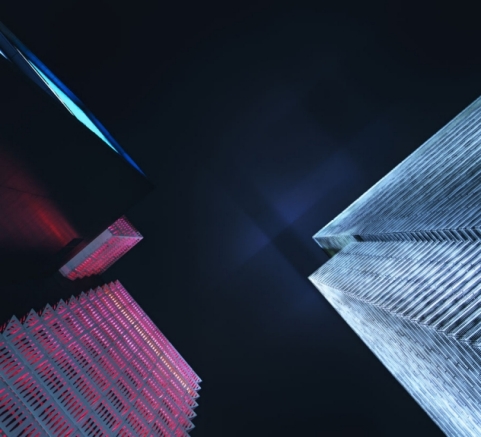

Global Emerging Markets

Tap into the world’s growth engine with a different perspective.

The global economy is increasingly being driven by emerging markets growth. We expect this trend to accelerate in the coming years. With our long-established investment process and decades of investing in the region, we have found plenty of high-quality companies in emerging markets – but taking an active approach is key.

What we invest in

Dominant consumer franchises

With favourable demographics and low consumption per capita – particularly in Southeast Asia and India – we believe dominant consumer franchises can offer good growth potential over the long term.

Strong alignment, innovative culture

Decisions taken by company management in both good and bad times can significantly affect its long-term outlook. We look for strong alignment with management and a culture that embraces innovation.

High quality financials

As income levels rise, we believe credit penetration in emerging markets will continue to increase. We aim to back the most efficient and risk-aware financial franchises to gain market share through the cycles.

Internet and technology

Rising smartphone usage, young demographics and large pools of IT talent have led to burgeoning technology markets. With an ability to reinvest at high rates, we believe market leaders will continue to increase their market share and generate long term growth.

Our approach to responsible investment

Non-label disclaimer

Our approach to responsible investing has been shaped by an emphasis on stewardship and the belief that quality managers and good governance should ensure that environmental and social concerns are rightfully addressed. We have integrated sustainability analysis into our investment process and engage extensively on environmental, labour and governance issues.

Sustainable investment labels help investors find products that have a specific sustainability goal. FSSA's products do not have a UK sustainable investment label as they do not have a non-financial sustainability objective. Their objective is to achieve long-term capital growth by following its investment policy and strategy.

Investment Insights

- Article

- 3 mins

- Article

- 6 mins

- Article

- 4 mins

Price & performance

Strategy overview

Issuer:Key facts

ASX announcements

The iNAV reflects the estimated NAV per unit in respect of the Fund’s assets that have live market prices during the trading day. The issuer of the Fund has engaged ICE Data Indices, LLC as iNAV calculation agent to independently calculate the iNAV.

* iNAV calculations as shown (the "data") are provided by ICE Data Indices, LLC or its third party suppliers and are updated during ASX trading hours. iNAV calculations are indicative and for reference purposes only. The Fund is not sponsored, endorsed, sold or marketed by ICE Data Indices, LLC, its affiliates ("ICE Data") and ICE Data or its respective third party suppliers MAKE NO EXPRESS OR IMPLIED WARRANTIES, AND HEREBY EXPRESSLY DISCLAIM ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT TO THE iNAV, FUND OR ANY FUND DATA INCLUDED THEREIN. IN NO EVENT SHALL ICE DATA HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, DIRECT, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES. You acknowledge that the data is provided for information only and should not be relied upon for any purpose.

Strategy Overview

This Fund is an Irish domiciled UCITS fund marketed in the UK under the Overseas Fund Regime (OFR). The Fund is not subject to the UK sustainability disclosure and labelling regime.

Key Facts

Exit Price:

Price Date:

Issuer:

* This is an annualised interest rate from the past seven days. For actual performance for our Cash Funds, please view the performance page.

Issuer:

Strategy Overview

Key Facts

|

Download Full Unit Price History |

Past performance is not a reliable indicator of future performance. Unless otherwise stated, performance returns for periods greater than one year are annualised. Gross performance returns are calculated using a time-weighted return methodology. No allowance has been made for an investor's own brokerage when they buy their units on a securities exchange.