China equities: Quality and patience go a long way

In the second article of this three-part series, Martin Lau, managing partner and lead portfolio manager of the FSSA China Growth strategy, discusses the importance of keeping a long-term mindset and valuation discipline as the strategy celebrates its 30th anniversary this year.

During my career over the past 20-plus years, there have been two major lessons. The first is to focus on bottom-up analysis and hold on to quality companies. Sentiment could turn extremely positive or negative, which I experienced first-hand during the Asian Financial Crisis in the late 1990s, the bursting of the tech bubble in the early 2000s, and the Global Financial Crisis (GFC) in 2008. But the key driver of share prices over the long term is the ability for companies to generate value, by growing their earnings or net asset value.

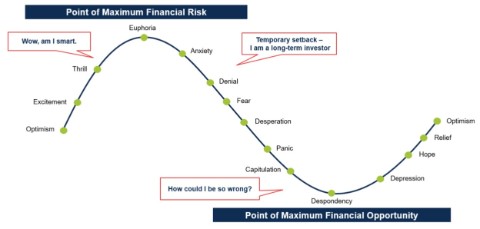

The second lesson is to remain disciplined and not be carried away by greed or fear. I have seen the same market trade at 60x price-to-earnings (PE) and 5x PE. This means when the market is fearful, we need to be more courageous, and when the market is irrationally bullish, we should tread carefully.

Going against the crowd can be difficult, especially in this environment with steep interest rate hikes in the US, the Russia-Ukraine conflict, weakness in Chinese property and rolling Covid lockdowns. We are not macro investors, nor can we predict how such events will play out. But while every crisis is different, the ingredients are often the same – they all relate to human nature.

The below chart helps to put things in perspective. As we reflect on the prevailing emotions around Chinese stocks over the past year, we appeared to be closer to the bottom than the top. Therefore, we have added to our high-conviction core holdings.

Where are we in the cycle?

Importance of discipline

Source: FSSA Investment Managers

Focus on quality as bottom-up investors

Somewhat unique to our investment process is the amount of time we spend meeting with management teams – we hold more than 1,500 meetings a year. Rather than build complex financial models, we try to gain conviction around a company’s competitive moat, sustainability of earnings growth, and the management’s integrity. An acid test of our conviction is whether we would buy more of a stock if the price halves.

Amid the recent headwinds, we have continued to meet with companies to see how they adapt. We believe the best companies tend to emerge stronger from setbacks, as we saw with China Mengniu Dairy following the 2008 melamine scandal, or Techtronic after the US housing market crashed during the GFC.

Our focus on quality also helps to avoid losses. If the management are not honest, they will find ways to take advantage of minority shareholders. China has given us plenty of scandals, as in the case of Chaoda Modern Agriculture, Gome, Luckin Coffee and more recently, Evergrande.

These incidents all point to a lack of integrity, in the form of fraudulent financials, insider trading, or bribery. To form a clear assessment in our company meetings, we also read between the lines and observe the nuances of their culture. Is there a domineering leader? Do they treat their employees well, and care about the broader society? We view any mistreatment of other stakeholders as a clear red flag.

Keep a long-term horizon

We believe the growth in company earnings is what ultimately drives share prices over the long term, as seen in the below chart. One needs both patience and conviction to reap such rewards, so when we add a stock to the portfolio, we hold on to it for the long term. All of our top 10 holdings have been in the portfolio for more than 10 years. As the adage goes, “It's not about timing the market, but time in the market.”

For example, after China Merchants Bank (CMB) listed in Hong Kong in 2006, the share price went nowhere for a number of years. Headwinds included the GFC and concerns around non-performing loans (NPLs). But despite these concerns, CMB’s earnings have risen and so has the stock price, performing better than most Chinese banks over the long term. This is largely due to CMB’s track record of prudent risk management and organic growth in assets without the need for outside capital. Recently, we have added to our holdings amid attractive valuations.

China Merchants Bank share price and earnings since 2007

* Earnings per share

Source: Factset, FSSA Investment managers, February 2023

Similarly, we have been shareholders of Tencent since 2005, and it has performed well over the long term. We have always found the management to be stable and down to earth. They have consistently focussed on user experience and executed better than their peers, building up strong moats through major apps like WeChat. While the company is unlikely to repeat its past growth due to its sheer size, we expect it will achieve 10-15% sales growth per annum in the coming 3 to 5 years, given the potential to monetise its existing apps. Therefore, we saw the recent pessimism as a buying opportunity.

Tencent has scope to monetise its WeChat app, while the stock is cheap relative to history

Ad revenue per hour (US$)

Price-to-book ratio

Sources: Factset, Questmobile, Morgan Stanley, FSSA Investment Managers as of February, 2023

Maintain valuation discipline

Besides our focus on quality and investing for the long term, valuation discipline has always been part of our investment philosophy. Maintaining this discipline can be difficult in practice, but it helps that the team has experienced various cycles and seen the market rebound from extreme pessimism. In hindsight, the best buying opportunities usually arose when the economy was at its worst, like during SARS in 2003.

As investors, part of our job is to consider opposing views to the crowd. In the property sector, for instance, the prevailing negative sentiment is constraining new investments and supply, which means new opportunities could arise as demand catches up. Another example is China’s ‘common prosperity' agenda, which has raised the regulatory standards in sectors like education, internet, healthcare and property. We think share prices have factored in these challenges; in fact the regulations can help these industries improve. Companies will need to be more disciplined with spending, and the ones with stronger franchises should gain market share.

The other side of valuation discipline is avoiding hot, crowded areas of the market. Given our team’s experience, we are naturally cautious and sceptical. Some people may see this as a drawback, but we believe this conservative attitude has saved us more often than not. For example, we avoided lossmaking internet and electric vehicle companies, which meant missing out on gains during ebullient periods, but conversely protected our capital when the market sentiment turned.

Conclusion

China has always been opaque in areas like policy-making, which can lead to big surprises and market volatility. Whether we have seen the bottom will only become clear in hindsight. Until then, we continue adhering to our investment discipline by focussing on quality, keeping a long-term horizon, and constantly challenging one another, lest we get carried away by our own greed and fear.

Source: Company data retrieved from company annual reports or other such investor reports. Financial metrics and valuations are from FactSet and Bloomberg. As at February 2023 or otherwise noted.

Related readings

- Article

- 8 mins

- Article

- 8 mins

- Article

- 12 mins

Important Information

References to “we” or “us” are references to First Sentier Investors (FSI). The FSSA Investment Managers business forms part of First Sentier Investors, which is a global asset management business that is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group.

In Hong Kong, this document is issued by First Sentier Investors (Hong Kong) Limited (FSI HK) and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this document is issued by First Sentier Investors (Singapore) (FSIS) whose company registration number is 196900420D. In Australia, this information has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (FSI AIM).

This document is directed at persons who are professional, sophisticated or wholesale clients and has not been prepared for and is not intended for persons who are retail clients. The information herein is for information purposes only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information

is appropriate in light of your investment needs, objectives and financial situation. Some of the funds mentioned herein are not authorised for offer/sale to the public in certain jurisdiction. Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time.

Any opinions expressed in this material are the opinions of the individual authors at the time of publication only and are subject to change without notice. Such opinions: (i) are not a recommendation to hold, purchase or sell a particular financial product; (ii) may not include all of the information needed to make an investment decision in relation to such a financial product; and (iii) may substantially differ from other individuals within First Sentier Investors.

Please refer to the relevant offering documents in relation to any funds mentioned in this material for details, including the risk factors and information on requirements relating to investor eligibility before making a decision about investing in such funds. The offering document is available from First Sentier Investors and FSI on its website and should be considered before any investment decision in relation to any such funds.

Neither MUFG, FSI HK, FSIS, FSI AIM nor any of affiliates thereof guarantee the performance of any investment or entity referred to in this document or the repayment of capital. Any investment in funds referred to herein are not deposits or other liabilities of MUFG, FSI HK, FSIS, FSI or affiliates thereof and are subject to investment risk, including loss of income and capital invested.

To the extent permitted by law, no liability is accepted by MUFG, FSI HK, FSIS, FSI AIM nor any of their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that we believe to be accurate and reliable, however neither the MUFG, FSI HK, FSIS, FSI AIM nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of FSI.

Any performance information has been calculated using exit prices after taking into account all ongoing fees and assuming reinvestment of distributions. No allowance has been made for taxation. Past performance is not indicative of future performance.

Copyright © First Sentier Investors (Australia) Services Pty Limited 2023

All rights reserved.