus on quality and investing for the long term, valuation discipline has always been part of our investment philosophy. Maintaining this discipline can be difficult in practice, but it helps that the team has experienced various cycles and seen the market rebound from extreme pessimism. In hindsight, the best buying opportunities usually arose when the economy was at its worst, like during SARS in 2003.

As investors, part of our job is to consider opposing views to the crowd. In the property sector, for instance, the prevailing negative sentiment is constraining new investments and supply, which means new opportunities could arise as demand catches up. Another example is China’s ‘common prosperity' agenda, which has raised the regulatory standards in sectors like education, internet, healthcare and property. We think share prices have factored in these challenges; in fact the regulations can help these industries improve. Companies will need to be more disciplined with spending, and the ones with stronger franchises should gain market share.

The other side of valuation discipline is avoiding hot, crowded areas of the market. Given our team’s experience, we are naturally cautious and sceptical. Some people may see this as a drawback, but we believe this conservative attitude has saved us more often than not. For example, we avoided lossmaking internet and electric vehicle companies, which meant missing out on gains during ebullient periods, but conversely protected our capital when the market sentiment turned.

Conclusion

China has always been opaque in areas like policy-making, which can lead to big surprises and market volatility. Whether we have seen the bottom will only become clear in hindsight. Until then, we continue adhering to our investment discipline by focussing on quality, keeping a long-term horizon, and constantly challenging one another, lest we get carried away by our own greed and fear.

Source: Company data retrieved from company annual reports or other such investor reports. Financial metrics and valuations are from FactSet and Bloomberg. As at February 2023 or otherwise noted.

Related readings

- Article

- 8 mins

- Article

- 8 mins

- Article

- 8 mins

Important Information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of FSI. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of FSI. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of FSSA Investment Managers portfolios at a certain point in time, and the holdings may change over time.

In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors and FSSA Investment Managers are business names of First Sentier Investors (Hong Kong) Limited. First Sentier Investors (registration number 53236800B) and FSSA Investment Managers (registration number 53314080C) are business divisions of First Sentier Investors (Singapore).

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.