Regional India Strategy October 2021

Monthly Manager Views - October 2021

Godrej Industries

Our investment philosophy is to back owners and managers with whom we feel strongly aligned. These owners typically have track records of treating all stakeholders fairly, in both good and bad times. They are ambitious in growing their business, but also risk-aware in their pursuit of growth.

In India, we typically find these traits in family-owned companies (commonly referred to as “promoter groups”). Families are able to take a multi-decade view of their business and act counter-cyclically to create value for all shareholders. Our favoured promoter groups are those who recognise the advantages of introducing professionally-run management teams, high-quality boards and other best practices with respect to governance. We follow such changes closely to identify the cultural markers of families which are likely to succeed over time, and others that may be left behind.

The Godrej group was founded in 1897 and has been stewarded by the family successfully across generations. Its current leaders, Pirojsha and Nisaba Godrej, are from the fourth generation of the family. While they lead the group’s governance, the day-to-day operations of each underlying business are led by talented professional managers. This combination of family ownership and professional management has helped Godrej build leading businesses in segments ranging from Home & Personal Care products to Residential Real Estate and Animal Feed.

Godrej Industries is the group’s listed holding company, which owns a 24% stake in Godrej Consumer Products, 47% in Godrej Properties and 62% in Godrej Agrovet. It has a track record of successfully incubating new businesses, such as Godrej Properties, which was listed in 2010 (current market capitalisation of USD 8.6bn) and Godrej Agrovet, which was listed in 2017 (current market capitalisation of USD 1.6bn). We have been shareholders of Godrej Industries for the most part of the last decade.

Recent developments at the company have been encouraging. Its board has been refreshed with four new independent directors as long-standing directors retired. The new board members include the ex-CFO of Novartis India, a partner associated with Fidelity International, the co-founder of a reputed Venture Capital firm and the chairman of a leading Home and Kitchenware brand. Additionally, Godrej Housing Finance, which was set up in 2020, has been injected by the family into Godrej Industries for a nominal sum, and Manish Shah, an executive with significant experience at Citigroup, was appointed its CEO. Given the strong reputation of the Godrej group, the housing finance business is able to access funding at attractive rates. Its pilot program with Godrej Properties has received a strong customer response. Similar to Godrej Properties and Godrej Agrovet, we believe this business has potential to create significant value over the long term.

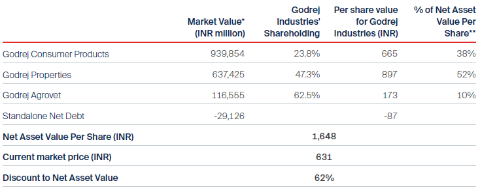

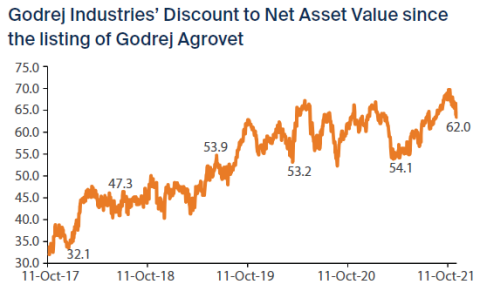

Godrej Industries’ shareholding in Godrej Consumer Products and Godrej Properties account for 90% of its net asset value. Godrej Consumer Products’ growth has been weak in recent years. It recently appointed Sudhir Sitapati, who has spent over two decades at Unilever, as its new CEO. We expect its performance to improve under Mr Sitapati’s leadership. Godrej Properties is benefiting from the consolidation in India’s fragmented real estate industry, as poor-quality local developers lose out to leading brands like Godrej. These expectations are reflected in its expensive valuations. In stark contrast, Godrej Industries’ valuations are exceptionally attractive, in our view, at a 62% discount to the value of its stakes in its listed subsidiaries and associates. The family appears to share the same view, having increased its stake in Godrej Industries by 6% since 2019.

*Market value of Godrej Consumer Products, Godrej Properties and Godrej Agrovet, as at 12th November 2021.

**The % of Net Asset Value is adjusted for the standalone net debt. Source: FactSet, BSE India.

Source: ICICI Securities, 12th November 2021

Performance commentary

The FSSA Indian Subcontinent Fund declined in October. The key contributors to performance were ICICI Bank and Mahindra CIE Automotive.

ICICI Bank rose after it reported strong quarterly results. Its Net Interest Income (NII) rose by 25% and earnings per share (EPS) by 29% over the same period last year. The bank’s asset quality and Return on Assets (ROA) continue to improve steadily.

Mahindra CIE Automotive also rose after it reported strong financial performance. Its revenues grew by 21% and operating profit by 78% over the same period last year. The company benefited from a rebound in automotive demand in both its Indian and European operations, and market share gains. Its efforts to improve operating efficiency over the last year has helped it strengthen its profitability. The key detractors were Solara Active Pharma and Colgate Palmolive (India).

Solara Active Pharma declined due to concerns about price inflation on its key raw materials. However, our discussions with the management reassured us that the long-term prospects are still bright, with the CEO stating an ambition to grow revenues nearly four-fold over the coming five years.

Colgate Palmolive (India) declined following concerns about rising commodity costs affecting its profitability. It has dominant market share in oral care which affords the company strong pricing power. Colgate has a long track record of improving its profitability consistently. In our view, it will be able to continue improving its profitability over the medium term, as it passes on price increases to consumers and upgrades its product portfolio to more premium products.

* Company data retrieved from company annual reports or other such investor reports. Financial metrics and valuations are from FactSet and Bloomberg. As at 31 October 2021 or otherwise noted.

Important Information

References to “we” or “us” are references to First Sentier Investors (FSI). The FSSA Investment Managers business forms part of First Sentier Investors, which is a global asset management business that is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group.

In Hong Kong, this document is issued by First State Investments (Hong Kong) Limited (FSI HK) and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this document is issued by First State Investments (Singapore) (FSIS) whose company registration number is 196900420D. In Australia, this information has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (FSI AIM).

This document is directed at persons who are professional, sophisticated or wholesale clients and has not been prepared for and is not intended for persons who are retail clients. The information herein is for information purposes only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation. Some of the funds mentioned herein are not authorised for offer/sale to the public in certain jurisdiction. Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time.

Any opinions expressed in this material are the opinions of the individual authors at the time of publication only and are subject to change without notice. Such opinions: (i) are not a recommendation to hold, purchase or sell a particular financial product; (ii) may not include all of the information needed to make an investment decision in relation to such a financial product; and (iii) may substantially differ from other individuals within First Sentier Investors.

Please refer to the relevant offering documents in relation to any funds mentioned in this material for details, including the risk factors and information on requirements relating to investor eligibility before making a decision about investing in such funds. The offering document is available from First Sentier Investors and FSI on its website and should be considered before any investment decision in relation to any such funds.

Neither MUFG, FSI HK, FSIS, FSI AIM nor any of affiliates thereof guarantee the performance of any investment or entity referred to in this document or the repayment of capital. Any investment in funds referred to herein are not deposits or other liabilities of MUFG, FSI HK, FSIS, FSI or affiliates thereof and are subject to investment risk, including loss of income and capital invested.

To the extent permitted by law, no liability is accepted by MUFG, FSI HK, FSIS, FSI AIM nor any of their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that we believe to be accurate and reliable, however neither the MUFG, FSI HK, FSIS, FSI AIM nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of FSI.

Any performance information has been calculated using exit prices after taking into account all ongoing fees and assuming reinvestment of distributions. No allowance has been made for taxation. Past performance is not indicative of future performance.

Copyright © First Sentier Investors (Australia) Services Pty Limited 2021.

All rights reserved.